Buying real estate is no doubt a confusing emotional roller coaster that truly tests even the calmest investor.

You just have to look at the recent spike in prices in Sydney and Melbourne to see how much emotion has ruled the market. Buyers have piled in as everyone else is buying and are pushing prices even higher. On the other side of the spectrum, people are staying away in droves from areas like Perth due to low market activity.

“The marketplace is made up of people and they tend to respond to sentiment,” says Sam Saggers, CEO of Positive Real Estate Group. “The moment you let sentiment enter your thought process when buying investment property, you spoil the deal. Don’t taint the art of buying for investment with your own personal emotions and excitement.”

This means you need to be poised under pressure and buy an investment property based on the numbers. If the deal stacks up, then it should be considered. What that means is the property has a good rent, it’s in a good suburb, and it’s a good time to buy, which is when the market is soft.

“Your only thought, when considering a property, should be how much profit can you make from this property or how will it perform over the short, medium and long term. It’s not about how it makes you feel,” says Saggers.

To help you avoid losses, we’ve enlisted the country’s leading experts to give you their top tips.

14 Emotional Pitfalls to avoid

Paying too much for property is never smart. Unfortunately, as the frenzy happens, people tend to overcapitalise and borrow more than they should, sinking more money and debt into a black hole. Paying too much is an easy trap to fall into in a bull real estate market.

An investor is like a farmer, in the sense that you can only reap what you sow. You won’t see results immediately when searching for property if you want to underpay, not overpay. It takes time to find a good property deal, and you need patience, which is a rare skill in the modern world. Patience is a small price to pay for what you will receive.

Creating a deal that, as we say in the industry, ‘stacks up’ takes endurance and commitment, so don’t rush into anything. Most real estate

is sold in the market to buyers who are impatient, emotional and who consider themselves too time-poor to show persistence. The average buyer sees 10 properties over a few weekends and then purchases one based on their personal taste. A smart investor, on the other hand, will make offers on many properties and then walk away, and even sit out periods of the market cycle rather than buy.

The internet allows you to make offers on properties sight unseen, providing a level of ability to prod values without committing. People now buy real estate over the phone and internet from right across Australia, so it also doesn’t just have to be in your backyard. Offers, if structured properly, are not binding if the right terms and conditions are set out in advance, so consider it a sounding-out process.

2 Overbidding at auction

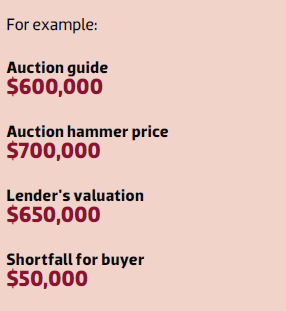

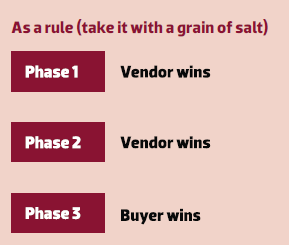

Knowledgeable investors realise that realtors generally want 20–30% more at auction than they suggest to you as a buying guide. They also like you to get attached to the property; if you have spent money on due diligence, you are more likely to want to bid and be ready to push your limits.

Many emotional buyers overbid, get caught up in the moment and overpay. Some of the repercussions of this can be immense. The property may not be valued as highly by the banks, who may see it as overpriced; meaning that you may have to make up the shortfall on what the bank is willing to lend.

Remember: Auction is a three-phase selling process. Agents want you to buy either before auction when you’re likely to make a high emotional offer that is too good for the seller to refuse, or at auction when the frenzy is on. The only time you should buy at auction is once the emotion dies off and for some reason the property passes in (after the auction folds, which can be a good time to buy).

3 Succumbing to your fear of missing out

Why does this happen? Some people say that jumping around from one property to the next without a plan and then missing out weekend after weekend on properties fuels them to pay more.

Paying more may mean you secure your dream property. However, it may not be in your best interest to adopt this view for two reasons.

Firstly, some properties that you visit are not good deals; you just waste your time and are lured in by the marketing. This triggers you to want to buy hastily out of a desire to do a deal quickly.

Secondly, the properties that you do like and that suit your budget are often swamped, to the point that when you attend the open homes there are as many as 20 or 40 other groups in the door.

Open homes sometimes last for only 15 minutes, and agents are pretty savvy at fast opens, which are emotional nightmares for the unsuspecting buyer in a strong market. This also leads to a fear of missing out. Just pay over the price and it will end? Sure, but at what cost?

4 Not doing due diligence

When going through the process of buying, as a general rule you need to do some due diligence. You can negotiate a specific timeframe or terms that will allow you to gather more information about the proposed property. The property that you are buying is a live deal, so be sure to act swiftly and not procrastinate. Generally, try to exchange on a property within 21 days.

