Sydney and Melbourne have both seen consistent increases in vacancy rates in recent times, with statistics published by the Real Estate Institute of NSW indicating that the average vacancy rate in Sydney was hovering around 3.4% as of August 2019 – well above the target range of 2–3%.

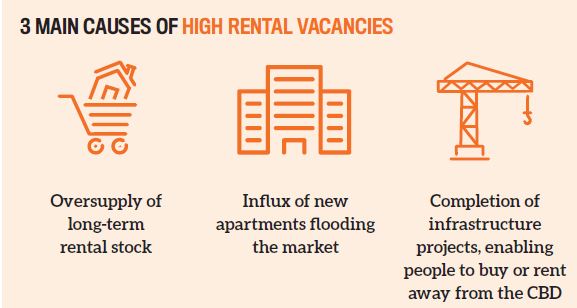

This is in part attributed to a signifi cant influx of units into the market, and the availability of more affordable stock elsewhere, explains Quirin Schwaighofer, co-CEO of shortterm rental accommodation management firm and Airbnb partner MadeComfy.

“We’re currently experiencing an oversupply of long-term accommodation in certain locations, which is driven by a larger release of new apartments,” Schwaighofer says.

“Several infrastructure projects have been completed or are about to be completed, especially in Sydney, which enables people to buy or rent properties further away from the CBD at a lower cost and have an easy commute.”

The rental rates for conventional leasing are falling in conjunction with this, and conditions aren’t expected to improve over the next 12 months.

“A lot of the short-term rental hotspots in Sydney, Melbourne and Brisbane are around attractions like the CBD and beaches”

“I expect long-term rental rates to continue at this level for at least another 12 months, if not to drop further,” Schwaighofer predicts.

As a result, it may be the ideal time for landlords to capitalise on the rising trend of short-term accommodation. According to REINSW, this sector has been blowing up over the past few years, amounting to over $30bn in business in 2016 and growing. For landlords who are able to capitalise and get a steady stream of tenants, the rewards can be immense.

Being such tourismheavy cities makes Sydney and Melbourne ideal shortterm rental markets.

“A lot of the short-term rental hotspots in Sydney, Melbourne and Brisbane are around attractions like the CBD and beaches like Bondi, Manly, St Kilda and Broadbeach,” Schwaighofer explains.

“They’re also close to sport and entertainment event locations like the MCG or Rod Laver Arena in Melbourne, Olympic Park and Moore Park in Sydney, or the Gabba and Suncorp Stadium in Brisbane.”

He adds that it’s not only the popular tourist destinations where shortterm accommodation can thrive; with short-term letting, a broad range of tenants are attracted to the tenancy pool, including holidaymakers, relatives, visiting family, and executives needing to travel for work.

“Thirty to forty per cent of urban short-term rental bookings are driven by corporates or executives who prefer to be close to their office in the CBD or other office districts,” Schwaighofer says.

“Another 20–30% are driven by mid-term tenants who stay for about 21 to 180 days. These tenants prefer a trendy suburb like Fitzroy, Newtown or West End.”

Running a smooth short-term rental

With the sheer volume of short-term rentals out there, you may wonder how you can leverage this strategy to your financial advantage. It all begins with ensuring your property stands out from the pack – and how you market your property is vital to this.

“To drive strong returns and occupancy, you want your listing to be on top of the search rankings of booking channels”.

We learned from our partnership with Airbnb that high-performing Airbnb listings stand out from the crowd with a quirky or colourful property,” Schwaighofer says.

Part of the appeal of short-term accommodation is the unique experience it promises to tenants compared to hotel stays. This doesn’t mean you need to turn your house into an Instagramfriendly igloo in order to snag tenants, but what you do need to do is make it highly presentable – especially for the camera.

Guests will be browsing the property online, and they are more likely to stop and review when they see a place that looks neat, clean, bright and open. For this reason, you don’t want to scrimp on getting very good pictures taken, as you want to show off the best of your property.

While leasing out a property for the long term generally means that you hand over the key and essentially leave tenants to their own devices, with short-term rentals you have to play the host – and play it well.

“A well-performing Airbnb drives five-star reviews by providing a great experience to guests, and part of that experience is basics like high-quality pillows, mattresses, a sofa, dining chairs and cutlery. They are also well maintained, with the property owner/host acting quickly on maintenance requests or issues,” Schwaighofer says.

While this doesn’t mean you need to provide everything a guest could possibly want, you do need to ensure that there’s adequate stock of typical necessities like bath products, toilet paper and towels. Being able to take this simple load off guests’ shoulders can aid you in getting repeat bookings, as Airbnb listings rely on stellar reviews to drive new bookings.

Being able to respond promptly to guests’ needs also shows that you’re paying attention, and they will often show their appreciation in the right way – through positive reviews that serve to bump up your listing.

Installing the right management

All of this may sound like a lot of work, which isn’t very appealing to busy investors who are juggling a day job, family and social commitments on top of their investments.

This is where property managers like MadeComfy come in, as the right property manager will certainly pay dividends in the long run.

For investors who are used to catering to long-term tenants, it can be a challenge to adapt to the different mindset of running a short-term rental. According to Schwaighofer, long-term rentals are more like commodities, whereas short-term accommodation is performancedriven. So the property manager you hire needs to be able to grasp the complexity of handling a short-term rental.

“Just because you change your agent doesn’t mean you’ll be able to increase your long-term rent from $750 to $950 a week. However, by changing agents, you might be able to save 1–2% on the management fee, around $400 to $700 a year, and you could receive better service,” he points out.

“It is very different for shortterm rentals, where your agent has to predict a nightly rate that drives high occupancy and rental returns whilst maintaining a high quality of service for guests in order to ensure fi ve-star reviews for over 60 bookings per year.”

“To drive strong returns and occupancy, you want your listing to be on top of the search rankings of booking channels”

The quality of the agent you get for your short-term rental can have a strong – and immediate – impact on your earnings, he adds.

“An agent that charges you a 12% commission might only be able to generate bookings averaging $700 per week with low guest reviews, whilst an experienced agent on 20–25% commission might be able to deliver more than $1,000 per week on average,” Schwaighofer says.

For this reason, he advises investors to select a property manager wisely, based on their capability to attract tenants efficiently.

“Don’t simply believe a marketing pitch, but look at the infrastructure and their experience. A short-term rental manager has to understand their capability to drive bookings, deliver a high level of service to their guests and ensure that you have full transparency,” he explains.

While other long-term landlords struggle with high vacancies and low returns, Schwaighofer adds that depending on the location and the quality/set-up of the property, MadeComfy clients “achieve between 20% and 70% better returns, net of our fees”.

Transforming your property into short-term rental accommodation can be tricky, and it can require you to change the way you think about leasing property out. But the profit you could gain in a climate of rising vacancies could make it well worth the challenge!

Receive an instant estimate of your property’s rental potential based on nearby comparable rentals at www.madecomfy.com.au