Many investors baulk at the thought of buying into a low socio-economic area. Others have no choice. But which would be the best option from a strategic perspective, assuming we all had a choice? Which option would benefit the investors' primary goals?

What is a premium suburb?

Just so we're singing from the same song sheet, how about I give my definition of a premium suburb? A premium suburb will have some or all of the following attributes.

- Properties are expensive

- People who live in the suburb will have higher incomes

- Premium suburbs are in the best locations with respect to amenities such as transport, shopping, schools, etc. – they have the lot

- They are in the best locations with respect to tranquillity, beauty and leisure pursuits

- They are always in demand in both good times and bad

- The demand for premium suburbs is usually higher in good times than in bad times when money is plentiful

- Prices can get 'silly' when buyers with ample mony jostle for the best slice of the property cake

- Premium suburbs are usually found in city locations and near or with easy access to the heart of the city

- Premium suburbs are usually older suburbs that have gone through generations of gentrification

- Finding vacant land is highly unlikely

- Premium suburbs may have heritage listings and will probably be tightly controlled by the local council in terms of future development activity

Examples of premium suburbs might include:

- Double Bay in Sydney

- Toorak in Melbourne

- New Farm in Brisbane

- Peppermint Grove in Perth

- Unley Park in Adelaide

- Battery Point in Hobart

What is a lower socio-economic suburb?

- A lower socio-economic suburb will have some or all of the following:

- Prices of properties are considered very affordable, even 'cheap'

- Lower socio-economic suburbs are usually found on city outskirts

- They are relatively new suburbs

- Amenities in the area may be threadbare and will probably be fairly basic, limited to schools and shops

- Infrastructure is minimal

- Gentrification is in its infancy

- There may be a fair amount of vacant land

- A car will often be required to get to most things, apart from perhaps a corner shop or local primary school

- The incomes of residents are usually lower than those in the greater region in which the suburb sits, hence

- The housing may be more modern than in some premium suburbs but it will be very basic and there will probably be no heritage listings

Why are you investing?

I believe there are really only two things any investor should be considering for their next investment: risk and return. This is the case for buying property, buying shares, running a small business, commodities, cash, bonds, you name it. The reason I chose property investing after a disappointing foray into share investing is that the overall return-to-risk ratio was clearly better for me. I could access information about property markets that ordinary homeowners weren't even aware of. Since homeowners drive the market, I was ahead of them in terms of knowledge so I could outperform the average property growth rates. On the other hand, the fund managers who drive the share market had access to information I couldn't obtain, so it was hard for me just to keep pace with the All Ordinaries Index. And of course there was always greater volatility and uncertainty in the stock market. Each investor needs a level of risk that is acceptable to their circumstances, both financially and in terms of their capabilities, experience, available time and timeframes, stress levels and so on. Within an acceptable risk profile the next most important goal is maximising returns. On some occasions that means focusing on cash flow, and on others it means building equity. I will anaylse here the two options of premium versus lower socio-economic suburbs from the perspectives of risk and return for property investors.

Arguments for and against premium suburbs

The main argument for choosing a premium suburb is of course that it will always be in demand. Readers of my previous articles know that I focus on the demand-to-supply ratio (DSR) to gauge the potential for capital growth of a property market (see DSRscore.com.au). There are two types of demand, only one of which we're interested in as property investors. Imagine a 14-year-old boy who wants a Ferrari. This is desire, a kind of demand. But it is wishful thinking, and this demand doesn't affect the price of Ferraris at all. Now imagine a multimillionaire walking into a luxury dealership. The millionaire's demand definitely does affect the price of Ferraris because they have the capacity to actually buy one. I often hear real estate agents dropping that familiar cliché, “This area will always be in demand”. It may be, but will it always have the best capital growth? Buying activity affects demand. Wishful thinking doesn't.

From the perspective of a resident, the premium suburbs have it all. But we're not planning to become residents; we're property investors, so we need a different perspective. We need to consider risk and return.

Premium suburb risk analysis

Having a large and consistent pool of people vying for a piece of paradise lowers the risk of an investor buying there. The investor will always be able to rent property in great locations where everybody wants to live.

Property will never become worthless in a premium suburb. And sooner or later capital growth will happen. Also, because the prices are so high, you will usually get a much better class of tenant. They are more likely to be responsible and timely in paying rent. It’s usually in the low socio-economic suburbs that you hear stories of nightmare tenants.

The risk of investing in premium suburbs seems quite low at this stage of the argument. Many investors would argue, however, that the prices are simply too high in premium suburbs and they don’t represent good value for money. But this is a misnomer since value for money can happen at any price. And the high price of such suburbs hasn’t stopped their growth over the last few decades, has it? In fact, prices have just kept climbing and what was considered too expensive is now considered good value.

