The law of supply and demand dictates that price grows in areas where demand outpaces supply. So, how do you find these markets? Mark Coburn explains

As a property investor you’ll naturally target suburbs with the best capital growth and rental yield prospects. There is a wealth of information out there to help you identify the suburbs positioned at the sweet spot on the supply/demand spectrum. Yet most investors don’t know how to use this information or choose to ignore it in favour of a subjective feeling for what constitutes a ‘good’ investment.

In our experience, only one in every 250 properties on the market at any given time is truly ‘investment grade’. Therefore, you need to use data in an objective and consistent manner to zero in on the best opportunities.

Consider this simple example, based on a $500,000 property held for 20 years. At this price, you will find properties across the spectrum from low to high-grade investments.

If it achieves 6% capital growth per annum and $500 per week in rent, the property will be worth $1.6m and have returned $575,000 in rent after 20 years. But what if you picked a property that returned an extra 0.75% pa in capital growth and $50 per week in rent?

You’d be better off by over $300,000 (combined capital growth and rent), before you even consider finance and tax benefits. The right property will make a big difference to your long-term return.

Demand and supply indicators

To assess an area’s demand and supply situation, we use 40 statistical and fundamental data sets to determine whether suburbs are over or undersupplied. We start with statistical data and, when we’ve narrowed down the selection, we move on to fundamental factors such as population, economic activity, supply of dwellings, infrastructure, urban renewal… the list goes on. Everything is weighted based on relative importance to the supply/demand equation.

Below we introduce you to some of the statistical indicators we use to assess the area’s demand and supply situation and some of these are freely available from Australian property websites such as www.yourinvestmentpropertymag.com.au, while others are sourced from local research houses.

Vendor discounting

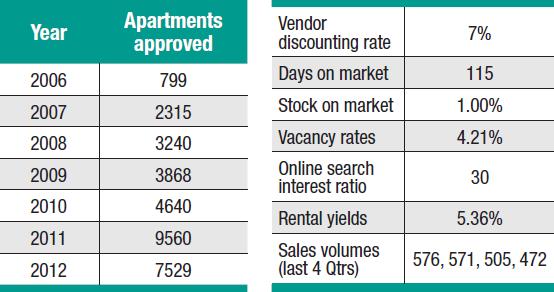

Vendor discounting is the difference between the asking price and the sale price for a property. Data on vendor discounting is available at the back of this magazine and online, as well as at www.domain.com.au for each suburb.

A large vendor discount (greater than 7%) indicates a buyer’s market where sellers are more willing to negotiate downwards on their original asking price. This could be a result of decreasing demand, an over supply of property or both. In this sort of market discounted prices can be found, although there is a risk to capital growth.

On the other hand a small vendor discount (less than 4%) indicates strong demand for properties in a suburb; in other words, a seller’s market. In essence, the cause is undersupply of properties relative to demand. This is a good indicator for capital growth, however it does not necessarily mean there will be great investment opportunities.

If the suburb is over heated – if prices have been rising consistently for some time – this could actually be a disincentive to future buyers in the short term.

Days on market

The number of days on the market is a great indicator of demand and can vary significantly by suburb. Three months (90 days) is the average time a property takes to sell, so ideally we look to suburbs that have been on the market for fewer. When demand is strong, 90 days would be considered a long time on the market. Days on market can be sourced through www.homepriceguide.com.au or www.yourinvestmentpropertymag.com.au.

Stock on market (%)

This is the number of properties currently for sale in a suburb as a percentage of the number of properties in that suburb. Not all suburbs are the same size; 50 properties for sale in a suburb would be considered high supply if there are only 1,000 properties in total, but in a suburb of 20,000 properties, 50 would indicate low supply. So we need to calculate the number of properties for sale as a percentage of properties in total. A low figure represents an undersupply of properties. Stock on market (%) can be sourced through www.homepriceguide.com.au.

Vacancy rates

Vacancy rate is the average time a property spends vacant. A low vacancy rate indicates that there is either high demand for rental accommodation, low supply, or a combination of both. A vacancy rate of 3% is considered ‘normal’. If it reaches 4% or above, you should be concerned. A 2% vacancy rate is great, while 1% or lower means there may be a boom in rents imminently. One of the places you can source this data is research houses such as SQM Research (www.sqmresearch.com.au) and Real Estate Investar realestateinvestar.com.au. Your Investment Property also carries an extensive list at the back of the magazine.

