A high cash flow property investment is one that pays you more each month than it costs you to own.

Say the property sets you back $2,500 every month once mortgage repayments, council rates, insurance and other ownership costs are paid; a positive cash flow investment would then generate an income of more than $2,500 per month, thereby delivering instant profits to your bank balance.

When we look long term, the aim of most investors is to own their investments outright so they can eventually live o the income in retirement – and positive cash flow investments could be a step in that direction.

For instance, let’s go back to the previous example and assume this property generated a monthly income of $2,800, or $300 more than the expenses. After you’ve paid tax on that income (equivalent to your income tax rate; we’ll assume roughly one third), you’ll be left with $200 in additional income.

Plow that income straight back into the investment mortgage and you could accelerate your ownership plans. In fact, you could save up to $60,000 over the life of the loan – and own the property six years sooner.*

High-yield properties are also important for lower-income Australians who want to build a portfolio but can’t afford to manage additional expenses on a property where the income doesn’t cover the outgoings.

That said, not all high-yield properties are created equal. In chasing big property returns, investors could turn to remote locations based on the promise of a high rental income, without factoring in the potential for higher vacancy rates and/or sluggish capital growth.

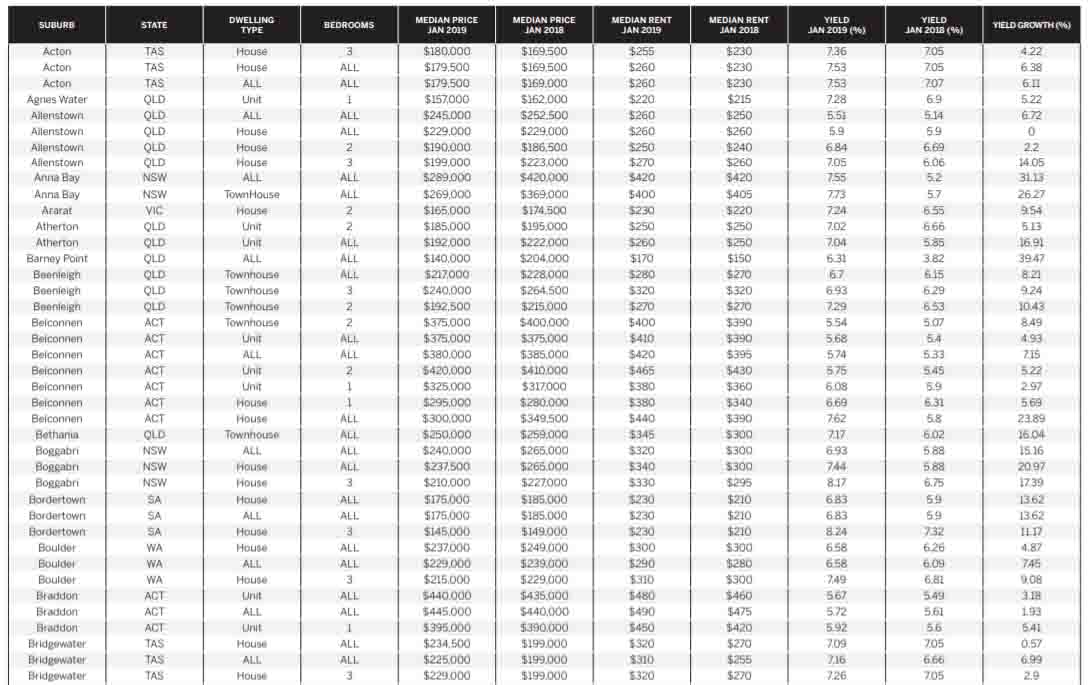

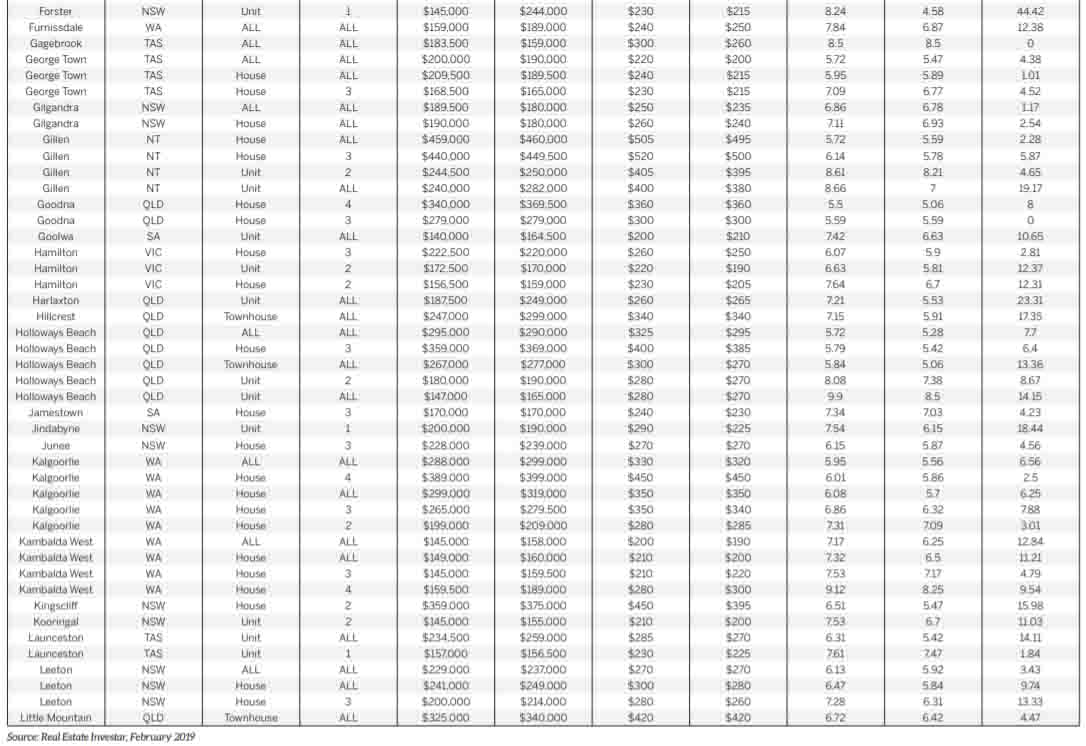

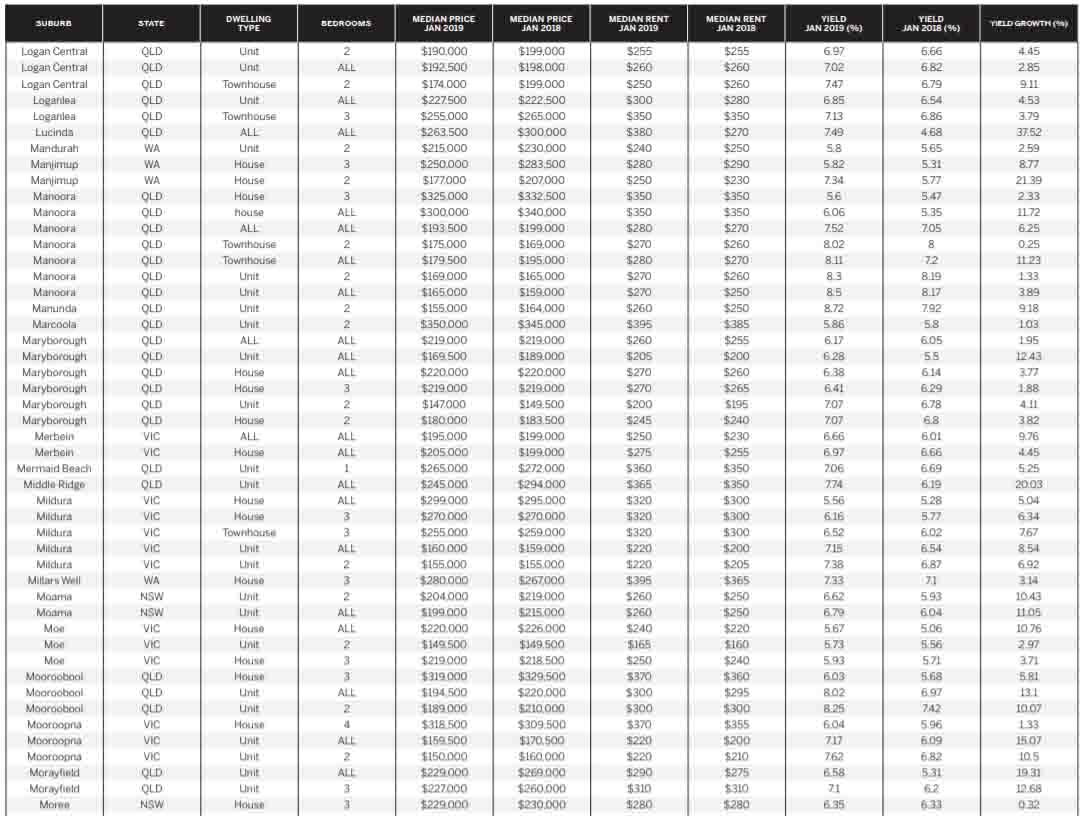

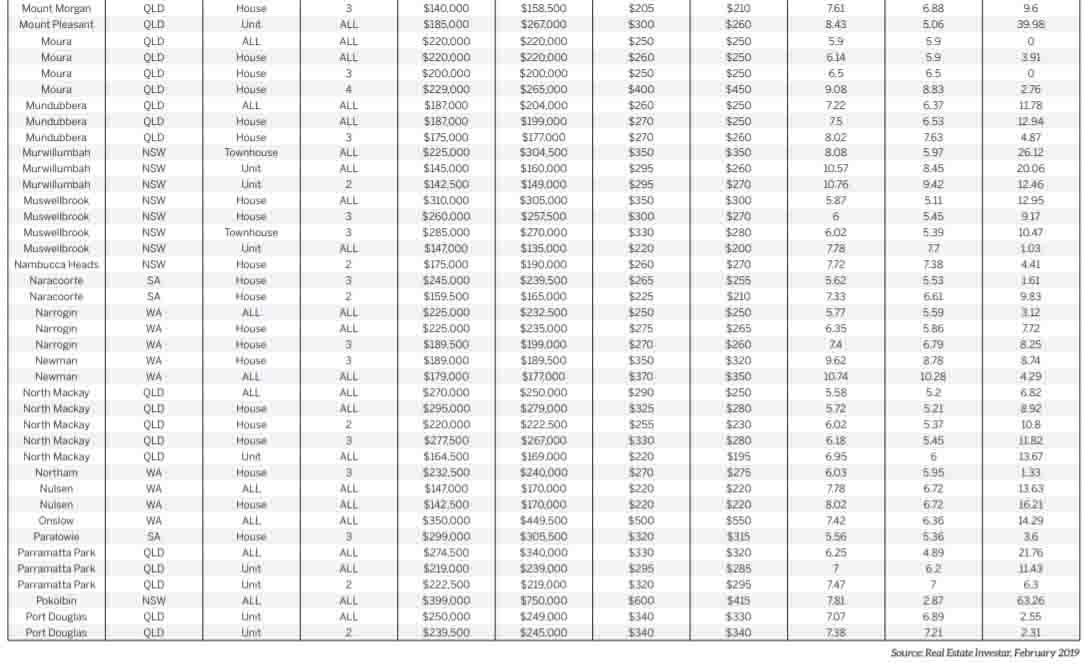

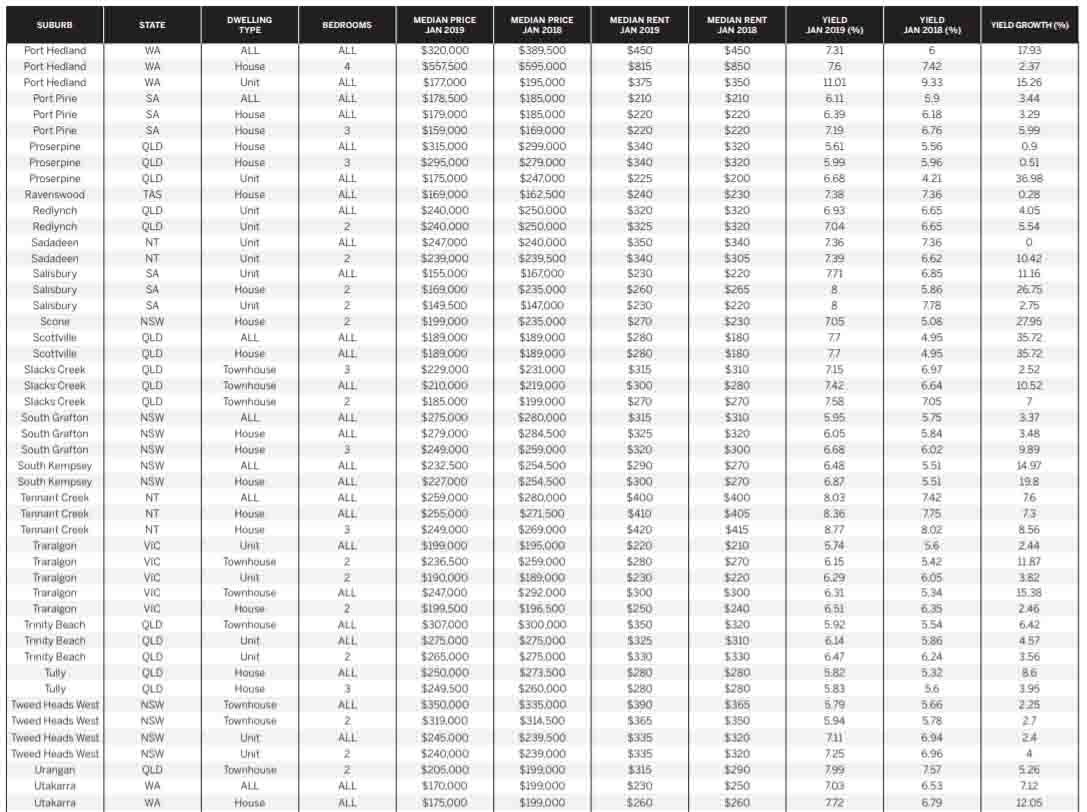

It’s crucial that you consider the bigger picture when planning your next investment, which means doing your due diligence on everything from vacancy rates and unemployment rates to historical capital growth and population forecasts. The suburbs in this report may give you some inspiration as you embark on your search for your next investment.

High-yield risks

In the pursuit of sky-high returns, don’t add highly risky properties to your portfolio – they have the potential to move you further from your wealth creation goals, rather than closer. The riskiest high-yield plays include:

