Just like many hot button issues, the debate on whether houses make better investments compared to units continues to divided investors. Whether you prefer to invest in house rather than units, the reality is that units are no longer the laggard they once were, thanks to soaring demand from homebuyers.

While houses are still the dominant force, it’s quite a change to see how fast the market share of unit purchases has grown in such a short time.

One reason is affordability, but it’s also a lifestyle choice for people – particularly younger people, from Generation Y who are starting to become a real force in real estate.

This generation is more comfortable in smaller homes, and they value well-located properties close to the CBD and wired for technology much higher than having a big yard for barbecuing and playing backyard cricket. They happily forgo a five bedroom expensive brick McMansion in favour of a smaller apartment that costs half as much.

As a result, units in many inner-city locations have recorded strong capital growth, rising on par and in some cases even performing better than houses.

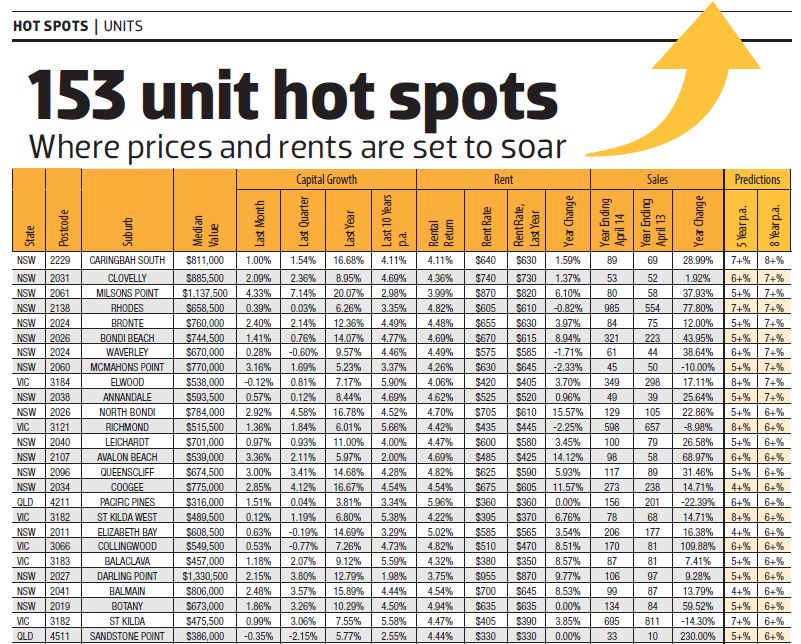

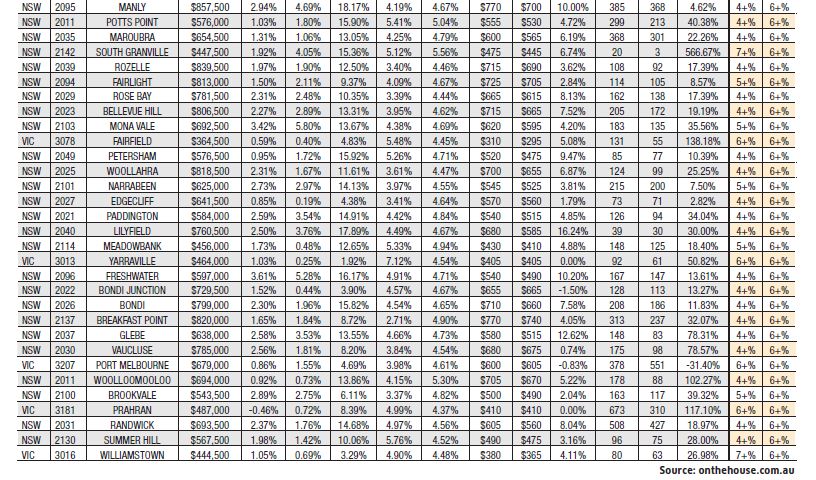

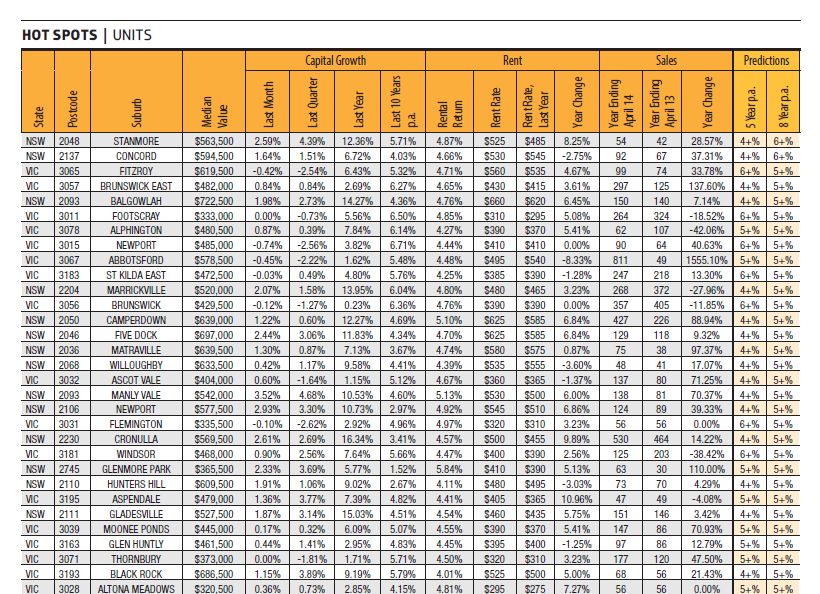

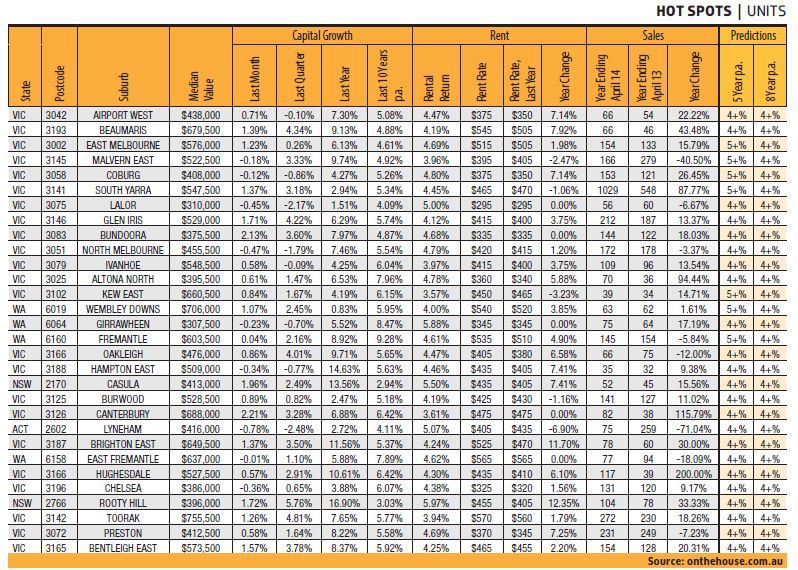

According to the latest Real Estate Investar (www.realestateinvestar.com.au) figures, some unit markets grew nearly 50% during the past 12 months as shown by these tables below.

What to buy

When it comes to investing in units, the closer you are to the employment and economic centre, the better. This means staying within a 2-12 km radius of the city centre.

It’s important to look for a pleasant, quiet ambience with close proximity to all sorts of infrastructure and amenities, such as schools, transport and shops.

Another key is to make sure there is a parking spot included,something that can make a huge difference in demand, especially if the unit is in an area with few street parking opportunities.

Make sure the building is wired for technology. As an example, an apartment block that is wired for the National Broadband Network (NBN) will be more attractive to a lot more renters and potential buyers than those that aren’t.

A pool and gym might also build up demand for many buyers, but beware that these add to the maintenance cost of the building.

Most importantly, don’t be turned off by smaller apartments. There used to be a phobia about buying smaller one-bed or studio apartments and some banks even didn’t lend to buyers unless the apartment was of a certain size.

