When it comes to investment hotspots, many investors want to get into areas before the crowd does, so that they can pick the cream of the crop before everyone else. So where are smart investors looking now for their next target properties? Real Estate Investar compiled comprehensive data on the most popular searches on its website to support this exhaustive and exclusive market analysis

Internet search results alone may not necessarily guarantee future sales, but they can identify an emerging hotspot before it actually becomes one. Areas with high search results may indicate growing demand, because the people who are searching are actively seeking to purchase investment properties. With that in mind, Your Investment Property teamed up with Real Estate Investar to bring you areas that savvy investors have been targeting over the past six months to gauge where the smart money is going.

Where smart investors are putting their money now When it comes to investment hotspots, many investors want to get into areas before the crowd does, so that they can pick the cream of the crop before everyone else. So where are smart investors looking now for their next target properties? Real Estate Investar compiled comprehensive data on the most popular searches on its website to support this exhaustive and exclusive market analysis To put the data in context, Real Estate Investar has approximately 100,000 members and 2,500-plus paying subscribers. On average each month, 70,000 searches are performed by subscribers.

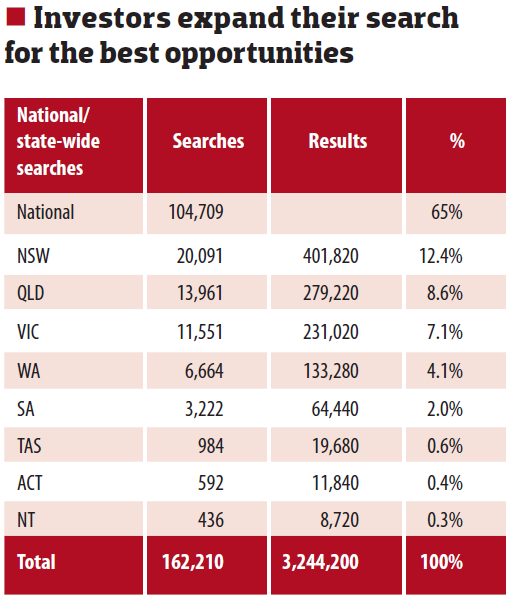

These users have the ability to search based on different geographic options. The data shows the total number of searches and the results found during their searches.

The Sunshine State dominates

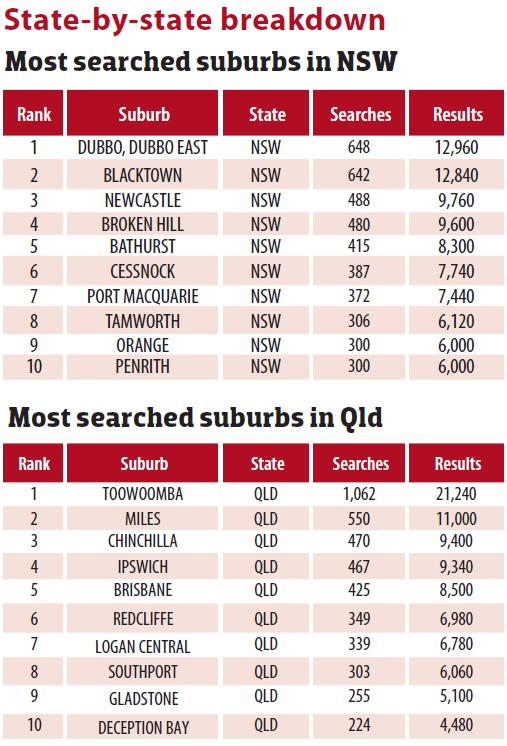

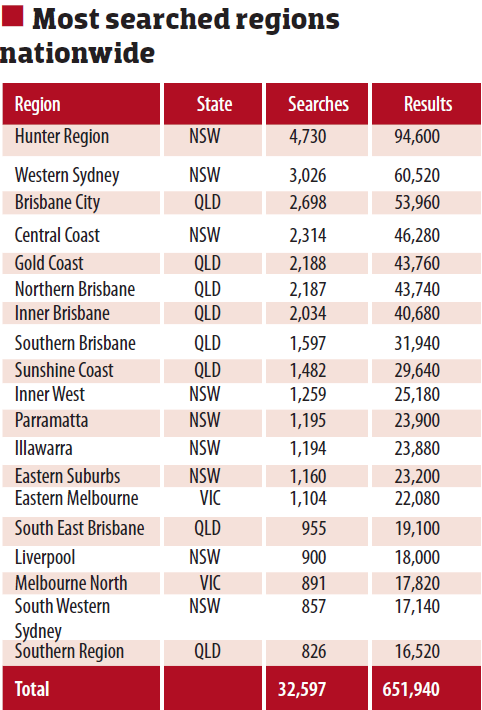

The results offer a very good indication that investors are particularly interested in Queensland and NSW property, says Justin Davey, head of partnerships at Real Estate Investar.

