The results of a worldwide property report have compared capital growth in several of the globe’s key property markets, and Australia’s performance may come as a surprise.

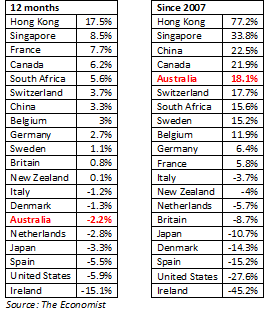

Released towards the end of 2011, The Economist’s global house price survey compared the performance of 20 property markets over the previous 12-month period, as well as since 2007 when the GFC began to take hold.

Over the 12-month period, Australia was one of the losers – showing a mild dip in property prices of -2.2% according to the survey. However, the lucky country appears to have fared remarkably well in the wake of the GFC, scoring capital growth of 18.1% according to The Economist’s figures.

These results ranked Australia at number 15 out of the 20 countries surveyed for capital growth over 12 months, but five out of 20 for capital growth since 2007.

The findings are consistent with the correction period that was observed across much of Australia last year, but the good news is that – in percentage terms – Australia is far from bottom of the global pack when it comes to capital growth.

Of the 20 countries surveyed by The Economist, Ireland came in rock bottom for 12-month growth – scoring -15.1%, followed by the US (-5.9%) and Spain (-5.5%). These places were duplicated when it came to capital growth rates since 2007, with Ireland scoring -45.2%, followed by the US (-27.6%) and Spain (-15.2%).

The standard bearer for capital growth in both categories, according to the survey, was Hong Kong – a market that’s notorious for its severe housing shortage – with 17.5% growth over 12 months and 77.2% since 2007.

The Economist hit the headlines last year for labelling Australian house prices as being overvalued by 53% based on rents and 38% based on income relative to long-run averages – an overvaluation of 25% based on the average of the two figures.

However, industry figures in Australia have met 2012 with cautious optimism, with Residex CEO John Edwards being amongst the latest commentators to highlight the country’s underlying economic strengths.

“Given the problems and the position of global economies, Australia has done well by comparison and in global stakes it remains one of the few bright spots,” said Edwards.

He noted that Europe’s economic woes have had an impact on the Australian economy, but pointed out that Australia is able to stimulate its economy by increasing borrowings and decreasing interest rates.

“I am confident that the year ahead will be better for residential property owners compared to last year. Most owners should see their assets hold value or increase and this year could in fact be a good time for investor activity provided the world economy doesn’t move into severe recession as a consequence of the problems in Europe,” he said.

The results:

Do you think that the Australian property market is set to weather the global financial storm? Have your say on our property investment forum.

More stories:

Australian property to bounce back in 2012

First home buyers to lead the way in 2012