Not all of us earn $100,000 a year. Hell, some of us don’t even scrape $60,000. And even if our salaries are decent, that doesn’t mean we’ve all got the ability to save up the $50,000 or so in upfront costs necessary to purchase a property in a ‘decent’ suburb.

Faced with this pretty depressing reality, what choice do aspiring yet cash-constrained investors have? Not invest? Rely on super? Neither of those sounds like a compelling option. But there is another way. Property in markets like Sydney and Melbourne may be well beyond the mark of $450,000, but there are plenty of other areas where it is possible to purchase property for under $200,000. Some of these places have large populations.

But are they reliable areas to invest in? In theory, some are. In fact, certain investors would say that purchasing in an area where property is cheap, and where a lot of people live, is a smart approach. The motivation is simple: a lot of people live there and there will always be a market for property there because prices are cheap. Your buy-in is low and there is little chance that prices will fall backwards since they are starting out so low anyway – so what could go wrong?

Theory vs practice

A look at Australia’s cheapest and most populous suburbs, compiled by Real Estate Investar, shows that the majority of these types of markets are not good places to invest in. And it’s not because there is no demand for property in these neighbourhoods. Because property prices are affordable and these suburbs are large, people do buy property in these markets – and a lot of it. It’s just that little of this activity has the habit of pushing prices up. Incredibly cheap markets are often cheap for a reason. Socio-demographic problems can be rife and some of these markets don’t have access to good amenities – that’s why they’re cheap.

The exceptions to this rule are (1) commuter markets and (2) regional centres with a strong service offering:

1. Commuter areas can have quite boisterous real estate markets because demand from city workers, however far away the nearest city may be, keeps pushing prices up. In this type of suburb, residents can have quite high incomes, despite living in areas where property prices are very cheap.

2. Regional centres, ignoring mining towns, tend to be cheaper because they are far removed from capital cities, but robust economic drivers can ensure that these housing markets aren’t dominated by negative market forces such as widespread unemployment.

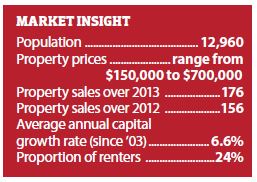

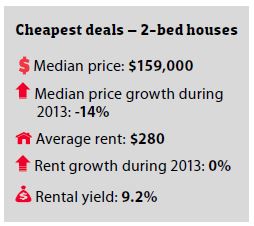

With this in mind, data from Real Estate Investar reveals which cheap and populous real estate markets offer investment opportunities worth researching further.

Viable Cheap And Populous Markets

KINCUMBER, NSW

Kincumber, like many parts of NSW’s Central Coast, has a property market that is largely driven by affordability. Halfway between Newcastle and Sydney, this suburb is popular with commuters – professionals with families tend to like the area because it is cheaper than either of those cities, but it is also within reasonable travelling distance of both.

Kincumber’s selection of services and amenities is decent, ticking all the basic requirements that tenants would want. There is a Coles, several takeaway restaurants, sports facilities, some pubs and a scenic walking track along the waterfront. The area is also close to numerous national parks and some beaches. The Gosford and Woy Woy train stations are approximately 6km and 7km away, respectively.

From a supply and demand perspective, the suburb looks to be in a strong position to see price increases. There is a low amount of property available on the market (just 0.7% of all properties), but conversely, demand is strengthening. Properties tend to spend just 10 weeks on the market before attracting buyers, and because the average buyer is only able to negotiate 5% off the listed price, sellers are getting pretty close to what they originally asked for. This indicates that buyers are facing a fair amount of competition for properties.

For a market that isn’t within a major city, Kincumber also currently has a high proportion of houses being sold through auction. The current auction clearance rate is 70%, above the national average.

GOULBURN, NSW

Goulburn continues to have a robust property market because it is galaxies cheaper than Canberra but within commutable distance of the city. With most Canberra houses priced around the $550,000 mark and units typically priced at around $400,000, Goulburn’s median house price of $295,000 seems a steal by comparison.

Around 50 minutes’ drive from the Australian capital, this property market’s combination of affordable prices, larger block sizes and convenience for families has seen a lot of city workers move to the town. Goulburn also benefits from Canberra’s chronic undersupply of land for new development. The ACT is notorious for being slow to release new land, and this has historically given Canberra a tight housing market, and in turn an expensive one. Goulburn, by contrast, is a more open market.

It also has largely everything an aspiring tenant would want or need. Most residents get their groceries at the local Woolworths and there are numerous schools. The local hospital is conveniently positioned within the town, and there are many parks scattered around the suburb.

For investors, the current rental market is in a healthy space. The vacancy rate for houses is 1.6% and for units 1.9%. Many properties also attract reasonably high rents, and finding cash flow positive property is a lot easier in this market.