“It is clear that the members are actively seeking out Queenslandbased property at a higher than normal level,” Davey says. “When you consider that political polls are often conducted on just a few hundreds, and then those numbers are extrapolated across the wider population with an accurate result, the data gives a detailed insight into the current thoughts and focus of investors across Australia. Expect Queensland to make some serious gains in the year ahead.”

Investors expand their search

With a large proportion of Australians searching nationwide for opportunities, it’s clear that investors have an open-minded outlook, at least when it comes to where they plan to invest in property. Over the past six months, roughly one in four active Australian property investors have been looking elsewhere, outside their home turf, and not solely focusing their attention completely on any particular state, city or suburb.

Investors expand their search for the best opportunities

Investors in NSW are the most active in looking outside their home states, most likely due to the fact that property prices have soared during the past 12 months and the markets are deemed too hot.

Investors in Victoria are also feeling the heat and are actively seeking opportunities elsewhere as prices have unexpectedly skyrocketed during the same period.

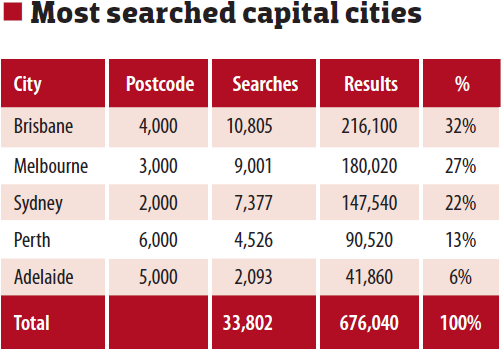

There was more good news for Queensland when looking at the capital city searches. Brisbane finished first, taking a third of all recorded searches during the same period. This was 5% more than Melbourne and 10% more than Sydney.

What was particularly unexpected was tat Sydney finished third with 7,377 searches, while NSW was first on the state-wide level. This suggests that the massive gains in prices during the past 12 months have taken their toll and investors have moved on to other regional centres for opportunities.

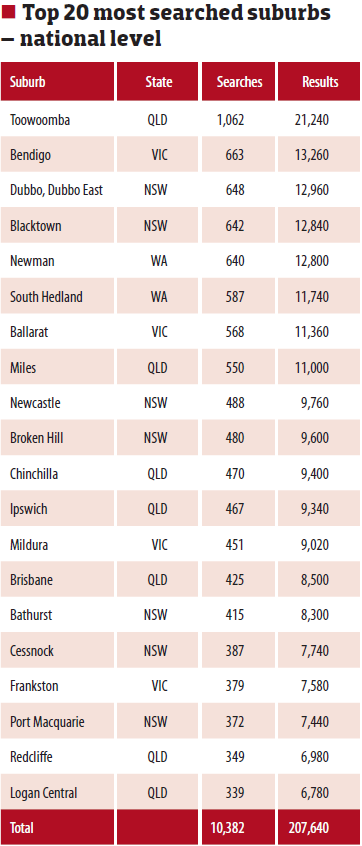

Toowoomba leads the way

With its strong and immensely diverse local economy, it’s little surprise that Toowoomba is the most popular area for investors in the current market.

Known as Australia’s ‘job capital’, with exceptionally low unemployment of 4.2%, much lower than the state average of 5.9%, the list of growth drivers in the area is a long one.

Being in close proximity to the resource-rich Surat Basin, the area is in a prime position to take advantage of the ongoing demand and infrastructure spending.

There’s a new $1.5bn bypass being built in Toowoomba over the next seven years and its new airport is also nearing completion. The bypass requires an extra 2,500 workers to move to the area and the airport is good news for its tourism industry and for residents who are frequent commuters. It may not have beaches or the vast array of culture that attracts many people to the capital cities, but it remains one of Australia’s biggest inland cities and is tipped to get even bigger.