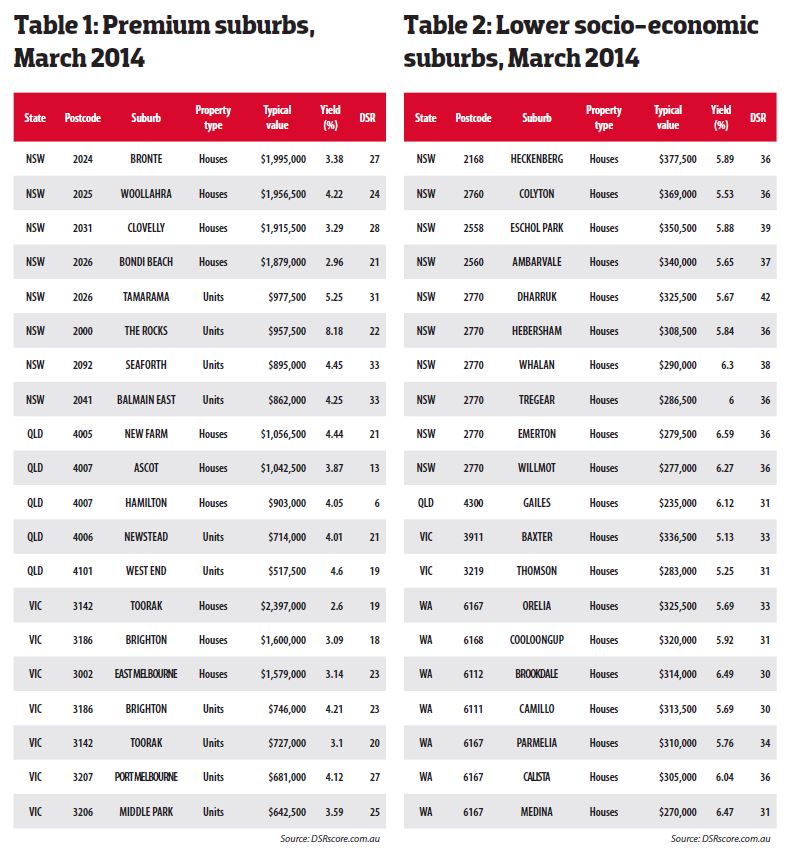

Check out Table 1 for a list of premium suburbs, and note the typical values. You’ll see that they really can limit the number of investors and homeowners able to buy there. And this is a problem. You want the highest number of people haggling for properties to place the most pressure on prices to go up. Premium suburbs only have a relatively small number of potential buyers. Having a large pool of potential buyers reduces the investor’s risk if they need to sell in a hurry. Taking a year to sell a top-end property is not uncommon.

Click on the image below to enlarge

Having illiquid investments is a risk. Property is very illiquid already, but you can make it worse than it has to be. If premium suburb prices move into the ‘silly’ range at the top of their market cycle, there is considerable risk in buying there at that time. Some Sydney markets may start to move into this area towards the end of 2014. The biggest gains and falls in prices happen in premium suburbs, with the possible exception of mining towns and other one-industry regional markets. Although demand for property in Sydney is still high, significant future dampen enthusiasm in some suburbs. This will bring the DSR ratios back towards a more balanced state. Price growth will moderate and in some cases may flatten out completely.

The best time to buy into premium suburbs is when confidence has returned to the economy. A decent gauge is when the occasional economist starts predicting a move up in interest rates after they’ve been low for a long time. We're definitely there now so some premioum markets repeats good buying opportunities.

Return analysis for premium suburbs

One of the problems of premium suburbs is that their high price tags don’t usually attract a large number of renters. The rental yields on houses in such suburbs can be as low as 2.5%. See Table 1 for an estimate of the likely yields achievable in these premium suburbs at the moment. In general, the yields in premium suburbs will limit the return for investors from a cash flow perspective. That makes capital growth all the more important if you’re going to buy in these markets. Note that the average DSR score for the premium suburb markets listed in Table 1 was 23. This is considered ‘balanced’. The average for March 2014 countrywide was 23 as well. This took into consideration over 13,000 markets with sufficient data available at the time.

As can be seen from Table 1, apart from some markets in Sydney, there doesn’t appear to be too much promise for spectacular capital growth in this list. The big problem with premium suburbs, in my opinion, is that they have already ‘been there, done that’. Some of the biggest drivers of growth are new infrastructure and gentrification change.

Many investors assume that if a property market has all the right amenities and infrastructure, it will outgrow locations with minimal infrastructure or amenities. They are wrong. When a train line is extended through a suburb, the improved infrastructure pushes up prices as homeowners and renters realise the benefits of living nearby.

But after a decade of that train station being available, the increase in property prices has already been well and truly factored into current prices. So growth plods along as usual without any further new drivers or change. The extension of the train line created an imbalance between supply and demand. The new train station increased demand. But over time prices climbed enough to dampen demand. The imbalance has been rebalanced by pricing in the market.

Property markets are like homeostatic organisms trying to maintain balance. Your skin sweats when you’re hot in order to cool you down, and you get goosebumps when you’re cold to thicken your skin and keep you warm. Similarly, property markets have surges in price growth in response to external stimuli. The key to capital growth is finding markets that are out of balance and where the balancing act will come about by price growth, which reduces demand and restores balance. It’s all about change, and premium suburbs have done their dash when it comes to change. They already have everything.

