Reductions in interest rates and the easing of constraints on lenders imposed by the Australian Prudential Regulation Authority (APRA) will provide some positive impetus for purchaser demand. However, lenders are expected to maintain more conservative lending policies. New dwelling completions peaked in 2018/19, and rental growth has softened in response to high levels of new supply.

BIS Oxford Economics estimates that most state markets are in oversupply, with some at best being close to balanced. Weak wages growth is holding back consumer spending, while a decline in new dwelling construction is becoming a drag on the economy. An acceleration in economic growth is not expected until 2020/21 after residential construction bottoms out and both increasing building activity and business investment begin to drive economic growth.

Notably, the fall-off in purchaser demand is now translating to a decline in new dwelling commencements, which are expected to fall some 25% from their 2018/19 peak of just under 220,000 dwellings to a low of 163,000 by 2020/21. This downturn in new supply will sow the seeds of the next cyclical upturn. Population growth is expected to remain high, at an estimated 400,000 per annum over the next three years, fuelled by high net overseas migration inflows.

New supply will fall below underlying demand, and a number of markets are expected to begin to tighten again. This in turn is expected to see prices begin to rise by 2020/21 and accelerate by 2021/22 as growth in the economy gathers pace.

Conditions will be differentfrom city to city, as well as between the house and unit markets. Units are expected to face more challenges than detached houses in the coming years.

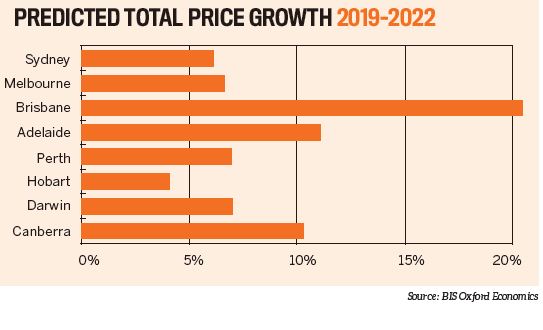

Overall, house price growth across most markets is forecast to barely pass inflation over the next three years, although prices are expected to accelerate across most capital cities by 2021/22 as the current downturn in supply hits home.

The greatest upside to house prices is expected to emerge in Brisbane, although it will not be immediate. Price rises will be modest in 2019/20, with acceleration in price growth expected the following year.

Moderate price rises are expected to tick over in Canberra and Adelaide, with both forecast to see price rises just above the rate of inflation.

By June 2022, median house prices in both the Sydney and Melbourne markets are expected to still be below their respective peaks of June 2017 and December 2017.

The resource-focused markets of Perth and Darwin have already experienced significant declines in prices, and will continue to experience challenges. However, by 2021/22 the excess dwelling stock in these markets is expected to finally be absorbed, which will set the scene for price rises in subsequent years.

Meanwhile, the recent ‘rock star’ market of Hobart is expected to slow down. Affordability has steadily become more challenging and rising supply will mitigate some price pressures. Only limited price growth is expected to 2022.

Angie Zigomanis is senior manager at BIS Oxford Economics and author of the Residential Property Prospects 2019 to 2022 report