Not surprisingly, not one inner-city area made the top 10 most searched suburbs. The closest suburb to a capital city is Blacktown, which is 27km from the Sydney CBD. This indicates that investors are favouring the more affordable areas with higher yields.

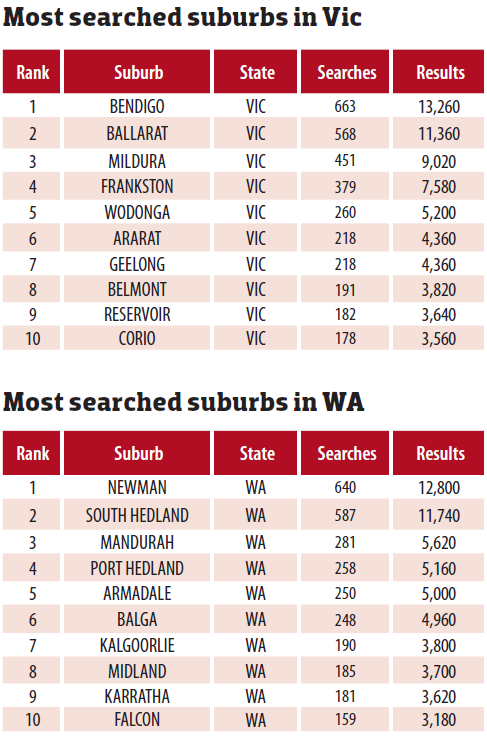

Despite the slowdown in the mining sector, investors’ appetite appears to be stronger than ever, lured by high rental yields to houses in the WA towns of Newman and South Hedland, which are achieving a whopping 11% and 9% respectively. These two suburbs in the Pilbara region finished with more than double the searche results of the third most searched suburb in WA, which was Mandurah.

One surprise result is that not one

suburb from SA, the NT, Tasmania or ACT made it into the top 20. And despite having Australia’s best economy and consistently strong population growth, only two suburbs made the top 20 from WA: Newman and South Hedland. This could be an indication of people thinking beyond the nation's mining boom or at least the resources sector in WA.

This is in contrast to strong interest in resource-rich areas of Newcastle and Broken Hill in NSW, which both made the top 20.

State highlights

Leading the way in NSW are Dubbo and Dubbo East. In addition to having gold, coal and other mining ventures, this area has great amenities. It doesn't really matter that it's a five-hour drive from Sydney and four hours from Newcastle and Canberra. It has underrated restaurants, a range of schools, a train station with inter-city connections, and, of course, the world-famouos Taronga Western Plains Zoo.

One important exception to the NSW/Queensland trend was the regional city of Bendigo, which finished second overall and first in Victoria. Indeed, this area is a much cheaper alternative to the city, with many houses half the price of those in Melbourne.

No doubt investors were also attracted to the plans for a new highway, hospital and upgrades to the airport, not to mention the abundance of opportunities for renovations.

It was a similar story in Geelong, where there has been a wave of infrastructure announcements made by the state government. All the doom and gloom surrounding manufacturaing was not enough to put off searcers, as it finished up as the seventh most searched suburb in Victoria.

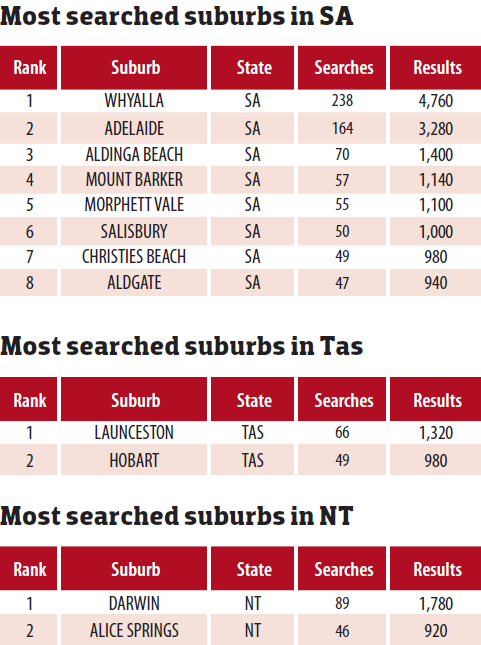

Whyalla topped the list in SA despite predictions that it would be 'wiped off the map' if a carbon tax was introduced. This area not only benefits from mining ventures but also has a seaport located on the east coast of the Eyre Peninsula.

