You’ve found your dream home. It’s got everything you need: proximity to the CBD, shops and schools, and a stunning dining room you can’t wait to entertain guests in. There’s just one problem.

The deposit you’ve painstakingly saved during the past year is no longer enough as prices have surged past the unaffordable range.

Lucky for you and many others in a similar predicament, there is still a way to live in a dream home and own a property. In fact, more and more people are taking this idea on board.

Recent data has revealed that an increasing number of fi rst home buyers are opting to purchase an investment property before buying their own home.

Indeed, 36.6% of investors are first time buyers, according to Mortgage Choice’s latest Investor Survey. This is a far cry from the 21.1% recorded at the same time last year.

There’s no doubt about it; affordability is the main (but far from exclusive) advantage of being a ‘rentvestor’.

For the many people who work in (or close to) the CBD, high property prices can be a barrier to living in that vicinity and hence enjoying the ease and

efficiency of short travel times.

“I don’t know many people who can afford to buy their first house within the CBD, or within the realm of the CBD,” says Fab Mastro, a mortgage broker at Mortgage Choice Whittlesea in Melbourne.

“So what they do is they invest where they can afford and they rent where they can live.”

• Renting your way to your dream home

In the current market, buying your dream home can be very expensive, and it can feel like most properties are overpriced, particularly if you are in a city like Sydney, says Hank Hong, senior mortgage consultant at Home Loan Experts in Sydney.

“Living at home or renting where you want to live and having two or three investments over a few years can be a stepping stone to buying your dream home,” he says.

“It’s a good balance between life and finances.” Hong knows more than most about rentvestors, as he not only works with them but is actually one himself. In fact, in addition to renting where he wants to live, he has built a portfolio of investments and developments over the past five years.

“These developments will provide me with a 50% deposit to purchase my home once complete,” he says.

Tax advantages

The interest on investment properties is tax deductible, as opposed to interest on a principal place of residence (PPOR), which is not.

It’s the landlord who pays for things such as maintenance and repair costs, which as a renter you don’t worry about. However, as an investor you have to pay these too, but in your case they are tax deductible because you don’t own your own home.

Hong says he is a big believer in building an investment portfolio to both increase capital growth and reduce tax.

Better lifestyle

Renting where you want to live means you are generally more likely to fi nd and afford a home that will suit your personal needs than someone on the same income who is buying.

If you’re a young, single professional, that might mean renting a one-bedroom apartment within 10km of the CBD.

Whereas, if you’re living with your young husband/wife and two young kids and renting a three-bedroom house about 20km from the CBD that’s close to sought-after schools and shops, this might be your dream property.

• Disadvantages of rentvesting

Repayment risks

In some circumstances, rentvestors are highly vulnerable to external factors which they can’t control.

Imagine that you are renting close to the CBD of a capital city and paying a mortgage on two investment properties in a mining town. Then, all of sudden, the mine closes and the tenants of both your investment properties move out. Not only that but it’s now a struggle to find tenants and the costs are mounting.

To make matters worse, you have just been made redundant and therefore don’t have a steady income to pay off the mortgages.

It sounds like a nightmare, so if something similar to this happened to you, could you cope financially and emotionally?

This is a scenario that somebody who is paying off their PPOR with no investment properties does not have to worry about. For them, the main concern is simply keeping their job and making sure they have a buffer of savings in place in case interest rates rise.

Another external factor investors on average incomes should watch out for is the risk of price falls. This can be combated by investing in areas with diverse economies and low unemployment.

Freedom is limited

One of the great things about owning your own home is the ability to be in control of your destiny.

If you are renting there is no guarantee you will be able to stay in the property for as long as you like; this is at the behest of your landlord.

Additionally, if you are planning on making any changes to the property, you will need to seek permission from the landlord.

New rules are making rentvesting harder

Despite recent price rises in certain capital cities contributing to an increase in the number of rentvestors, there are other factors currently at play that could reverse this trend.