However, the demographics have changed. A one-bedroom unit is becoming a high-demand commodity as shown by the rapid growth in prices in the Real Estate Investar report and this trend is likely to increase even more.

The demand for renters has also shifted to smaller apartments, as more single occupiers are looking for the cheapest option in a competitive field that has pushed rents way up in the past couple years.

What not to buy

There are, however, areas where demand is not so strong. For one, some of the high-rise apartments in the Docklands in Melbourne are likely to see subdued growth due to oversupply.

Some experts also warn about buying in high-rise apartments due to their lack of scarcity value. They tell us to avoid the temptation of being swayed by the mangnificent views from atop beachfront high-rises and remember you won’t be living in these properties.

However, as in everything real estate, this depends on the individual building. Some high-rise apartments in Sydney have skyrocketed in price during the past 18 months and continue to attract buyers.

The same is true in Brisbane. Demand for inner-city apartments have also grown strongly during the recent months. For example, units in inner Brisbane jumped 8% during the 12 months ending May, according to RP Data.

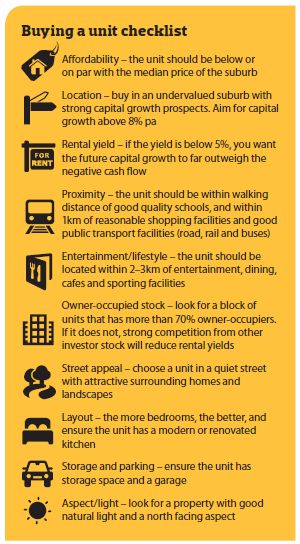

What to look for when buying

When choosing a unit there are specific details that can help you refine your search and improve the desirability of your property.

1. Bedrooms and floor space

The more bedrooms and the larger the floor space the better. If you're looking for one-bedder, look for floor area more of at least 50sqm, for a two-bedroom unit, look at buying something above 80sqm, and above 110sqm for a three-bedroom unit. More bedrooms mean that as an investor you can charge more rent, and your tenants can split the rent further to reduce their costs. However, it depends on the dominant demographic in your chosen suburb. Many single professionals prefer to live on their own rather than share so one or two bedders could be a better option. It’s also more affordable to buy them.

2. Level

The position of the unit in the building is the next element you need to look at. If your unit is in a quiet suburb, your tenants or buyers will probably be young families or empty nesters. These types of tenants or buyers will be looking for an easily accessible but safe, smaller apartment block with a unit on the first two floors.

Renting families are likely to expect that the apartment has its own garage or allocated parking spot. They may also pay more for a home with a good view of the city, water or surrounding suburbs.

If you are looking to buy in an active inncer city lock, you will most probably be renting your unit to young professionals. In the upper end markets these tenants will pay for good views, but in the general tenant market, any level of the building would suffice.

Ground floor level is often a tricky option as it's not the easiest to sell, although it can be attractive to older renters who don't want to go up the stairs or people with young kids.

When considering the type of unit to invest in, it’s always best to check the demographics of the area you’re

buying into.

For example, well-located and well-designed onebedroom units could do very well in inner-city areas as renters prefer to live on their own rather than sharing with others on a two-bed unit.

Two-bedders generally command premium price and affordability constraints could dent further capital growth.

“Most would say a two-bedroom unit is better because it offers more rental options, which is true, however a superiorly located one-bedroom unit will outperform most two-bedroom units that are located in a middle or outer-ring suburb from a capital growth perspective,” says Kingsley.

• Buying a unit in a complex that has high ongoing costs. Some owner’s corporations charge special levies for things such as water damage or fireproofing for timber stairwells.

• The unit doesn’t have things that tenants want. This could be: a nice view, an internal laundry, parking facilities, well-lit spaces and a place that lets them enjoy some privacy.

• Buying in high density apartments.

• Buying in a complex with problematic tenants.

• Buying for the wrong demographic, such as purchasing a one-bedroom unit in a family dominated suburb.

• Failure to do proper statistical research such as not checking the yields, vacancy rates, days on the market and other market indicators

• Buying sight unseen.