Note, however, that some change still takes place in premium suburbs. Prices, for example, are changing all the time. And as a city grows, the premium suburbs become a smaller percentage of the total number of suburbs in the city.

What percentage of Sydney suburbs, for example, have a beach? That percentage is getting smaller as the city limits expand. So the scarcity factor starts creating a change relative to the surrounding suburbs, even when the suburb itself may not change at all.

OK, so we know that premium suburbs are scarce and getting scarcer as cities grow. We also know that people want to live in these premium suburbs, thus creating demand. But when will their buying behaviour affect prices, pushing them upwards, if there is little potential for change in the suburb itself?

It all comes down to affordability. We need the following to be true:

- Incomes in the higher brackets have gone up over the past few years, preferably faster than the cost of living

- Property prices in premium suburbs have not increased over the same timeframe

- Interest rates are low

- Lending policies are relaxed

- Business confidence is stable and gworing

In these circumstances you can expect cashed-up buyers to find the premium suburbs attractive. This is all great in theory, but to actually see the influence of demand and supply on the market, you really need to keep your eye on the DSR score. There are many more suburbs considered ‘premium’ than the short list I have provided in Table 1. You can keep an eye on the DSR scores for many suburbs in the data section at the back of tihs magazine, or by using the free property research web tool boomapp.com.au.

Risk analysis for low socio-economic suburbs

Whenever a low socio-economic suburb is suggested as a good investment option, the major cause of eyebrow raising is the fear of encountering nightmare tenants. Everyone has heard the stories and can visualise lengthy tributanl proceedings that don't compensate for the lost rent, lost time and added stress. My suggestion in these markets is to ‘aim low to gain high’. That is, aim low with respect to your rental expectations, and that way you’ll gain the highest class of tenant. If the property could fetch $300/ week, offer $285 instead to get a larger number of applicants. Then you pick the best one, preferably with the longest clean track record. What you lose is $15/week, which only adds up to $780/year. What you gain is only peace of mind, minimal vacancy time and possibly a saving of thousands of dollars in repairs. Engaging the best possible property manager is a must-have in low socio-economic areas.

Thorough research is all the more important in low socio-economic markets. You need to know where the trouble spots are. You don’t want to think you picked up a bargain and later discover that the property is surrounded by Housing Commission homes, and drug lord wannabes are selling their stock to teenagers in the skate park out the back. Affordability is working in favour of low socio-economic markets. Everybody has probably heard complaints about how hard it is to buy one's first home. Frist home buyers are complaining that properties are too expensive. If it truly is that hard to get into the market, people will be targeting the bottom. There will always be more average- and low-income earners than high-income earners.

The reason premium suburbs are so scarce and low socio-economic suburbs are plentiful is that not many people can afford the premium suburbs. That means there is a much larger pool of potential buyers for low socio-economic markets. Being able to sell quicly in one of these markets is not so difficult, assuming stock-on-market levels are reasonable.

When you target the bottom of the price range of properties in a city, there is little room for property values there to deflate further. The risk of heavy price loss is greatly reduced in low socio-economic markets.

In a booming economy with considerable wage growth, you’d think that as people upgrade and move out of low socio-economic markets, this reduces demand for them. But all that happens is that renters who previously couldn’t own take the place of upgraders.

Return analysis for low socio-economic suburbs

Table 2. shows that right now there are plenty of low socio-economic markets with favourable stats for investors. The yields are almost double those of the premium suburbs in Table 1, and the average DSR score is 35. Admittedly, I did pick some of these because they had favourable DSRs. This is to show that there is great potential for capital growth.

In compiling the list of premium suburbs for Table 1, I didn’t weed out any markets with a high DSR score. I was simply looking for characteristics of markets that are typically ‘premium’. The potential for rapid capital growth in low socio-economic suburbs is higher, since a single infrastructure project could be a huge kicker. And with minimal infrastructure, there is potential for this to happen multiple times in the future. Another advantage is that in the low socio-economic corners you know the market is making its own niche. This increases its popularity and draws in tenants and homeowners. That culture creation is an external stimulus, creating an imbalanced market.

The gradual removal of a stigma associated with a low socio-economic suburb is another opportunity for advanced capital growth. Obviously, a suburb without such a stigma can't benefit from its removal. But don't expect these bad attitudes to happen overnight. Wait until you see it happening before jumping in too early.

Table 2 shows a list of hand-picked housing markets that one could argue are in low socio-economic suburbs. Compare the typical values against those of the premium suburbs in Table 1.

Conclusion

Some of the best capital growth potential and excellent yields are available in our capital city outskirts in lower socio-economic suburbs. An investor turning their nose up at these locations may not realise the opportunity cost they incur.

At the same time, some premium suburbs in our city centres are ripe for harvesting given the current state of the economy. No particular strategy is a better choice for every investor all the time. Each investor’s current circumstances are as different as each property market and each property within a market. Examine everything on a case-by-case basis and be thorough in your research. Get expert help whenever you’re not sure.

This article was published in the July 2014 edition of Your Investment Property magazine. You can subscribe to the magazine here.