How does annual rental growth of 11.8% sound? The first quarter of the year may have been one of mixed fortunes for rental markets in our state capitals, but certain cities have managed to outperform the rest of the pack and record stunning rental growth figures.

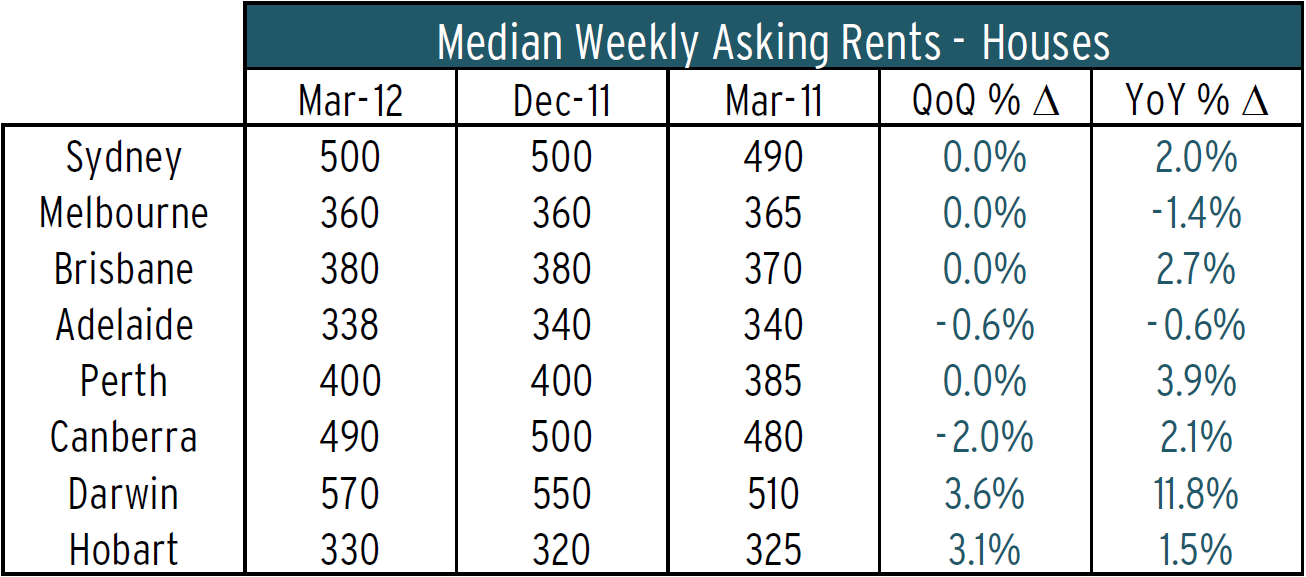

The first quarter of the year has not been kind to capital city investors hoping for rental growth, with the national median asking rent for houses remaining flat and the median for units falling by -1.1%, according to the March 2012 Rental Price Series Quarterly Report from Australian Property Monitors (APM).

However some markets managed to buck the overall trend and stage impressive quarterly growth in median asking rents, notably the Darwin and Hobart house markets, which saw increases of 3.6% and 3.1% respectively.

The big losers over the quarter on the housing front were Canberra (-2.1%) and Adelaide (-0.6%), while rental growth in the remaining state capitals was flat.

Over the 12 months to March, however, the APM statistics paint a rosier picture of the rental market with six out of eight state capitals recording annual rises in median asking rents. Once again, the big winner was Darwin, with a staggering year-on-year increase of 11.8%. Perth was the next best performer (3.9%), followed by Sydney (2%). The big losers over the year were Melbourne (-1.4%) and Adelaide (-0.6%).