However for single women renters, this poses some potential security risks due to possible break ins.

3. Orientation

Property experts agree that an apartment facing towards the north and away from the road would make a highly desirable unit in the right area. This type of unit would make a highly desirable unit in the right area. This type of unit would receive a good air flow and minimal noise from traffic.

A unit which is newer or has been renovated to incorporate modern open plan living will also be attractive to tenants and owner-occupiers. Look for an apartment which provides plenty of natural light and areas which can be used to entertain and relax.

4. Details

Investors should be looking to buy established dwellings with character details as these properties will return higher capital growth due to their individual designs. They are often built with higher ceilings and more solidly, and they look nicer than the new high-rise apartments. However, there's potential for higher maintenance cost as well.

As an owner-occupier, you may be better off buying a newer apartment as it is less likely to have major problems and there is generally less maintenance involved.

5. Number of apartments in the block

Ben Kingsley, CEO of the property and financial advisory firm Empower Wealth, says the best unit investments are those that are well located in smaller blocks of apartments with quick transport to major employment, as well as great lifestyle elements.

The reasons for this are threefold:

1. An owner in a small block will own a greater percentage of the land value and it's the land value which appreciates.

2. Medium and high density blocks have much higher running costs (such as maintaining lifts, pools, general maintenance) so your income returns are less.

3. You don't have as much scarcity value in medium to high rise property. These types of properties are located in zoning areas that provision for many highdensity dwellings so owners are more susceptible to the higher probability of forced sales or oversupply periods, impacting their capital gain potential.

Andrew Crossley is one of Your Investment Property’s Investor of the Year winners from 2012, and the author of Property Investing Made Simple agrees and adds that it's best to target boutique developments limited to 8-12 in number, which are the only kind he buys.

“Never would I entertain buying in a 63-storey building with hundreds of units, no matter the location.”

However, Crossley believes the location is extremely important in the sense that some suburbs are more suited to units than other, as it's all about meeting the desires of the target demographic.

“In Queensland, for example, I would prefer a house in Toowoomba and a unit on the Gold Coast.

“Generally though, units offer more convenience and proximity to transport and infrastructure than houses.”

Looking for a mortgage broker with all the right moves?

Deanne Ezzy, Mortgage Broker of the Year, 2013

As a keen Latin dancer, Deanna has performed in many competitions, dazzling the crowd with her style and poise.

Recently Deanna's performance caught the attention of a different judging panel when she was awarded the title of Australian Mortage Broker of the Year (Reader's Choice Awards YIP Magazine).

We're proud of Deanna and it's fantastic to have her recognised by property investors across the country for the financial success and freedom she's helped them achieve. So what makes Deanna stand out from the thousands of other mortgage brokers in contention for this title?

You could put it down to her knack for finding property investors the best loans and structuring them to provide the greatest flexibility and access to equity...

...That's one of the reasons smart property investors use her; but we think it's her enthusiasm and her ability to think outside of the square that sets her apart.

So if you need guidance in financing a property in the near future or would like to discuss how to improve your existing loan structure, then do your investment a favour and talk to the best. Call Deanna direct on 0448 000 976 today to experience the peace of mind that comes with working with Australia's Mortgage Broker of the Year. Don't need to talk to Deanna today? Add her to your team and store her number in your phone when you do.

Why Trilogy?

What makes us different to other mortgage brokers? We specialise in working with property investors. And we're not aligned with any financial institutions, so the advice you get benefits you - not the banks. This means you can build your portfolio more quickly, avoid cross-collateralisation and access equity faster.

So whether you're looking for credit advice on purchasing your first investment property - or you want to expand your exisiting portfolio- talk to Deana and the team at Trilogy.

Call 1300 657 132 today to book your, FREE 30-minute Finance Strategy Session. Otherwise, visit trilogyfunding.com.au to download a host of free investor resources, from white papers on loan structuring, through to our hardcopy booklet, How To Structure Multiple Loans For Maximum Flexiblity And Control.

