The foremost is supply and demand. The motivation is that property prices tend to move upwards in an environment where demand for housing is increasing, but there is competition among buyers because of a limited selection of properties available on the market. The competition is important because it encourages buyers to outprice each other to get the properties they want.

With this in mind, the DSR Score (Demand to Supply Ratio) is a good indicator of markets that are on the verge of seeing upward movement.

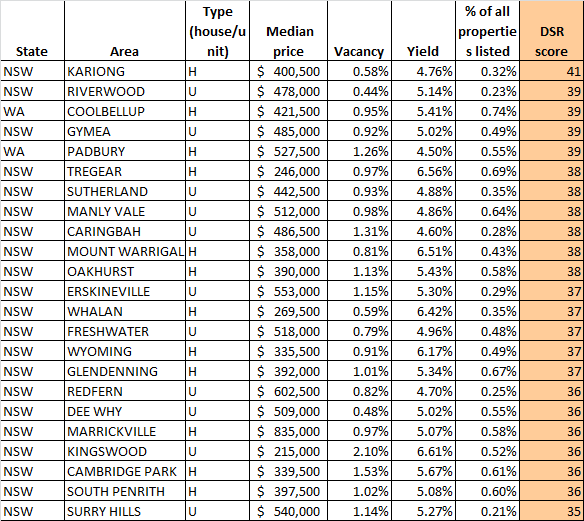

The DSR Score (DSRscore.com.au) collates a range of indicators that pinpoint whether a property market is seeing healthy demand and a low level of property listings. These include the average amount of time it takes for a property to sell, the proportion of properties put on auction that get sold, the number of online views that listings tend to get and the average difference between original listed prices and actual sales prices.

The DSR Score also takes into account vacancy rates, rental yield figures and the proportion of all properties in a suburb that are up for sale.

What results is an in-depth statistical insight into Australia’s many property markets.

From a supply and demand perspective, the data shows that some of the best markets to be a property owner at the moment are in NSW – almost overwhelmingly so.

Of the Australia’s markets with the best DSR Score – of which the data is statistically reliable – only Western Australia’s Coolbellup and Padbury stand out us markets outside of the Premier State.

Below are markets with a currently high DSR Score:

A DSR Score of 33-40 indicates a market where there is strong demand from buyers yet not enough properties for them to give them time to be choosy.

A DSR Score above 40 indicates that buyers are desperate. Properties in this suburb are highly desirable but there are few available. This imbalance of supply and demand will drive prices in the suburb higher at a faster rate.

Source: DSRScore.com.au