As investor, we try to make the best decisions possible based on the information in front of us, but all manner of factors – from the economy to interest rates to your own personal financial situation – can serve to change the game for us.

Property cycles are always moving, but not always at the same pace. There are some long-term trends we can see in the Australian property market, driven by market cycles that move to a predictable beat; however, when markets move up and down, the rate of change can evolve from inching along, to suddenly surging, to crashing into freefall.

Most successful investors understand that it’s the ability to ride through these cycles with a long-term investment timeline that will give you the greatest chance of real estate success. However, that doesn’t mean every piece of property held for the long term will ultimately prosper.

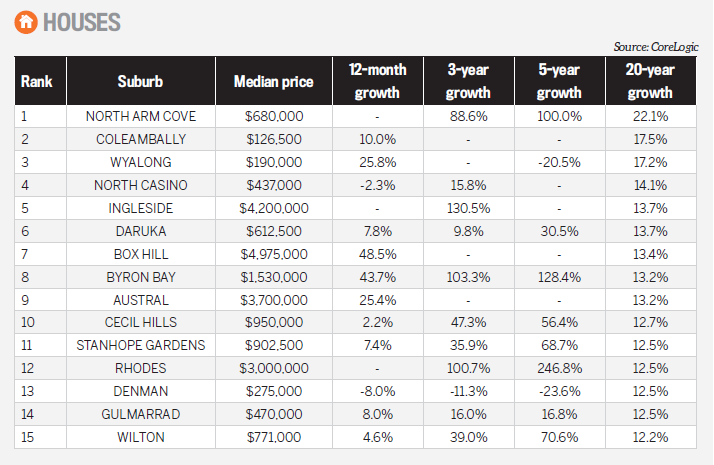

Investors still need to time the market and apply due diligence to their property purchases in order to ensure the biggest gains and most profitable outcomes. In this special report, leveraging real-life data prepared by CoreLogic, we have identified scores of suburbs that have performed optimally and delivered strong capital growth for the last 20 years* – lining property owners’ pockets along the way.

*For ACT, data is only available for 10-year price growth

1. Location: Being situated near jobs, public transport, infrastructure, amenities and entertainment is key to success.

2. Population: The area must have a growing population for local property demand to remain ahead of supply.

3. Supply: Constrained supply levels are essential for property price growth: just look

at the performance of landlocked suburbs around Australia that have no room to expand.

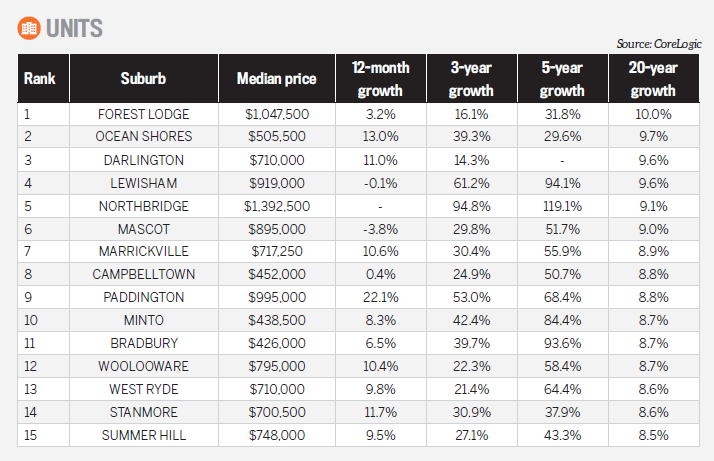

NEW SOUTH WALES

Sydney has long been a property powerhouse, so it’s no surprise that suburbs in the Harbour City dominate this research, but there are a number of strong regional performers as well

WILTON

MEDIAN HOUSE PRICE: $771,000 AVERAGE ANNUAL GROWTH: 12.2%* GROWTH LAST 3 YEARS: 39.0%

A small town in the Macarthur region of NSW, Wilton is around 80km southwest of Sydney’s CBD. The area was once mooted as a potential location for Sydney’s second airport but lost out to Badgerys Creek.

This area offers a semi-rural lifestyle, while still connecting residents to Sydney and Wollongong, which has driven strong long-term capital growth in the past.