Online search interest

Before real estate websites existed, data on search interest was only ever anecdotal. These days at www.realestate.com.au you can view search interest easily. What you are looking for is a high ratio of people searching for properties in a suburb against the properties listed for sale in that suburb. A ratio of 30:1 searches vs listings indicates strong interest. To access this data, click on the ‘suburb data’ menu on the left and select a state and suburb.

Auction clearance rates

Not all properties that go to auction actually sell – some are passed in. So we look to auction clearance rates (the ratio of properties selling at auction vs those going to auction) as an indicator of demand.

A clearance rate of 80% or higher generally means there is strong bidding and therefore strong demand. Clearance rates below 60% indicate low demand and that the market is perhaps not suited to auctions. Auction clearance rates by suburb for the most recent month can be found at www. domain.com.au. Auction clearance rates for the past week can be found on www.realestate.com.au.

Sales volume rates

History shows that there is a very strong correlation between sales volumes and price growth in a suburb. The number of sales that takes place in an area will change first, and then the prices will react. There is always a time lag between the two events occurring. This is also true whether the markets are rising or falling.

In a rising market, price rises are preceded by an increase in sales volumes, and conversely in a falling market, price falls are proceeded by a decrease in sales volumes (from the previous years). This allows an investor to buy into an area ahead of price growth by following the rising sales volumes.

Sales volumes can be sourced from RP Data (www.rpdata.com.au)

Putting theory into action

SUBURBS IN UNDERSUPPLY

Based on Stepping Stone’s™ analysis, units in Fortitude Valley and Newstead in Brisbane are currently undersupplied and have all the indicators that tend to translate into upwards pressure on prices. Data in these case studies is sourced from Resolution Research unless otherwise stated.

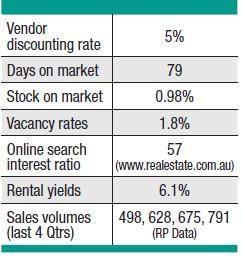

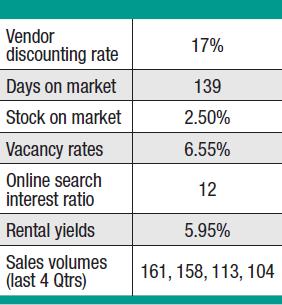

Fortitude Valley units (QLD)

Fortitude Valley units stand out in a statistical sense with low days on market, stock on market and vacancy rates as well as high online search interest. In addition, high rental yields of 6.1% are attracting investors seeking potential cash-flow positive investments, even with 100% of capital borrowed given the prevailing interest rate environment.

Adding to the picture are positive fundamentals around population projections, employment growth and apartment approvals. The Australian Bureau of Statistics predicts suburb population growth from 5,545 people in 2016 to 16,330 people in 2036 (an increase of 10,790 new residents), translating into high demand for new dwellings.

Meanwhile, there have been approximately 20,000 jobs relocated to the area with companies including Energex, Macquarie Bank, Bank of Queensland and Tatts Lotto. We consider jobs, infrastructure and affordability to be the key drivers of capital gains because people prefer to live as close as reasonably practicable to where they work and key infrastructure nodes for as little a price as possible.

Beyond these statistical indicators, one of the key drivers in Fortitude Valley is the significant urban renewal programs at RNA Showgrounds and the Gasworks Precinct ($5.2bn worth of development is underway), which will deliver consistent demand in the area for the medium term.

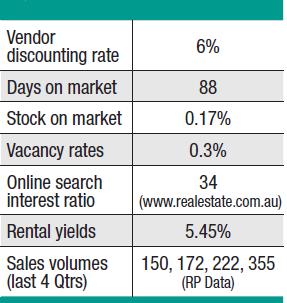

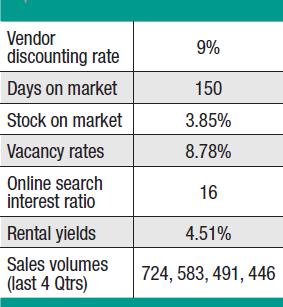

North Lakes (QLD)

The North Lakes region (Mango Hill, North Lakes & Griffin) statistical data is now beginning to point in favour of investors entering the market and capitalising on the array of new infrastructure spending, job creation and suburb gentrification in progress. Specifically this is the extension of the North entry of Costco and Ikea, the business park which will employ 20,000 in five years and the Moreton Bay rail link completion in 2016.