See graphs below (click on thumbnails for full-sized images)

Lyneham, ACT

Median age: 36

Median unit price: $425,000

12-month growth: 0%

Yield: 5%

Vacancy rate: 2.31%

5-year capital growth prediction: 4+% p.a.

8-year capital growth prediction: 4+% p.a.

Why to buy

Th prize for ACT’s most underrated and affordable investment suburb must surely go to Lyneham, as there is plenty to attract a wide variety of tenants. The proximity to nature parks and shopping centres (major and minor) are great drawcards for retirees and families. While the renowned café culture and the fact that it’s just 4km from the Canberra CBD is good news for young professionals and couples. Moreover, units are attractive for students in this area because they are close to both the University of Canberra and the Australian Catholic University.

Tourism also adds to the local economy, with the Exhibition Park In Canberra hosting famous car festivals, the Royal Canberra show and the National Folk Festival. There has not been any price growth within the past 12 months, however once more people become aware of Lyneham’s great value, an increase should well and truly be on the way.

Where to buy

There are modern and attractive apartments available in Archibald Street which are within walking distance of the Lyneham shops. Two-bedroom apartments can be bought there for less than $330,000.

Richmond, NSW

Median age: 40

Median unit price: $320,000

12-month growth: 7%

Yield: 6%

Vacancy rate: 2.08%

5-year capital growth prediction: 4+% p.a.

8-year capital growth prediction: 5+% p.a.

Why to buy

It may be home to one of Australia’s oldest and largest air force bases, but Richmond has much more to interest tenants than just extravagant aircraft and air shows. In recent years, there has been much renovation and rebuilding in the area,

and governments at all levels have ramped up spending.

Transport has improved, including the bus, taxi and train services which provide access to the Sydney CBD. There are a wide range of schools available for families, in addition to the university and TAFE campuses located in the suburb itself.

Richmond also attracts quite a number of older couples close to retirement and units are a good option for this demographic. In particular, the average gross rental yield of 6% for units is great value for astute investors. Just beware of flooding potential in the general area, so best to check with Hawkesbury Council about the suitability of the land before purchasing.

Where to buy

Units in Bosworth Street are particularly sought after because they are close to everything, including the train station, shops and parks. They also provide renovation opportunities.

Pacific Pines, QLD

Median age: 30

Median unit price: $365,000

12-month growth: 6%

Yield: 5%

Vacancy rate: 1.06%

5-year capital growth prediction: 6+% p.a.

8-year capital growth prediction: 6+% p.a.

Why to buy

Pacific Pines only became a suburn in 2003, but this area looks set to have a promising future for property investors. For starters, its location in the Gold Coast means it will benefit from the influx of infrastructure and jobs which are very much on the up due to it hosting the 2018 Commonwealth Games. The event itself is expected to boost the Gold Coast's economy by a cool $2bn.

Furthermore, the well-known tourism drawcards (Movie World, Dream World, etc) make it an ideal spot for young families and as the Aussie dollar drops further this should only help the local economy. It’s affordability also makes it a great option for families and there are plenty of education options within the area. There are many shopping options available in the suburb itself, including the large Helensvale Westfield centre.

With vacancy rates at 1.06% it shows people are increasingly catching on to the potential of this suburb.

Investors who are willing to sit tight should see good growth in coming years.

Where to buy

Aldgate Crescent is a popular spot for investors seeking units. Tenants here are close to three schools, three shopping centres, the M1 Motorway to Brisbane, and Helensvale train station.

Marrickville, NSW

Median age: 37

Median unit price: $542,000

12-month growth: 9%

Yield: 4%

Vacancy rate: 1.27%

5-year capital growth prediction: 4+% p.a.

8-year capital growth prediction: 5+% p.a.

Why to buy

Dubbed by some as “the new Paddington”, units in Marrickville are still affordable for investors, but may not be so in a few years’ time. With a typical unit in Marrickville spending just 33 days on the market and a vacancy rate of 1.27% demand is already strong and only set to get stronger. In fact, with a wave of yuppies increasingly targeting this area, it’s hard to believe that it was once very much a working class suburb.