In this area, dwelling types range from small, modest three-bedroom homes in need of renovating to huge, brand-new McMansions with price tags over $1m. Bingara Gorge, an exclusive estate offering tree-lined streets and the spectacular backdrop of Razorback Range, is the newest part of town and attracts the most interest from renters and property buyers alike.

NORTH ARM COVE

MEDIAN HOUSE PRICE: $680,000 AVERAGE ANNUAL GROWTH: 22.1%* GROWTH LAST 3 YEARS: 88.6%

North Arm Cove is a quiet residential suburb almost an hour north of Newcastle. Once considered as a possibility for the nation’s capital city, it’s a mix of both rural and urban areas, and the majority of the small population is located in the village itself, on the shore of the cove.

North Arm Cove is in the Great Lakes region and close to other favourite holiday destinations such

as Port Stephens and Nelson Bay. It’s becoming a great place to make a permanent move to, as the median house price currently sits at $680,000.

ABS data shows that the average age of North Arm Cove residents is 60, making it a popular retirement area, though around one in four households are renters. Average annual growth of 22.1% makes this semi-regional suburb a star performer.

OCEAN SHORES

MEDIAN UNIT PRICE: $505,500 AVERAGE ANNUAL GROWTH: 9.7%* GROWTH LAST 12 MONTHS: 13.0%

Byron Bay, the pinnacle of the haute-boho lifestyle, is situated in the Northern Rivers region of NSW, off the Pacific Highway. With the Gold Coast 90km to the north and Sydney 800km to the south, it’s a mecca for those seeking an alternative, relaxed lifestyle.

Ocean Shores

Houses in this area list at over $1m,

but apartments still offer an affordable price tag

Unit prices in the Byron Bay suburb of Ocean Shores recorded a 29.6% increase over the past five years, taking the current median price to $505,500. This popular seaside suburb attracts tourists and locals alike, who enjoy surfing, scuba-diving, and spotting humpback whales from coastal viewpoints. Eclectic stores and cafes abound in Byron Bay. Temperate waters make the beaches here ideal for swimming and snorkelling, and there are also subtropical rainforests nearby.

*20-year compound growth

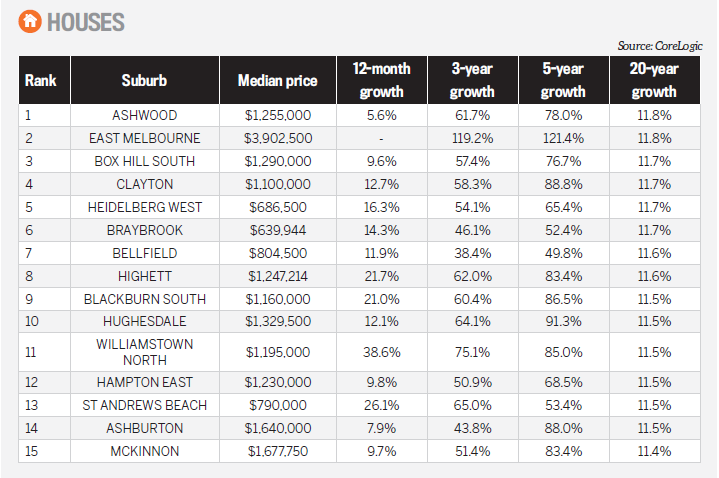

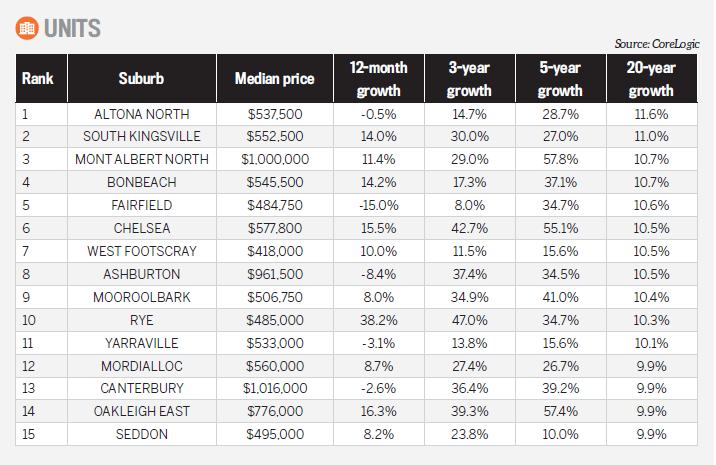

VICTORIA

From the Mornington Peninsula to Yarra Valley and the Melbourne CBD, there are suburbs all over this region that have allowed property owners’ profits to grow