Source: APM

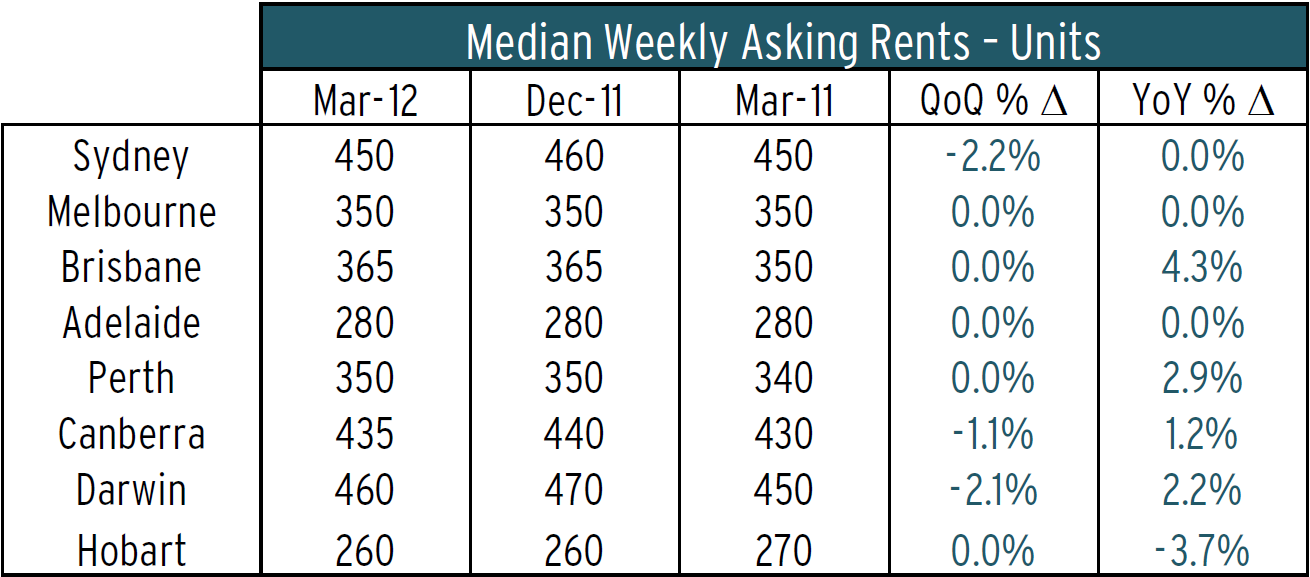

Darwin failed to be the standard bearer for rising rents in the unit market, however, recording a quarterly decline in its median asking rent of (-2.1%). Sydney (-2.2%) and Canberra (-1.1%) also recorded quarterly declines according to APM figures. Rental growth in the remaining capital city markets was flat.

On a year-on-year basis, Brisbane recorded the highest rental growth for units (4.3%), followed by Perth (2.9%), Darwin (2.2%) and Canberra (1.2%). The only capital to see a decline in its median asking rent was Hobart (-3.7%), while Sydney, Melbourne and Adelaide all saw zero growth.

Source: APM

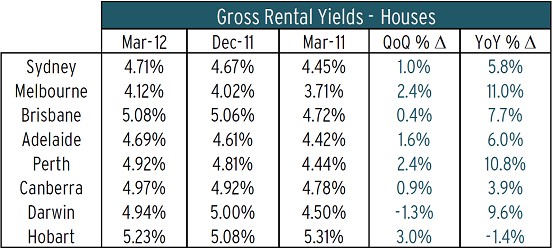

Interestingly, Despite its quarterly rental growth figure of 3.1%, the Darwin house market saw a quarterly decline in its median gross rental yield of -1.3%. All other capital city house markets saw their median gross rental yields rise over the quarter, with Hobart (3%) leading the way, followed by Perth and Melbourne (both 2.4%).

Looking at the year-on-year results, Melbourne recorded the largest rise in median yields 11%, followed by Perth (10.8%) and Darwin (9.6%). Hobart recorded the only annual decline (-1.4%).

Commenting on the general trend for rising rental yields, APM senior economist Andrew Wilson noted that yields "have increased marginally as prices growth remains subdued despite increased buyer activity in most markets".

"Units continue to provide higher gross rental returns compared to houses in all the mainland capitals," he added.

Source: APM

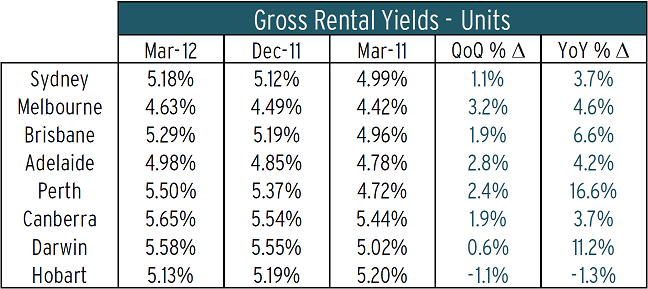

The standout figure in the unit market when it came to gross rental yields was Perth’s year-on-year increase of 16.6%. Darwin (11.2%) also recorded an eyebrow raising annual increase. Looking at the quarterly figures, Melbourne’s unit market saw the largest rise in median gross rental yields (3.2%), followed by Adelaide (2.8%) and Perth (2.4%). Hobart was the only capital city to record declines on either a quarterly or annual basis, scoring -1.1% and -1.3% respectively.

Source: APM

Decreased competition

So what has influenced the disappointing rental growth figures for the March quarter? Wilson argues that flat or declining rental growth over the March quarter for both houses and units “indicates decreased competition for rental accommodation, particularly from first homebuyers that have become active as housing affordability has improved.”

“This is particularly evident in Sydney where a 60% state-wide surge in first homebuyer loans (according to ABS figures) over the last quarter of 2011 has reduced demand for rental properties, particularly units.”

Fuelling the buyer demand in most capitals, he said, is improved housing affordability with the bottoming of the price cycle, falling interest rates and an improved economic.

Wilson argues, however, that better times may lie ahead for landlords.

“With ongoing shortages of accommodation, low levels of new supply and continued inactivity by investors, upward pressure on rentals can be expected to resume in most centres over 2012,” he said. “Gross investment yield growth should track sideways from mid-2012 as prices and rental increases emerge concurrently.”

Which capital city would you choose to buy in? Join the debate on our property investment forum.

More stories:

Is now the time to invest in Perth?

Australia’s building and population hotspots

Are you kidding? 25 suburbs with big capital growth AND cash flow