Trendy shops, cafes, restaurants are in abundance and it conveniently located just 7km south-west of the Sydney CBD, with excellent public transport options available. The area is also famous for its ethnic diversity, with many immigrants being drawn to the area. And the thriving arts culture makes it the place to be for all kinds of popular festivals.

Where to buy

Illawarra Rd and Marrickville Rd are popular choices for investors seeking units. Both are located near the fantastic eateries, shops and transport Marrickville is known for. Wherever you decide to buy, a quick sell would not be wise given the medium-long term potential of this suburb.

Summer Hill, NSW

Median age: 35

Median unit price: $542,000

12-month growth: 1%

Yield: 4%

Vacancy rate: 1.59%

5-year capital growth prediction: 4+% p.a.

8-year capital growth prediction: 6+% p.a.

Why to buy

For tenants looking for a taste of Europe in Sydney, there is no better place to be than Summer Hill. This suburb has a rich European village feel, including heritage listed properties with Italian and Eastern influences. There are many medium-density apartment blocks towards the railway station which are attractive for young couples

and small families. Indeed, this demographic are drawn to the good schools, nice parks for the kids to play in and relaxed café culture. Furthermore, there is easy access to the Sydney CBD by bus and train, which is just seven kilometres away.

Auction clearance rates are a high 86.4% and the average unit is being snapped up in just 25 days, which demonstrates that competition is already fierce for this area. Units here are still affordable compared to other suburbs of similar distance from the Sydney CBD, but increasing interest from investors is only going to push prices up.

Where to buy

There are spacious and contemporary units available on Gower Street, which are a short walk to the station. If you work in the city, Parramatta or the North Shore, this area provides a convenient drive to all three.

Chelsea, VIC

Median age: 40

Median unit price: $387,000

12-month growth: 1%

Yield: 4%

Vacancy rate: 1.78%

5-year capital growth prediction: 4+% p.a.

8-year capital growth prediction: 4+% p.a.

Why to buy

To give you an idea about how far Chelsea has come, it turned an old rubbish tip into the increasingly popular

Bicentennial Park, which has since become a haven for joggers and cyclists. It recently had further updates in the form of modern play and barbecue equipment.

Another drawcard are the beautiful beaches, which attract a lot of tourists in the summer. In addition to having a large shopping strip located on the Nepean Highway, it has its own train station which provides access to the Melbourne CBD that’s 30km away.

This suburb has more older people than other parts of Melbourne, who are drawn to the lifestyle and affordability. Units are particularly popular among this demographic.

Where to buy

Swan Walk and streets close by are popular due to the tranquillity of their position and also the fact that they are minutes from the beach, station and shops.

Balaclava, VIC

Median age: 41

Median unit price: $469,000

12-month growth: 1%

Yield: 4%

Vacancy rate: 1.88%

5-year capital growth prediction: 5+% p.a.

8-year capital growth prediction: 6+% p.a.

Why to buy

You know you’re in a great suburb when you’ve got easy access to the both the city and the beach. Furthermore, units here have steady demand and are still affordable unlike other parts of Melbourne which offer similar amenities. For example, at a median unit price of $469,000, they are much cheaper than neighbouring Elwood ($546,100).

Balaclava is located 7km south of the CBD and you have your choice of the train, tram or bus to get around. There are also great shopping options available on Carlisle Street, while the classy cafes and restaurants make this area popular with young professionals. With unit three-year growth at 3% and 12-month growth at 1%, Balaclava is well overdue for a price rise. It is also an area targeted by professionals, elderly couples, singles and students. In other words, much of the demographic that targets units - and they don’t look like turning their backs anytime soon.

Where to buy

The proximity to public transport and the peaceful park make Williams St a popular choice for investors and tenants.

Footscray, VIC

Median age: 32

Median unit price: $351,000

12-month growth: -3%

Yield: 4%

Vacancy rate: 2.79%

5-year capital growth prediction: 6+% p.a.

8-year capital growth prediction: 5+% p.a.