Some experts in the mortgage industry believe recent rules might result in a slight reduction in the number of first-time buyers purchasing investment properties next year.

These include APRA’s decision to cap investment lending growth at 10% for lenders, which resulted in Australian banks recently making changes to their investment lending policies.

Hong agrees that the new investment lending changes are going to make borrowing harder; however, he does see a potential upside to this for the likes of Sydney as far as affordability is concerned.

“On the flip side, this will reduce buyers and may cool down the Sydney market,” he says.

• Tips for those considering rentvesting

Do a test run

Mastro recommends that investors do a test run to see what they can afford before actually buying a property.

For example, you might be looking to buy a property for $500,000 and know the interest repayments are going to be $2,900 each month based on a 7% interest rate.

Do a test run to see whether or not you can actually save the required amount of money over a certain period. This will also give you a good idea of what you can and can’t afford.

“Doing it on paper and actually doing it are totally different things,” he says.

In particular, average income earners (or people earning between $50,000 and $70,000) are in a tougher situation for dealing with unforeseen circumstances than high-income earners who can build savings relatively quickly. For that reason, it’s also wise to have a buffer in place in the form of a healthy amount of savings.

Of course, having a stable job and paying bills on time is also necessary in order to be able to afford the ongoing costs of property.

CASE STUDY

CHRIS GRAY: THE KING OF RENTING

It’s hard to find a stronger advocate for renting than Chris Gray, founder and CEO of Empire.

His strategy of renting while buying investment properties has helped him accumulate a portfolio worth more than $10m.

What this proves is that rentvesting is not just a good idea for people on low and average incomes. It can really be a smart strategy for anyone, no matter how much you earn.

“The primary reason why I rent rather than buy is because, just like a first home buyer, even though I am reasonably well off I still can’t afford to buy the house I want in the right suburb,” he says.

His strategy is to buy properties such as two-bedroom units in blue-chip suburbs such as Coogee and Bondi.

“Because of their median price lots of people can afford them, and there aren’t that many of them so the rent rises,” says Gray. “Whereas I rent houses which are $3m, $4m, $5m, $10m, and because there is no demand for those properties since everybody thinks that rent money is dead money, then the rents go down.

“The other advantage is that suddenly all of my debt is deductible. I have no non-deductible debt because I don’t own my family home. So I think that wherever you can afford to buy a home you can afford to rent somewhere three or four times more expensive.”

Since Gray has been renting he has been living in everything from massive brand-new houses with seven garages, pools and saunas, to a unit that was completely circular with 360-degree views around Sydney.

He believes this idea can be a refreshing approach to how things were once done.

“Our parents’ generation is always saying rent money is dead money,” he says. “Just because your parents did it that way doesn’t mean you have to do it. I have no aspirations to ever buy my family home, nor has my wife. Originally, when we spoke to our accountant he said that when we got married things would change, and they didn’t; when you have kids things will change, and they didn’t; when they go to school things will change, and they didn’t. So with all these things everything comes down to attitude. We love renting and we are living in places we can’t afford [to buy].”

Act on logic

Remember, buying a home is often an emotional journey, and buying an investment property must be a logical and rational decision.

“When buying an investment property you should remove from the equation that you are going to live in it,” says Hong.

It’s also important to look at a range of property types in the area before buying an investment property, says Hong. Investors should not be put

off just because they have seen a few properties sold that were outside their price range.

Use a buyer’s agent

One thing Mastro did when he bought his first property was use a buyer’s agent. This is especially important for first home buyer landlords because it’s crucial they make a wise decision with their first purchase as this can kick-start their portfolio.

Mastro found the buyer’s agent’s services helpful because they could not just educate him about what an investment grade property looked like but could also save him time wasted on considering bad properties.

“I learnt some really useful things moving forward for buying property in general, whether it’s an investment or owner-occupied, and that helped shape my view on how property works,” he says.

