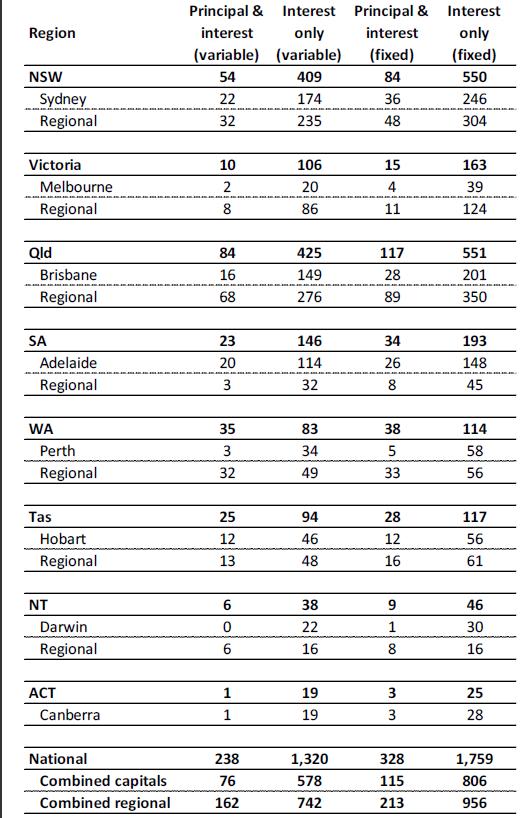

Australia has 238 suburbs or towns where the mortgage repayment is lower than the median rent, based on a principal and interest loan on a variable mortgage rate, RP Data has claimed.

The researcher today launched its annual ‘Buy versus Rent’ study, reporting the difference between the cost of paying rent and paying a mortgage across each suburb or town around the country.

Using an interest only loan, the list expanded to 1,320 suburbs/towns.

RP Data research director Tim Lawless said the results boded well for first homebuyers returning to the market. “We may see consumers returning to the property market as they realise in some suburbs [buying] may actually be cheaper than renting,” he said.

Lawless added that other factors support more buyers coming into the market. “With lower mortgage rates, tight rental markets resulting in some rental increases and lower home values, many buyers may see now as a good time to either re-enter the market or buy their first home,” he said.

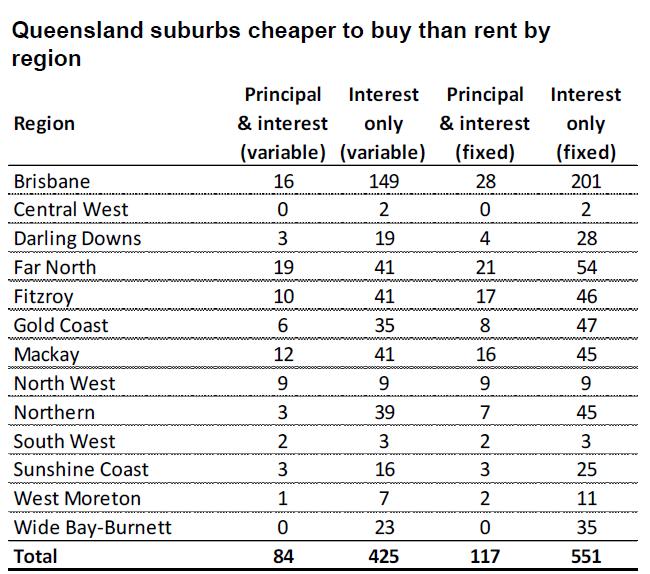

By state, Queensland had the most markets where it is cheaper to buy than rent, dominated by regional towns, which accounted for 68 of the state’s 84 markets that made the list.

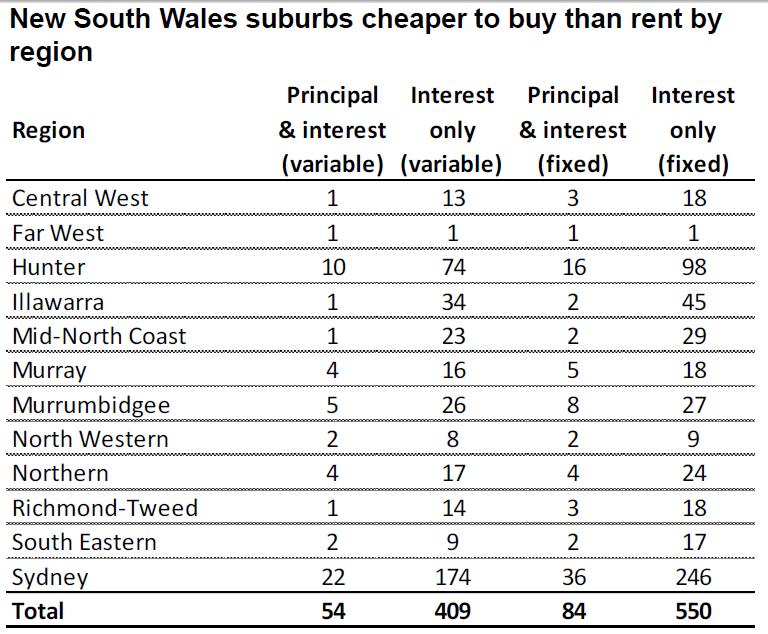

New South Wales property markets also featured heavily on the list, with 54 markets showing cheaper mortgage payments than median rents – 22 were in Sydney, the remainder in the regional parts of the state.

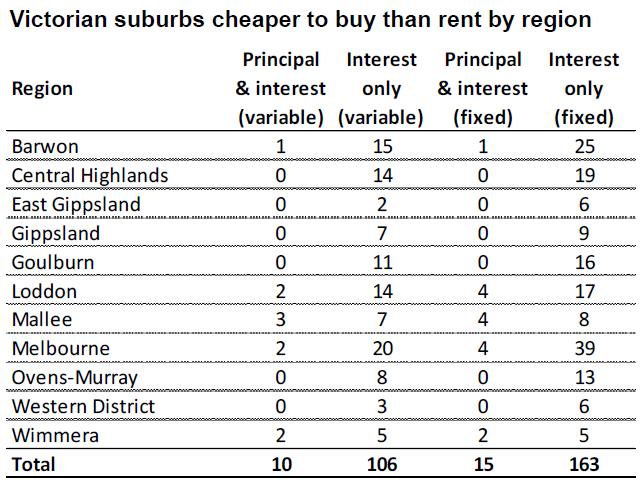

Melbourne recorded just two markets where a property is now cheaper to buy than rent. Adelaide had 20 and Canberra had only one.

The majority of Western Australia markets on the list were in the state’s regional areas, which enjoyed the lion’s share of locations where buying is cheaper.

Lawless pointed out that although the measure didn’t consider other costs of ownership, “it is a good starting point for further investigations into whether or not a potential purchaser should consider buying within a specific suburb.”

Australian suburbs where it's cheaper to buy than rent

Source: RP Data