10/05/2018

Most forecasts fail because they measure supply as the number of properties for sale, and demand as the number of buyers for them.

However, it is also true that there is one market for sales and another for rentals.

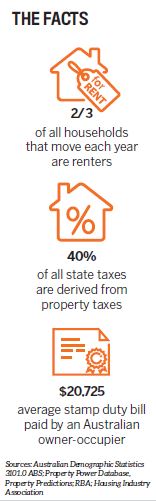

The ABS tells us that renters move far more frequently than owner-occupiers, so even though renters only comprise about one third of all households, they do most of the moving. In fact, two thirds of all households that move each year are renters.

Understanding the dynamics of our rental markets is critical to correctly forecasting where our housing markets are heading, not only because the rate of turnover is double that of owner-occupiers but also because changes in rental demand lead to changes in investor demand, which in turn affect prices.

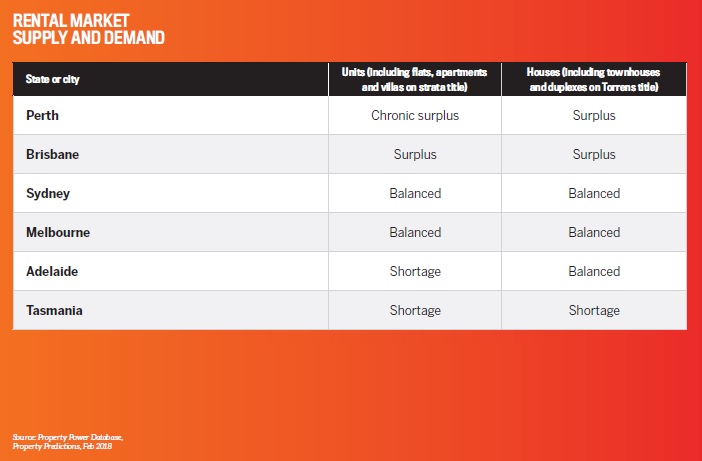

Let’s look at the current state of the rental markets in our mainland state capital cities and Tasmania to see what they reveal about the future. To do this, I have compared the total supply of rental stock for units and houses to the total demand for them from potential tenants in each mainland state capital city and all of Tasmania.

- Perth and Brisbane have falling rents and little price boom potential. Low house prices in Perth and Brisbane have encouraged many renters to become first home buyers. As a result, rental demand has collapsed, particularly in Perth’s unit market, where asking rents continue to fall. Until the rental markets in these cities return to a more balanced condition, there cannot be any significant price rises.

- Sydney and Melbourne boast strong rental demand and positive cash flow potential. Both the unit and house rental markets in Sydney and Melbourne are in balance right now, but rental demand continues to outpace supply. Melbourne’s intake of overseas and interstate arrivals is a massive 85,000 people annually, all of whom must rent, while in Sydney three quarters of the city’s annual population growth of 90,000 comes from overseas, consisting mainly of renters. Rather than prices falling, we can expect massive rent rises.

- Adelaide is set to boom – in the unit markets at least. There’s a shortage of vacancies in the unit rental market in Adelaide, and although this is only a small boutique market, it is predicted that rent rises followed by investor demand will cause good price growth.

- Tasmania is experiencing strong rent rises and a booming housing market. It is unique as a market with a shortage of both unit and house rental vacancies, and even though it already offers the highest yields in Australia, rents are likely to rise even further. This will lead to more investor interest in Tasmania’s housing market, so prices virtually everywhere have boom potential.

This analysis of major rental markets shows us the importance of taking their role into account when we make property market predictions.

is director of Lindeman Reports,

and author of Unlocking the

Property Market.