We often tend to focus on the total property value when shopping for an investment property – or the deposit needed to secure it. But what are some of the other fees that get lost in calculation?

Lenders Mortgage Insurance

Previously, buyers were required to hand a lender at least a 20% cash deposit before they could secure a home loan. But today, this amount has been diminished to as low as a manageable 5%.

In order to reap this advantage, a borrower will need to take out Lenders Mortgage Insurance (LMI), which will cover the bank in the case that your circumstances change – deeming you unable to continue tending to mortgage repayments.

In other words, it’s insurance the bank takes out to guard itself against possible risks associated with handing out more than 80% of a property’s value.

Whilst the cost of LMI can accumulate well into the thousands depending on how much you request to loan from the bank, the benefit today is that a borrower is able to pay for this amount either up-front, or spread it across the entire life of the loan.

Approximate cost: Several thousand, depending on your property value, and how much you decide to loan. For instance, for a property valued at $800k, borrowing $700k can cost you about $10k-15k in LMI fees – whereas taking out $750k will see this premium jump to $30k-plus.

Conveyancing and legal fees

After obtaining a mortgage or a pre-approval for a home loan, you will need to fund for a solicitor or conveyancer to handle the legal side of purchasing a property. Not only will they prepare all the necessary legal documents, but they will submit them and make sure everything is done correctly and by the enforced due date.

Furthermore, they can assist you on the property’s change of hand on settlement day, transferring your mortgage, liaising with the bank, lodging and paying the property’s stamp duty fee, and offering you with expert advice along the way.

Approximate cost: Legal fees can cost you anywhere from a few hundred dollars, up to approximately $2,000, depending on your solicitor or conveyancer’s rates, and your state or territory. Be sure to get an estimate of costs in writing prior to engaging their services.

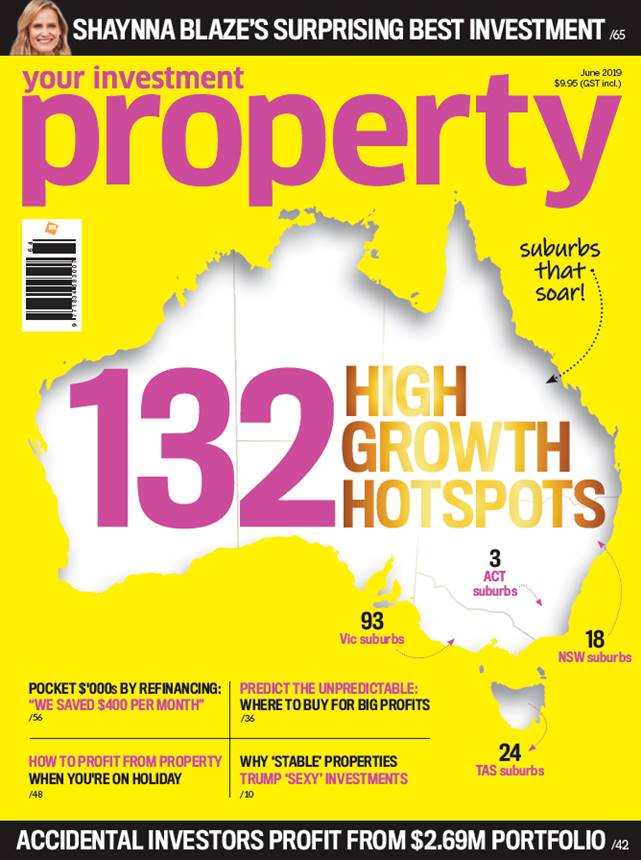

For the full story on additional costs when buying a property, read the complete feature article in the June 2019 edition of Your Investment Property magazine.

On sale at news agencies and Coles supermarkets 9th May to 5th June or download the magazine now.