BRAYBROOK

MEDIAN HOUSE PRICE: $639,944 AVERAGE ANNUAL GROWTH: 11.7%* GROWTH LAST 12 MONTHS: 14.3%

Braybrook is a suburb situated to the west of the Melbourne CBD, and while it was previously considered an industrial suburb, its popularity is rising among first home buyers, whose numbers have doubled in this market over the past five years.

Braybrook has been cleverly gentrfied over the past decade, as many of the industrial aspects have been transformed into housing developments. Appealing to families, there are plenty of daycare and schooling options for those with children, as well as bus services and train stations close by. Central West Plaza is a popular shopping centre, along with Braybrook Plaza.

The median house price is just under $640,000, and Braybrook is within commuting distance from the Melbourne CBD, which is just 20 to 25 minutes’ drive away. This makes it a popular rental spot for families, singles, young professionals and more.

Three-year capital growth for houses in this gentrifying suburb was 46.1%

Five-year capital growth of 65.4% has created many happy investors in the region

HEIDELBERG WEST

MEDIAN HOUSE PRICE: $686,500 AVERAGE ANNUAL GROWTH: 11.7%* GROWTH LAST 12 MONTHS: 16.3%

Situated around 11km from Melbourne’s CBD, Heidelberg West is an established residential suburb close to schools, childcare, public transport and a variety of shops. It has plenty of parks, trails and recreation facilities, and is close to Northland Shopping Centre to the west, La Trobe University to the north, and Austin Hospital to the south.

There are many character homes in the suburb that could benefit from being renovated, and development opportunities abound, giving investors an instant opportunity to add value. But even landlords who wish to pursue more of a ‘set and forget’ strategy could benefit from investing in Heidelberg West, which has experienced average annual growth of 11.7% over the last two decades.

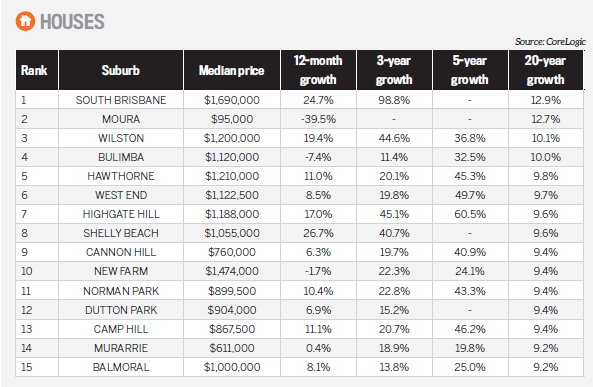

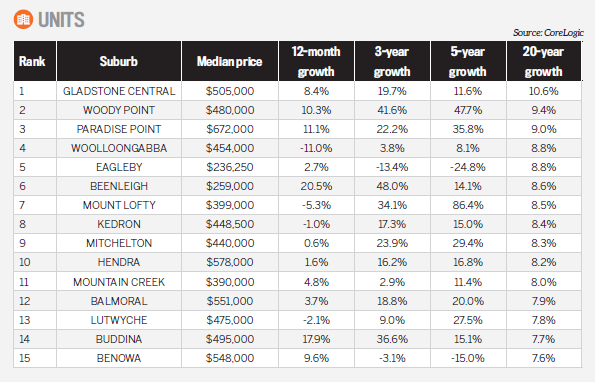

QUEENSLAND

The Sunshine State has seen mixed price growth over the last decade, due to its strong reliance on the mining economy. But in certain pockets, performance has outshone the average

BEENLEIGH

MEDIAN UNIT PRICE: $259,000 AVERAGE ANNUAL GROWTH: 8.6%* GROWTH LAST 12 MONTHS: 20.5%

Beenleigh, a southeastern suburb of Brisbane, is within the local municipality of Logan. It was originally a stand-alone town, colonised in the 1860s, but has been enveloped by the southern expansion of Brisbane.