One-industry towns. Does the area rely on its agricultural production, tourism appeal or mining economy to survive? If so, property values could be vulnerable during an economic downturn. Aim for areas with a big spread of income supporting the area, so that if one industry falters there are others driving the economy.

Remote suburbs. Think you’ve found the bargain to end all bargains in a far-west, remote town of Queensland or NSW? Perhaps think again; these types of regional purchases are particularly risky because their population size doesn’t support ongoing rental demand, and price growth is small and/or stagnant. Look for towns with at least 20,000 residents in the local government area.

Finance risks. Now more than ever, banks are looking to lower their risks when offering finance, so approaching them with a risky deal may see your loan application denied. Many banks are cautious about lending you money to purchase property in ‘risky’ postcodes, as they perceive the future outlook for the investment to be low-growth. Heed their warning that the suburb is too volatile to invest in, and move on.Small studios. Tiny studio apartments may offer a strong return, particularly if they’re located in a vacation high-rise that sees a constant turnover of holidaymakers. But these types of investments are hard to onsell and generally experience little to no capital growth.

*Calculation based on the yourmortgage.com.au Extra Repayment Calculator, assuming a mortgage of $300,000, an interest rate of 4.5% and a 30-year loan term, with extra repayments made from the beginning of the loan.

Find out how the team at Your Investment Property used Real Estate Investar data to find these 141 high yielding suburbs, in this on-demand webinar co-hosted by Sarah Megginson (editor of Your Investment Property Magazine) and Real Estate Investar.

NOTE: Exclusive discount on the Pro-Membership package mentioned at end of webinar.

Save 33% by clicking here.

Click on the images to expand

The full article highlighting all 141 high-yield top performers including suburb profiles was published in the April 2019 edition of Your Investment Property magazine.

The full article highlighting all 141 high-yield top performers including suburb profiles was published in the April 2019 edition of Your Investment Property magazine.