There are a number of projects being proposed, including making Whyalla Industrial Estate the servicing hub for the mining industry in north and west SA.

Not surprisingly, the top 500 most searched suburbs don't feature a single area from the ACT. The uncertainties surrounding the proposed cuts to the public service by the Federal Government are weighing heavily on sentiment.

In Tasmania, investors are focusing on the state's two biggest cities, Launceston and Hobart, thanks to affordability and more stable demand.

State of Origin

This category proved that the State of Origin match-up is not just confined to the NRL.

The top 20 most searched suburbs by region across Australia were all in NSW and Queensland, except for Eastern Melbourne and Melbourne North.

But it’s not totally unexpected that the Hunter Region smashed its competition to finish first. It finished is 1,704 more than the next highest region (Western Sydney).

And why wouldn’t it? Newcastle offers a lot of what capital cities offer, but without the outrageous prices. It has one of Australia’s largest ports and is the beneficiary of some of NSW's largest infrastructure projects. The region boasts an attractive lifestyle, including beaches and many other outdoor activities. And let’s not forget that Newcastle is forecast to be one of the fastest-growing cities in Australia.

The other two areas in NSW that did well were Western Sydney and the Central Coast, which finished second and fourth, respectively. Both areas are also seen as affordable alternatives to the more expensive Inner Sydney.

Interestingly, the second Sydney airport was announce in April, the month after these results were collated. There is bound to be further interest in Western Sydney now that that announcement has been made, as it is tipped to help create 35,000 jobs by 2035, among many other benefits.

Not surprisingly, given Queensland’s domination, Brisbane City, Northern Brisbane, Inner Brisbane and Southern Brisbane finished third, sixth, seventh and eighth, respectively. Some economists argue that the Campbell Newman Government got most of their big cuts out of the way early in their term and Brisbane should be a huge beneficiary of upcoming spending plans as the next election draws closer.

It was also hardly surprising to see the Gold Coast sitting fifth on the ladder, with the Commonwealth Games coming up in 2018. This major sporting event is expected to inject $2bn into the Gold Coast’s economy. The state government has also budgeted $100m to build infrastructure for the event, which is expected to create thousands of jobs for the region.

Cities triumph

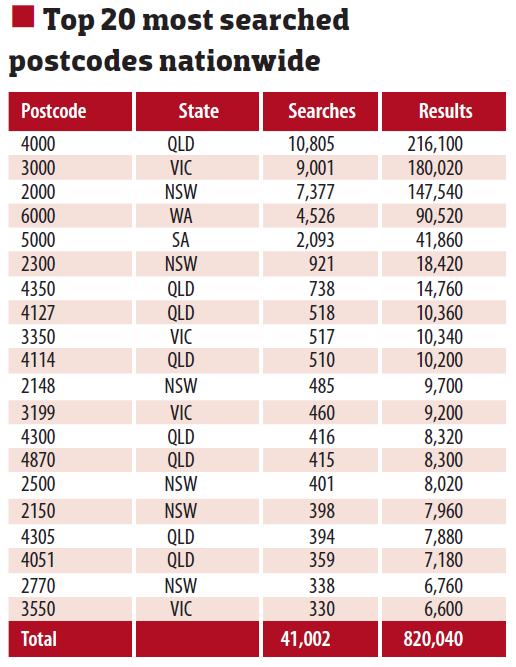

Queensland’s run of good form continued when it came to the top postcodes searched. The most popular was 4000, which covers the Brisbane Area. It was followed by the Melbourne area (3000), the Sydney area (2000), the Perth area (6000) and the Adelaide area (5000).

This suggests that when people are searching by postcode they are mainly looking at inner-urban areas, as opposed to outer suburbs, mining towns and rural areas.

This is hardly surprising considering the stability of demand in the inner cities, despite their higher price tags.

This feature is an excerpt from Your Investment Property's August Issue. To read the complete feature, you may purchase the issue or sign up for a subscription.