While early industries included dairy farms and an abattoir, the region has a more diverse economy today, with employment hubs in Brisbane and the Gold Coast within commuting distance. The Beenleigh Artisan Distillery is a heritage-listed tourist attraction, and the area’s indigenous Yugambeh language and heritage have been preserved in the form of a dedicated museum.

Unit prices in Beenleigh have grown by 48% over the past three years, and the median price is now $259,000. The suburb is home to around 8,300 people – 36% of locals are privately renting and a further 11% are living in social housing.

*20-year compound growth

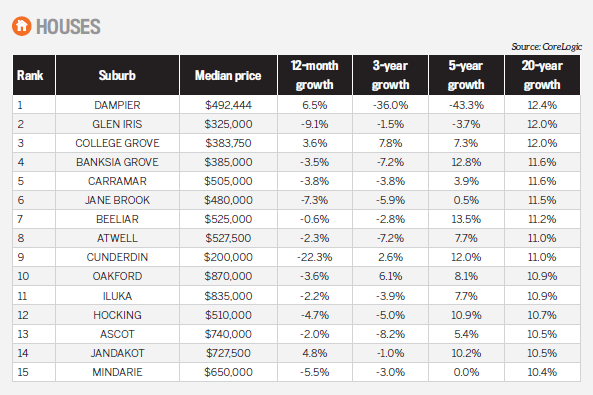

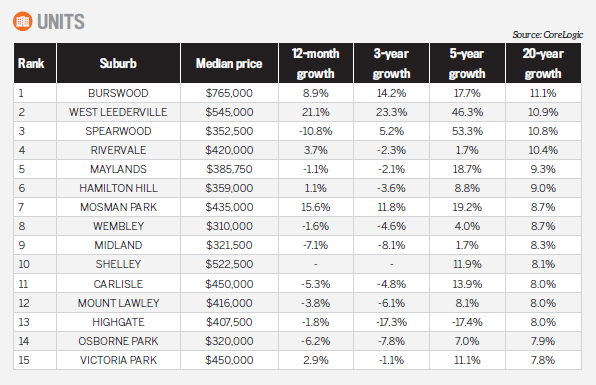

WESTERN AUSTRALIA

The property market out west has slumped over the last few years, but certain suburbs throughout WA have proven to perform well over the long term

BANKSIA GROVE

MEDIAN HOUSE PRICE: $385,000. AVERAGE ANNUAL GROWTH: 11.6%* GROWTH LAST 12 MONTHS: -3.5%

Until the late 1990s Banksia Grove was part of Neerabup, before it was revived and developed into its own neighbourhood north of the Perth CBD. With a wide range of amenities, like a shopping centre, an education precinct, retained native bushland and over 30ha of gorgeous parkland, today it is a modern, thriving suburb.

About 27km from Perth’s CBD and 5km from the Joondalup CBD, Banksia Grove takes pride in its native environment. It won the WA Waterwise Land Development Award after using innovative irrigation technologies to conserve water. Proud of its focus on sustainability, this vibrant suburb encourages houses to be energy-efficient as well.

With a median house price of $385,000 and boasting boutique retail outlets and reliable buses for easy transport, Banksia Grove’s popularity will continue to rise.