Aldinga Beach houses (SA)

The Onkaparinga Shire is a leading area for population growth, which is benefiting from major infrastructure spending (extension of train links to Seaford and a $400m upgrade of the southern expressway). The sales over the past four quarters validate the statistical evidence on offer and makes it an attractive opportunity for investors.

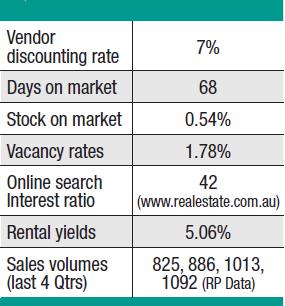

Pyrmont units (NSW)

At the current time, Pyrmont offers investors an attractive opportunity. There is no land left in the area where units may be developed and demand for stock has been steadily increasing over the past 12 months whilst vacancy rates remain low.

Pyrmont is strongly in demand as it is in very close proximity to the Sydney CBD, offers many transport options (ferry, bus and rail), has many entertainment options within walking distance, and most apartment blocks offer views of Sydney Harbour. The development of Barangaroo will also offer even more employment within walking distance.

SUBURBS IN OVERSUPPLY

Fortitude Valley and Newstead have the right combination of statistical and fundamental indicators to give us confidence in their prospects. Contrast that situation with what has taken place in the Gladstone units, Muswellbrook housing, Moranbah housing, Gracemere housing and Melbourne CBD units and you’ll see the difference between a sound supply/demand equation and a poor one.

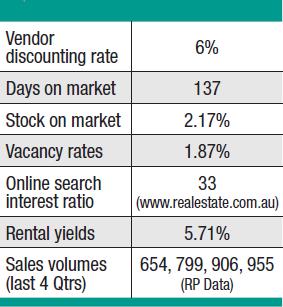

Gladstone units (QLD)

With $70bn worth of gas projects underway in the Gladstone area it became obvious that there would be an increase in demand for accommodation within the region. This resulted in the area increasing in value nicely in 2011-12. The developers then realised that there was a boom emerging and developing en-masse. As a result there is now a large over-supply of stock in the market.

Muswellbrook houses (NSW)

The Hunter region of NSW has suffered an oversupply of houses as a result of a downturn in the coal mining industry, as well as increased developer delivery into the market. This has resulted in rental yields and housing prices dropping as well as vacancy rates increasing dramatically since the 2010 boom. Investors would be well advised to steer clear of this region for the time being.

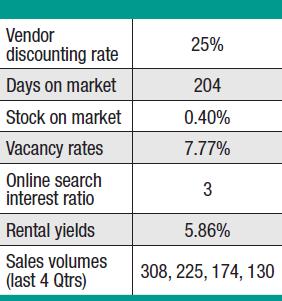

Moranbah houses (QLD)

The coal industry is the main employer of residents in the area and as the coal mining downsizes in the region, along with low commodity prices, the immediate outlook for property prices is bleak. Average days on market is 7-8 months with declining sales volumes. Property values are suffering losses of up to 40% in a 12 month period.

Gracemere houses (QLD)

Gracemere is around 12km west of Rockhampton. Developers have attempted to capitalise on the investment success of Rockhampton in the past five years, however they have built far too much supply for the market demand. Building approvals in 2012/13 were almost double the previous year and sales have now started to diminish considerably. As a result, investors would be advised to steer clear of this area for the time being.

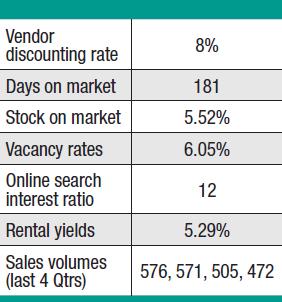

Melbourne CBD units (VIC)

There has been a nine-fold increase in the residential building approvals in the Melbourne CBD over the past eight years, whilst the number of sales has fallen well short of the underlying supply.

In summary

With the above statistics, investors have a great insight into the prevailing supply/demand situation in any suburb. You might not have the time or patience to compile and analyse 40 data sets like we do. However, you could use the basic statistics to quickly build a picture of the supply/demand situation for your shortlisted suburbs. Rather than relying on your own gut feel (or worse, what a real estate agent or developer tells you), you'll be refining your investment targets based on reliable data, helping you to make better investment decisions.

Mark Coburn is a property investment advisor and the director of Stepping Stone™, a buyer’s agency and property investment advisory

This feature is from the October issue of Your Investment Property Magazine. Download the issue to read more!