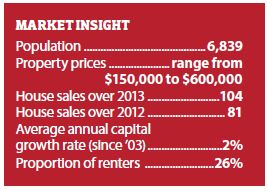

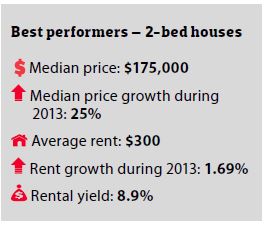

MILDURA, VIC

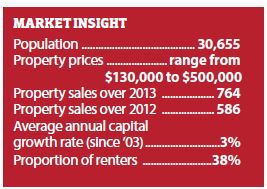

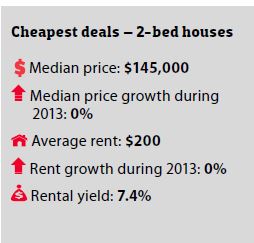

Most Australians are probably familiar with Mildura, mainly because of the juice company of the same name. With such a juicy legacy attached to the town, it’s no surprise that it remains one of Victoria’s biggest agricultural towns and a valuable service centre on the Victoria/NSW border. To this day, the area is still responsible for close to 80% of Victoria’s grape production. Because of Mildura’s relative isolation from bigger settlements (Adelaide is a four-hour drive away and Melbourne a six-hour drive) it has had to develop a strong offering of amenities to service its population. Prominent shopping brands such as Coles, Woolworths, IGA and Harvey Norman have a presence in the town and there is a shopping centre with cinemas. There are also four 18-hole golf courses within short distance of each other, a racecourse and other sporting facilities.

As investments go, Mildura property is fairly low on risk. On the surface, the town may not have the most diverse of economies to motivate a property purchase, but Mildura’s sheer size, coupled with

the rock-bottom level of pricing, suggests there will always be demand for property in this area and there is almost no room for prices to fall backwards.

Many of the properties available on the market go for as little as $140,000, and at that price offer highly attractive yields. Such properties won’t be strong contenders for large-scale capital growth, but for investors looking for cash flow at a low entry price, Mildura offers a lot of buying opportunities.

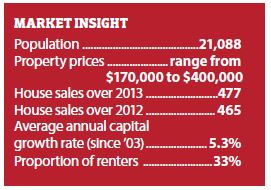

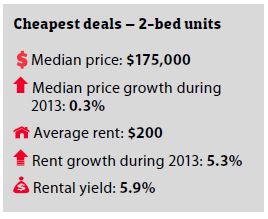

SHEPPARTON, VIC

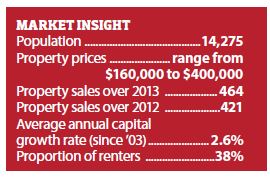

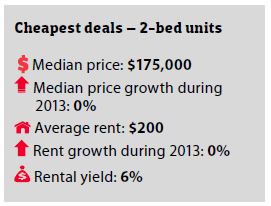

Like many areas with low property prices, Shepparton has something of a bad reputation. Depending on who you speak to, it can be a haven for bikies, drug dealers, miscreants or all of the above, and the police are apparently losing the fight against crime.

Reputations and reality, of course, are two different things, and although Shepparton does have its parts that remain rough around the edges, it is a better spot for property investment than it is normally given credit for. The local property cycle tends to be slow in Shepparton, so capital growth is not a general feature of the market, but the gap between rents and prices is quite large, meaning there are excellent cash flow opportunities going for rock-bottom prices.

The local economy has just enough in the way of activity to keep the property market afloat and lacking in volatility. The main industries are agricultural processing and associated industries, the former dominated by SPC Ardmona, Australia’s largest processor of canned fruit. There is also a military regiment in the area and a burgeoning retail sector servicing the Greater Shepparton area. The current vacancy rates for units and houses are 1% and 1.3% respectively, indicating a market with reasonable pressure on rents. This should keep average rental yields close to their current level of around 6%.

BURPENGARY, QLD

Burpengary is easily one of Brisbane’s cheapest neighbourhoods, with the median house price at $350,000. At this price range, it would appear at first that residents largely get what they pay for, as the suburb is fairly far from the action at 35km north of the CBD. In reality, its proximity to the Sunshine Coast gives it an advantage over a lot of other far-flung areas in the city’s western and southwestern regions.

The fact that families can get to the beach in less than half an hour is a major drawcard. The suburb’s amenities are also strong, despite its location. The selection of local shops includes a Woolworths and an Aldi, and as Burpengary is just off the M1, the rest of Brisbane is easily accessible.

Sure, the suburb doesn’t have the greatest history of capital growth and the current ratio of supply to demand suggests that won’t be changing soon, but the fact that it is possible to purchase property for under $200,000 with rental returns close to 10%, no less, suggests there is an opportunity for investors to pick up a property with great cash flow.

‘TEMPTING BUT NO’: CHEAP SUBURBS LACKING STRONG MARKET DRIVERS

NEWNHAM, TAS

I n this suburb of Launceston, too many properties are currently listed (3.2%) for current property values to hold their ground. Even at a $170,000 median price, values could well fall in the months ahead. At 6.11%, rental yields are good, but the vacancy rate of 3% suggests there isn’t enough pressure on the rental market for yields to stay that high.

COROWA, NSW

Corowa’s rental yield may look enticing, but the town has little in the way of an economic base. This is perhaps one of the reasons the property market moves slowly. The average property sits on the market for 226 days and few (16%) properties put up for auction are cleared. Owing to this soft activity, there was also a 10% reduction in the price of two-bedroom houses over 2013.

MOE, VIC

It would be hard for investors to move past some telling property statistics for Moe, regardless of how strong or weak its local economy is. The Latrobe Valley settlement currently has close to 3% of all its housing stock currently on the market – high for a regional settlement – while auction clearance rates (22%) and a slow selling market (the average property spends five months on the market) indicate low demand.