*20-year compund growth

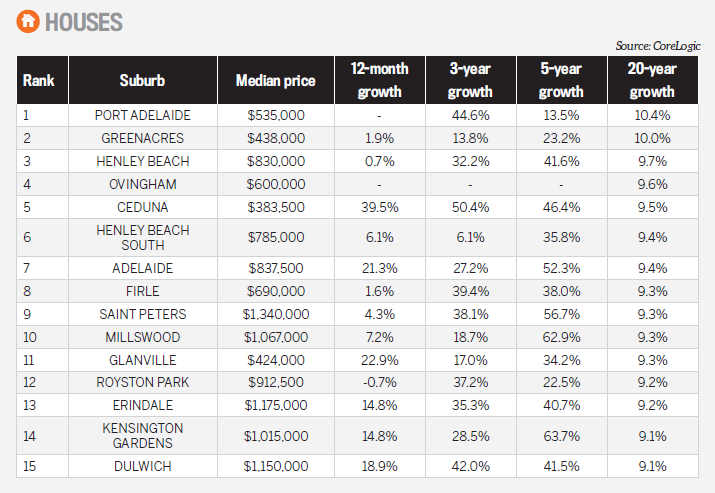

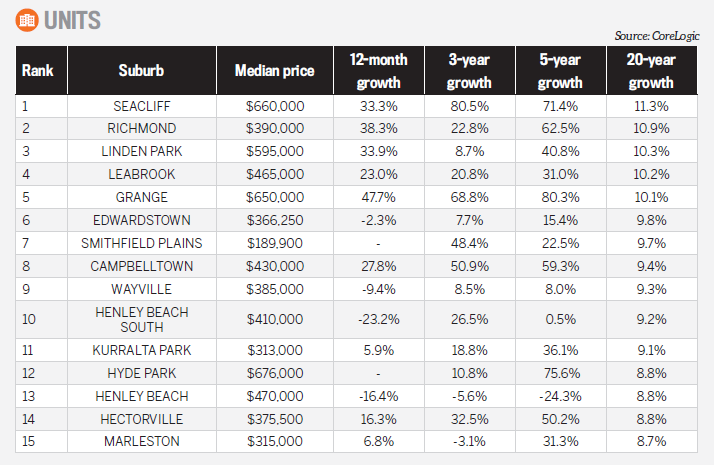

SOUTH AUSTRALIA

Capital cities to the east may have medians hovering around the million-dollar mark, but many Adelaide suburbs remain affordable – and boast an impeccable track record of growth.

GLANVILLE

MEDIAN HOUSE PRICE: $424,000. AVERAGE ANNUAL GROWTH: 9.3%* GROWTH LAST 12 MONTHS: 22.9%

Nestled between Semaphore and Port Adelaide, Glanville is a tiny suburb in South Australia situated a stone’s throw from the Port Adelaide River, and a short drive from the highly popular Semaphore Beach.

The suburb is becoming popular with many different demographics and in the last 12 months has experienced capital growth of 22.9%, lifting the average house price to a still-affordable $424,000.

The CBD is 25 minutes’ drive away, and though locals might consider this a long commute, Glanville is close to TAFE SA on the other side of Hawker Creek, making it an appealing suburb for students.

While there might not be much in the way of shopping centres or restaurants in Glanville itself, the suburb is centrally located within easy reach of many amenities in nearby suburbs, and is serviced by the Glanville train station.