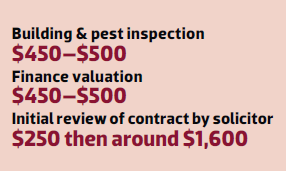

In that 21-day period, coordinate various third-party experts to help you formulate a better opinion on the property. This will include a legal opinion on the contract from a solicitor, a building report, a pest report, and a bank finance valuation.

The typical costs during your due diligence period of consulting independent experts are shown overleaf. This is an estimate only.

Due diligence costs money, so don’t ever skimp on it. The few hundred dollars it costs to run due diligence can save you a lot more in the long run. Don’t be put off if your due diligence finds a problem and the contract falls over. Don’t feel betrayed because you have lost money; feel grateful that you have been saved from the loss of far more. Due diligence is a vital part of the process, no matter the cards you’re dealt.

So many investors get this brief wrong. An investment should be pragmatic and a home is purely emotional and needs-based. To mix the two means that a numbers-based brief which is black and white is suddenly overridden by shades of grey. The journey is confused and the financial outcome is compromised.

Why is it risky?

This strategy is risky because an investor can overlay their own desires onto the project, and these desires may not make commercial sense for the area, the spend limit or the target tenant. The worst-case scenario is that the investor has a property which:

• doesn’t exhibit much growth

• is hard to rent out all year round

• doesn’t appeal to the target tenant of the area

It’s far easier to differentiate the home-finder brief from the investor brief. The quicker the assignment is defined, the more clarity the searcher can enjoy, and the better the result the investor can benefit from.

6 Deluding oneself that a holiday house can double as an investment property

Holiday homes entice novice investors all the time, but they are risky investments for the following reasons:

- Zero (or limited) income if the holiday home is untenanted

- Limited tax deductibility if the property isn’t rented out

- Expensive management, cleaning, laundry and catering during high season

- Holidaymakers usually want to rent the home when the owners want to use it

- If it is rented, the tenant isn’t necessarily the perfect, high-income-earning, professional tenant

- High vacancy rates in holiday hotspots during the low season

- Holiday hotspots can be the first to tank when times turn bad, as a stressed businessperson will turn in their holiday home before they’ll give up their home or business assets

What to do before buying a holiday home

Run a cost-benefit analysis and work out your real costs for the hotspot motel/hotel you wish to stay at. Then benchmark these against the real costs of the investment you are thinking of buying and holidaying at.

Be honest about how many weekends you think you’ll stay there, the cost of fit-out, and ongoing costs such as:

• Mortgage

• Rates

• Insurances

• Maintenance

• Cost of short-term/holiday rental for the times you aren’t using it

7. Selecting a property with your own ‘nice-to-haves’ in mind

From disliking the bathroom tiles in a property to selecting local areas that are ‘familiar’, buyers make grave mistakes based on shallow or non-existent criteria.

Why is it risky?

Unless you are representative of the target tenant, it is not advantageous to allow your own preferences to get in the way.

Often we meet new investors who entertain ‘buying property around the corner’ because it’s ‘easy to keep an eye on’. But who wants to be reminded of a tenant in their own local property when a good property manager can take away that concern?

And when clients express that they dislike a kitchen, or a colour scheme, or tiles, we ask if they are representative of the target tenant. If they aren’t, they may be placing a value on something a target tenant doesn’t actually care much about. This can cost them a better-quality asset choice in the long term, particularly if they are either overcapitalising, or focusing on an area that doesn’t offer optimal capital growth prospects.

What to do instead?

Keep an eye on the prize: outperforming capital growth, great-quality tenants, low vacancy rates and solid yield.

If all four of these can be achieved, then it’s only fair to say that the property has delivered, full stop.

8. Assuming that a bad tenant is representative of all tenants

This is often the hardest part of investing. Not everything goes to plan, and not all tenants are great tenants. Every now and then a tenant lets us down. Whether we’ve been duped by them, picked the wrong property manager, made a bad decision ourselves, or just lucked out, tenants can do the wrong thing.

When a property manager is selected carefully and a tenant is screened properly, it is rare for things to go seriously wrong. It’s fair to say that there is a low risk of experiencing these situations.

Why is it risky?

Investors often stop at one property because they got burnt. I am

always saddened by this, as one bad experience can ruin an asset class experience for someone who deserved a better run.

What to do instead?

Don’t become despondent. Ask yourself what could have been done differently. Seek a second opinion from a property manager if you are in doubt about how they handled the tenancy. Don’t assume that you’ll have another bad experience with the same property.

Being a landlord isn’t always easy, and our success is measured by how well we handle the challenging stuff. It’s rare that we make the same mistakes twice … and it’s all about learning and adventure.

When you fall in love with a property, you’ll inevitably pay too much for it. Buy with your head, not your heart. Think and act like a hard-nosed property developer.