“There are quite a few properties out there that are not growing as well, and whether you are buying your first, last or middle property, it’s great to have someone who can help you on your whole investment journey.”

Choose suburbs that are still underrated

Hong likes suburbs that once had a bad name but still have capital growth potential. This can be good for rentvestors on average incomes who are looking for affordable investment properties in suburbs with strong potential that is not yet reflected in the median value.

Hong cites Cabramatta and Blacktown as suburbs that had a bad reputation 10 years ago but have since experienced strong capital growth.

“The most important thing is to get your foot in the door; it might mean buying something much smaller or outside the metro area or interstate,” he says.

• It’s what you do with the money that counts

If you’re on average income, don’t fret. It’s not so much about the amount you earn but what you actually do with the money that determines how many properties you can afford.

“Getting a good cash flow strategy for someone who earns $50,000

might enable them to rent and buy an investment property, as opposed

to someone that has a poor cash flow strategy and earns $100,000 and can’t afford it,” says Mastro.

“I don’t think having a blanket rule where if you earn x amount of dollars means you can or can’t afford a property works. I believe it’s more about each individual person’s ability to save and to manage their money.”

Mastro says investors on average incomes should be putting roughly 30% of their income towards home loan repayments. However, if you purchase the right investment property and the rental yield continues to increase, then you might be able to afford to spend more.

Embrace change

Get into the mindset that you are going to be moving every year. Then if you end up staying, it’s a bonus. Try to treat renting as something that’s a bit more transient; as an advantage rather than as a negative.

Focus on what you are saving, not what you are spending

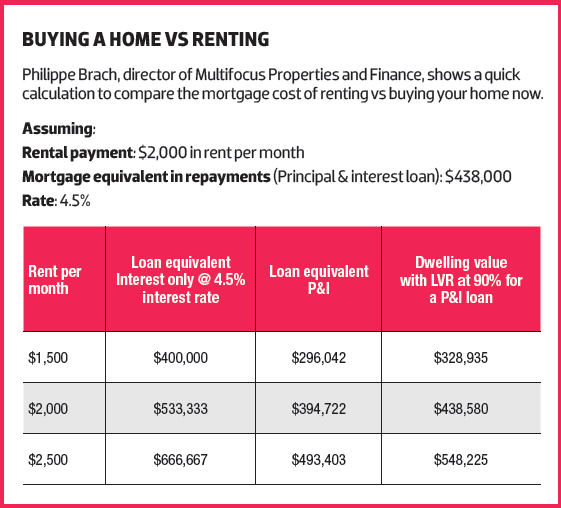

For example, consider a property worth about $600,000 at a mortgage of about 7%. To buy the property it would normally cost about $42,000 per year in interest. As a renter, you’re only paying $26,000 a year. So you’re effectively saving $16,000 a year, even before the tax deductions kick in.

What an average income earner could afford

Let’s take the following specific scenario. There are three people who have annual incomes of $50,000, $60,000 and $70,000.

They are all single and have no debts and no dependants. They are all living alone and are each paying rent for a unit at $350 a week, in addition to $1,500 in monthly household expenditure.

We also assume they are each able to afford one different investment property where they receive the following rental income:

50,000 person – $220 per week

$60,000 person – $310 per week

$70,000 person – $400 per week

A home loan calculator (assessment rate: 7.25%) was used to work out how much they could borrow, and we factored in a 20% deposit to determine how much they could pay for a property.

$50,000 person – $184,147

$60,000 person – $333,652

$70,000 person – $482,053

These numbers also factor in stamp duty (NSW) being paid, but do not include legal fees.

From these calculations, Your Investment Property has put together a list of potential suburbs which these particular people on the above incomes could afford. (See p30–36.) This is based on CoreLogic RP Data’s median suburb prices. Moreover, these lists also act as a guide for investors who are considering a certain price range and want an idea of what’s on offer.

It’s also important to note that the property an investor can afford significantly depends on their ability to manage money and the investing strategy they adopt.