*20-year compound growth

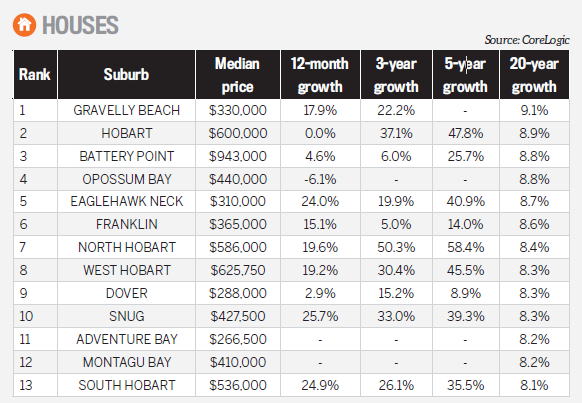

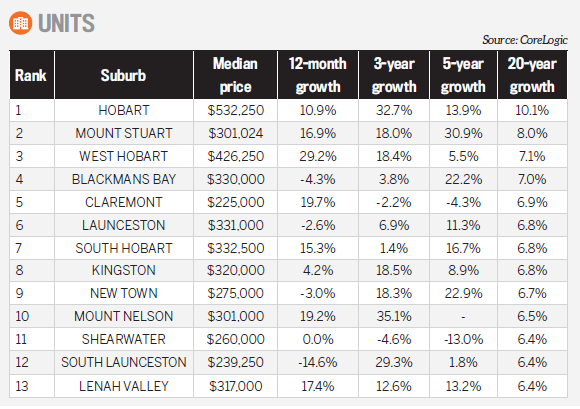

TASMANIA

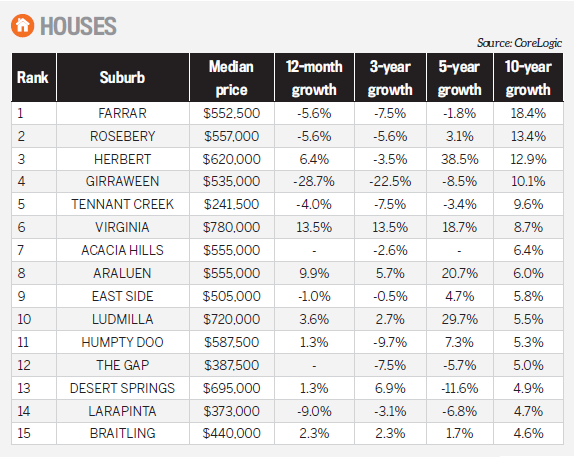

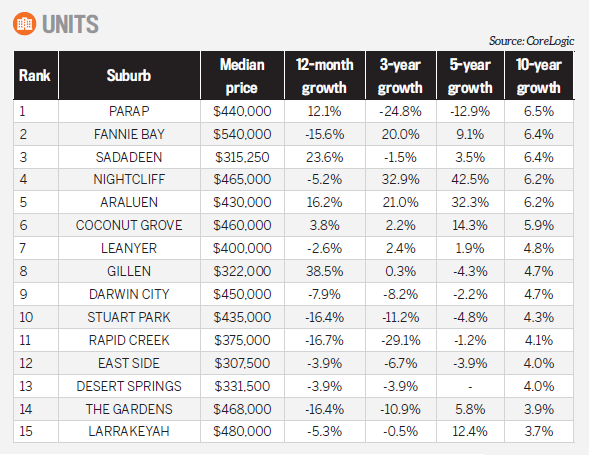

NORTHERN TERRITORY

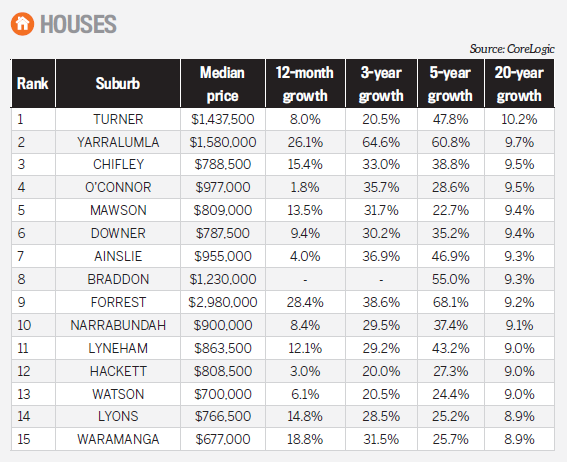

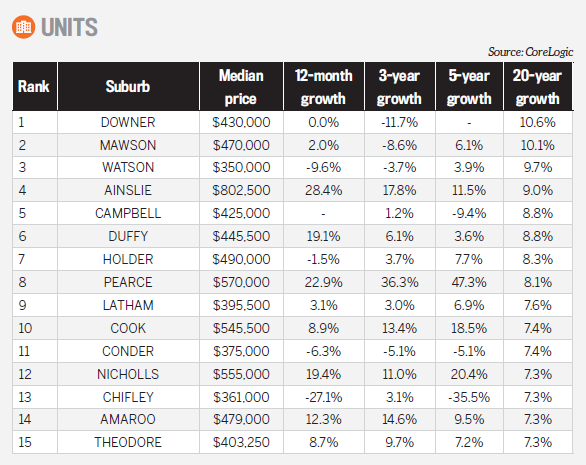

AUS CAPITAL TERRITORY