10 Talking yourself

This includes justifying an inflated price for a property. Telling yourself, “Oh, it’s a long-term investment, so what if it’s a few extra thousand more than I wanted to spend?” is the surest way to fritter away potential profits.

11 Renovating to your personal taste, rather than your target market's

This is a big mistake. Work out who your target buyer/renter is and tailor your renovations accordingly.

Asking for opinions and advice from friends, family or colleagues who are not on the same journey as you can make you doubt your decision to buy an investment-grade property and make you abandon it in the end.

This emotional roller coaster can be repeated over and over with every property, and months and years can go by without you buying anything. The right person to ask is the person who has experience or has succeeded in growing a portfolio.

13 Buying at the wrong time in the property cycle

It is easy to get excited and follow the herd mentality and to buy when the market is ‘hot’ and be emotionally invested. Everyone else is buying, so it must be the best time to buy.

The risk is that you may be buying at the peak of the market. You’re paying premium for a property that’s going into the correction phase, which could last for many years. This will stop you in your tracks as there will be no equity growth, and growing a portfolio will have to be put on hold.

You need to understand that property markets will not continually grow in value every year forever. They have to undergo the different cycles, such as growth, stability, correction and recovery. The best time to buy is when the market is showing all the drivers for growth, when property is becoming seriously undervalued and demand outstrips supply.

14 Holding out for the perfect property

So many investors start out with great intentions and do huge amounts of research to find the right area and the right property to buy. They find a property and then they continue doing more and more due diligence and need to have all the details accounted for before they make a decision.

By the time they are ready to make a decision, the property has been bought by somebody else. This type of waiting for the perfect property risks the investor never getting started and never reaching their goals. There is no such thing as a perfect property.

WHAT SHOULD YOU DO?

1. Know yourself

The reality is that we all suffer from the psychological weaknesses referred to above. But smart investors have an awareness of their weaknesses and seek to manage them. One way to do this is to take a long-term approach to investing. But this is also about knowing what you want to do.

2. Seek advice

Given the psychological traps we fall into as investors and the fact that investing is not easy, a good approach is to simply seek the advice of a coach such as an investment or financial advisor, in much the same way as you might use a specialist to look after other aspects of your life, like fixing the plumbing, taking care of your medical needs, or helping you get fit.

3. Invest for the long term

The best way to avoid losing on investments is to invest for the long term. Get a long-term plan that suits your level of wealth, your age, your tolerance of volatility, and so on, and stick to it.

4. Diversify

This is a no-brainer. Don’t put all your eggs in one basket, as the old saying goes. But plenty do. This could potentially leave you very exposed to a very low return or growth, if something goes wrong with the properties you’ve invested in.

5. Turn down the noise

Once you have worked out a strategy that is right for you, it’s important to turn down the noise on the information flow surrounding the markets. Too much information has turned investing into a daily soap opera, as we lurch from worrying about one thing to another. You’d be better off turning the financial soap opera off!

6. Focus on investments offering sustainable cash flow

There have been lots of investments over the decades that have been sold on the promise of high returns or low risk but were underpinned by hope based on hot air. The key is that if it looks dodgy, hard to understand, or has to be based on obscure valuation measures to stack up, then it’s best to stay away. By contrast, assets that generate sustainable cash flow and don’t rely on excessive gearing or financial engineering are more likely to deliver.

7. Recognise there is no free lunch

If an investment looks too good to be true in terms of the return and/or riskiness on offer, then it probably is.

8. Buy low, sell high

If you do have to trade or move your investments around, then remember to buy when markets are down and sell when they are up. This seems like a no-brainer, but most people do the opposite. There’s an old saying in investment markets: “Flows follow returns!” In other words, inflows are strongest after periods of strong returns and outflows are strongest after weak returns. It should be the other way around.

9. Don't fret the small stuff

It’s easy to spend lots of time worrying about an individual investment or whether to buy here or there. But the reality is that the key driver of your return is the assets that you are exposed to. In other words, asset allocation is paramount and it’s very hard to avoid this.

10. Recognise that the aim is to make money, not to be right

Many investors miss this. Lots of people have lost money by doggedly following some assessment that they were sure would be right. But the key is to recognise that getting some view right is not what it’s about. What it’s about is making money. Don’t get hung up on extreme views about where markets are going.

11. Beware the crowd at extremes

For periods of time the crowd can be right, and safety in numbers provides a degree of comfort. The problem with crowds is that eventually everyone who wants to buy will do so, and then the only way is down (and vice versa during crowd panics). As Warren Buffett once said, the key is to “be fearful when others are greedy and greedy when others are fearful”.

12. Finally, if you have the right long-term strategy, never despair

Things normally turn out OK eventually. Fortunes are invariably made out of tough times.