That’s the type of forecast that’s been going around for the last few months, in fact for the last few decades, and in the past have been easy to dismiss as they were made by overseas “experts” each trying to outdo the other with sensational headlines.

But how should one respond to last week’s headline when Australia’s biggest bank, the Commonwealth Bank, forecast property values could drop by 32%.

Well…it’s important to understand that most credible economists produce a range of forecasts that allow them to hope for the best but be prepared for the worst.

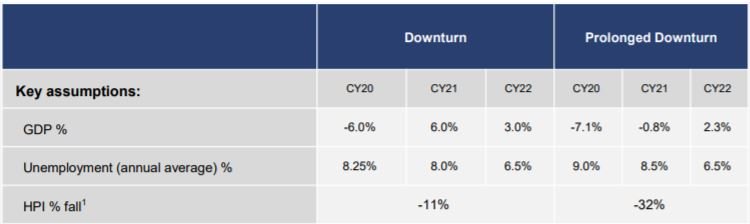

And this particular forecast of a 32% drop in property values was CBA’s worst-case scenario.

Not their most likely scenario. And it assumes a prolonged economic downturn as a result of the Coronavirus pandemic and also assumes unemployment will hit 9% this year before falling to 6.5% by 2022.

However, CBA’s preferred and most probable scenario is for a V-shaped recovery, in other words a shorter economic downturn which would see house prices drop by 11%.

Think about it…if CBA really believed that house price falls of 30% were likely, they wouldn’t really be lending borrowers 80% or even 90% Loan to Value ratios, would they?

Source: Commonwealth Bank Forecasts

What are the other banks forecasting?

Most credible economists and our other big banks all concede that if the world does fall into a severe recession, and Australia also experiences a prolonged recession creating prolonged high unemployment, property values could fall by about 30%.

But in all cases (other than for the for those well known perma bears) their most likely base case scenario is for some challenging times ahead this year and then a rebound in our economy and our property markets in 2021.

But don’t forget….

When headlines say Australian property values will drop 30%, it’s important to remember that there is not one Australian property market.

In fact, there’s not one Sydney or Melbourne property market either.

There are markets within markets dependent upon price point, type of property and geographic location.

So which part of Australia’s property market is predicted to fall in value by 30%?

Is it all properties? That’s unlikely.

Is it median house prices? Or will certain types of property fall in value much more than the other than others?

More bad news on the way

Sure consumer confidence has risen over the last couple of weeks as many of us are starting to see a light at the end of the coronavirus tunnel, but close to quarter of our workforce is now either unemployed or underemployed and these figures would be significantly worse were it not for the JobKeeper incentives.

And I see a lot more bad economic news coming our way over the next few months, which will test Australia’s resilience.

Some areas will suffer more.

But moving forward some suburbs are likely to only experience minimal falls in value while others will suffer more significantly.

Just think about the typical demographic who bought in the new housing estates in the outer suburbs of our capital cities.

Residents there are typically at the same stage of their life cycle, getting their foot on the property ladder, setting up their families, paying a large mortgage and carrying significant credit card debt.

These are the types of locations where residents are more likely to suffer mortgage stress, and if people need to sell up, at a time when their neighbours are in the same boat, property values could drop significantly.

The same is true for the many investors who have bought cookie cutter apartments in and around our CBDs and who now have minimal or even negative equity in their properties.

With few new investors buying this type of property, CBD apartments are likely to fall in value significantly.

On the other hand, the demographics of our established middle ring capital city suburbs are very different as they are populated by a range of families at different stages in their lifestyle.

Some residents would have bought their property 30 to 40 years ago and paid off their mortgage a long time ago.

Others may have purchased the property 15 years ago and paid off a significant portion of the debt while living in the same street there would a few newer residents who have significant level of debt against their homes.

In the suburbs demand currently demand is higher than the undersupply of properties available and values in the suburbs are likely to hold up well.

So what’s ahead?

What will happen to our property markets will depend upon how soon our economy picks up, the level of unemployment reached and importantly the level of consumer confidence coming out of our recession.

At the same time, with banks extending borrowers a lifeline in the form of deferred mortgage payments, there is no forced selling at present and this plus the lack of new properties being listed for sale is underpinning property values.

Fortunately our Federal government has learned a lot about handling monetary and fiscal policy during economic downturns resulting in the slashing of interest rates, the introduction of Quantitative Easing and our spending $300Billion plus to build a bridge to get us through this and will now doubt spend a lot more to kickstart the economy.

At the same time the State governments have introduced their own support and stimulus packages.

Clearly our housing markets won’t be immune to the Coronavirus economic fallout and property transaction levels will be significantly impacted over the next few months with discretionary sellers staying out of the market.

In the short term:

- “Investment grade” properties and A grade (above average) homes could fall in value by around -5%

- B grade (average) homes could fall in value by up to -10%,

- C grade (less than perfect) will be the hardest hit as there will be a flight to quality.

But this will be on a on very low levels of transactions and the pace of recovery from that point will depend on the state of the wider economy.

On the positive side, households and property investors whose incomes remain stable and secure will be able to take advantage of historically low interest rates.

This should support a return to stronger levels of property price growth in the medium term.

..........................................................

Michael Yardney is CEO of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

Michael Yardney is CEO of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

To read more articles by Michael Yardney, click here