Why to buy

This multicultural hub is increasingly catching the eye of investors. Located just 6km west of the Melbourne CBD, Footscray has come a long way from its working class roots. It is now increasingly attracting young professionals who thrive on the trendy nightlife and more than 100 restaurants which Footscray offers. Young students are also drawn to the arts and music festivals.

And while it is now known for its variety of people from different countries, it seems the future will be more about the number of people. Indeed, Maribyrnong Council predicts the population of Footscray will more than double from 14,100 to 30,500 by 2031, which would mean it would require about 7,000 new dwellings. Footscray’s units have dropped slightly in value over the last few years but this looks likely to have bottomed out.

Where to buy

There are a good range of apartments available on Droop St which are located near the Victoria University Campus, trams, restaurants, and have simple access to the CBD. A two-bedroom apartment can be picked up here for less than $340,000.

Ascot Vale, VIC

Median age: 35

Median unit price: $410,000

12-month growth: -1%

Yield: 4%

Vacancy rate: 2.17%

5-year prediction: 6+% p.a.

8-year prediction: 5+% p.a.

Why to buy

Some people might think of family suburbs as boring and quiet, but that’s certainly not the case with Ascot Vale. In addition to the great schools and parks (especially along the Maribyrnong River), the Union Road shopping strip has a wide range of boutique retail outlets, cafes and restaurants.

Transport is also excellent with trains and trams providing access to the CBD, which is just eight kilometres away. And one major attraction for Ascot Vale is the Royal Melbourne Showgrounds, which are adjacent to the world-famous Flemington Racecourse.

Furthermore, this suburb offers many apartments and townhouses which are appealing to an increasingly affluent demographic.

Where to buy

Units on Union Road are a stone’s throw from shops, public transport, local parklands and have simple access to the Melbourne CBD. There are quality apartments there which would suit small families and couples.

North Beach, WA

Median age: 41

Median unit price: $487,500

12-month growth: 7%

Yield: 5%

Vacancy rate: 2.21%

5-year capital growth prediction: 7+% p.a.

8-year capital growth prediction: 4+% p.a.

Why to buy

As you might have guessed from the name, North Beach is a northern coastal suburb of Perth with very scenic views. It’s located just 10 minutes from the Perth CBD which can be done via the nice and easy drive along the Mitchell Freeway and Reid Highway.

Apart from small shopping sections in Flora Terrace and Castle Street, there are fantastic options in the neighbouring suburb of Karrinyup. The schools and parks also make the suburb a drawcard for families. Moreover, Onthehouse.com.au's five-year growth prediction of 7+% pa is delightful news for would-be investors.

Where to buy

Apartments on West Coast Drive have stunning ocean views and are close to shops, restaurants and transport. These are particularly well-suited to retirees and young professional couples who like this area. Some might be a little expensive but they will always appeal to tenants as long as the ocean stays put.

Girrawheen, WA

Median age: 33

Median unit price: $310,000

12-month growth: 11%

Yield: 6%

Vacancy rate: 0%

5-year capital growth prediction: 4+% p.a.

8-year capital growth prediction: 4+% p.a.

Why to buy

It's tempting to think that a suburb with median unit price of $310,000 doesn’t have much to offer tenants, but that's certainly not the case with Girrawheen. This suburb is throwing off the shackles of its dodgy reputation and becoming more known for its great value than its crime rates.

It's only 15 minutes to both the beach and the city and there are great bus and train services that will get you there. The state government has spent millions revamping the suburb and investment demand has increased concurrently. Indeed , there are 0% vacancy rates and only 0.12% of stock on the market for units.

It may have grown by a solid 11% in the last 12months, but with such a low median unit price compared to neighboring suburbs, there could be plenty of growth still to come. Gross rental yields are also a healthy 6%

Where to buy

Casserley Avenue and Tendring Way are both popular with investors. Three-bedroom units can be picked up from these two streets for less than $320,000, so it's a great option for a low-income investor. Over the long-term there could be great gains to be made here. And if you don’t want to wait for that you can make your own growth, as there are plenty of properties just ripe for renovation here.

This feature is from the September issue of Your Investment Property Magazine. Download the issue to read more.