Reports of an increasing flurry of collective sales have not been as prevalent in the media headlines lately, although there are still many site sales currently being cultivated behind closed doors, averaging two to three years before they are marketed to the public.

Knight Frank’s research shows that collective sales can include horizontal sites, with multiple homeowners banding together to form amalgamated residential super lots; and vertical sites within a building, comprising owners of individual apartments and offices.

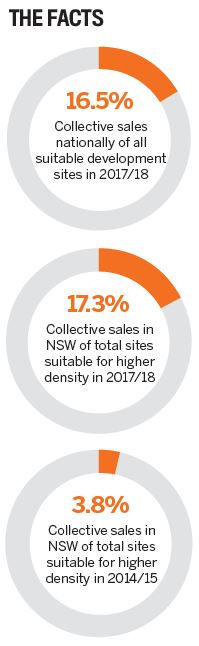

In 2017/18, collective sales made up 16.5% of all site sales suitable for low-, medium- and high-density development in Australia. This is seven times more than five years previously!

It’s quite common for off-market transactions and extended settlements to be pushed out by up to two years for this type of purchase, so there are likely to have been additional sales recorded over the past year, which will need to be backdated once settlement occurs. This may lift collective sales beyond the 20.4% recorded in 2016/17.

A similar strata reform has recently been passed by the WA government to encourage the upgrade of buildings not currently reaching full potential, and to curb urban sprawl. Although regulations must still be drafted for this new reform, it’s understood that a requirement of 80% of owners in a scheme of five or more lots must vote in favour before the State Administrative Tribunal can determine if the scheme has met all requirements in order to be terminated.

In Victoria, the share of collective site sales by value has fallen each year since 2014/15. The relative value of development sites in Melbourne is still favourable when compared to Sydney, and there remains a good mix of available sites across the suburbs of the planned city. At this stage, Victoria avoids the need to explore types of reform.

Bucking this trend, despite Queensland development sites being relatively better priced than in both these states, collective sales suitable for higher density have continued on an upward trend since 2015/16. This result has been a mixture of older Brisbane inner-city apartment blocks ripe for redevelopment and secondary office suites selling in one line, the latter reflecting weak office market conditions with sustained high vacancies in recent years.

Both foreign and local buyers represented a reasonably even spread across horizontal and vertical collective sales in this last year compared to previous years.

Michelle Ciesielski

Michelle Ciesielski

is the head of

residential research at

Knight Frank Australia