The personal finances of Australians are in their best shape since the GFC, according to research released this week, but it appears that our appetite for home loan debt has dropped.

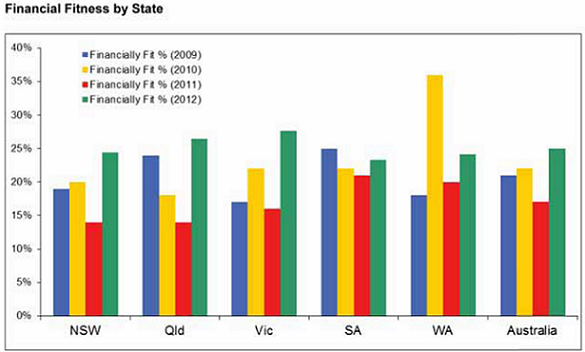

The Bankwest Financial Fitness Index found that 25% of Australians can now be labelled as “financially fit” – an 8% increase on last year’s figure of 17%, and the highest recorded figure in the Index’s four-year history.

According to the bank’s research, a “financially fit” individual has regular savings, a range of insurance, low housing costs relative to income and, high asset levels relative to debt and income.

“Borderline fitness” was defined as having moderate savings, some insurance, average housing costs and moderate debt levels. A “financially unfit” Aussie was described as having an over reliance on debt, little or no regular savings, no insurance coverage and high housing costs.

The annual survey of 1,000 individuals found that 44% of respondents had become more conservative in their spending habits, with Bankwest retail chief executive Vittoria Shortt putting this change in attitude down to global economic uncertainty.

“Consumers are responding to the economic uncertainty by being more careful with their finances, such as using cash or debit cards to make purchases rather than credit,” she said. “This follows on from last year when consumers were making a conscious effort to reduce their debt levels and curb their spending.”

According to the Index, 24% of Australians were found to be “financially unfit” – an improvement on last year’s figure of 31% – while 51% were labelled as “borderline” cases.

“Although we are developing positive habits, a quarter of Australians are still over-reliant on debt, have less savings and insurance, and are struggling with relatively higher housing costs,” said Shortt.

Source: Bankwest Financial Fitness Index

Mortgage demand wanes

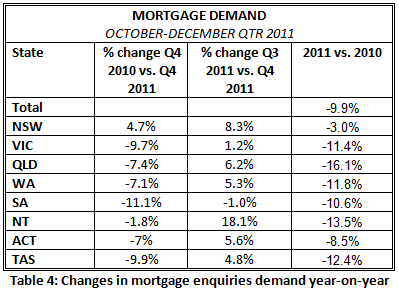

Australia’s cautious approach to taking on debt appears to have had an impact on property market activity, with Veda research revealing that credit checks associated with mortgage applications fell for the eighth consecutive quarter during the final quarter of 2011 – representing a year-on-year decline of 9.9%.

This represented a continuation of the steady bottoming out in mortgage applications recorded since the GFC, said Veda, with NSW being the only state to record an increase in mortgage applications when the data from the December quarters of the last two years were compared.

Source: Veda

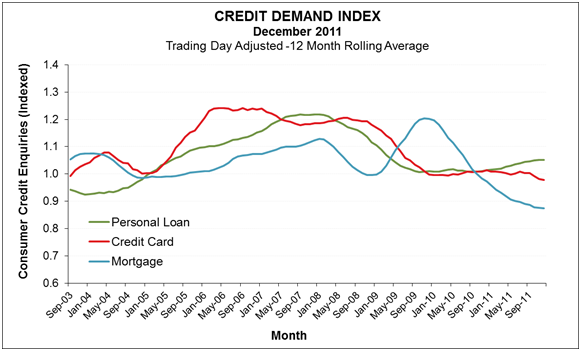

Looking at the figures, Veda’s head of consumer risk, Angus Luffman, noted that mortgage-related credit checks have seen a long period of decline since their notable spike during the First Home Owners Boost era of October 2008 to December 2009.

In encouraging news for property market observers, however, he noted that “the rate of decline in terms of mortgage demand has been slowing”.

“So we’re seeing that as positive, and that rate of decline has been decreasing each quarter,” he added. “When that bottoms out is something we’ve still got to see in terms of the nationwide picture”.

Is the global economic situation affecting your desire to enter the property market? Join the debate on our property investment forum.

More stories: