The index measures the number of Commonwealth Bank mortgage applications against the number of homes for sale within a market to determine if conditions favour buyers or sellers, or if they’re balanced between the two.

Where the number of properties being advertised for sale outweighs the number of mortgage commitments the market is considered to be in favour of the buyer.

Where new home loans are outweighing the number of homes being advertised for sale, the market is said to favour the seller.

Markets are given and index ranking of 1 – 5, with 1 being an extreme buyer’s market and 5 being an extreme seller’s market.

A ranking of 2 is said to be a buyer’s market, while a 4 means a market favours sellers.

A score of 3 is a balanced market.

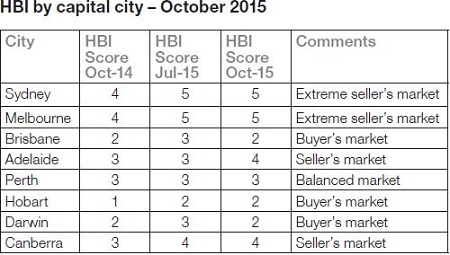

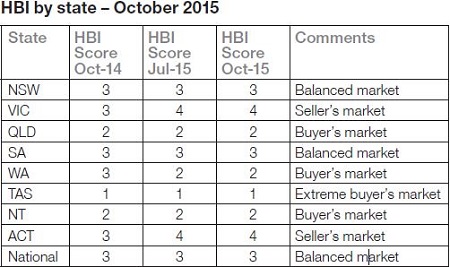

With scores of 5 in the latest edition of the index, which measured conditions from August – October, Sydney and Melbourne have been labelled extreme seller’s markets.

In the previous edition of the index, which looked at conditions in the three months to the end of July, both cities were labelled as seller’s markets with an index rank of 4.

The index currently ranks Adelaide as a seller’s market, after it was balanced in the previous edition, while Canberra has remained as a seller’s market.

Brisbane and Darwin are said to have moved to a buyer’s market from a balanced one in the three months to October, while Hobart has remained a buyer’s market.

Conditions in Perth are said to have remained balanced between buyers and sellers.

Source: Commbank/CoreLogic

But with the data used for the index running only to the end of October, Rich Harvey, managing director of Property Buyer, said conditions in some markets may have changed already.

“There’s a six-week lag between the end of October and now, and in that there’s already been some change. Around October was when the market hit an inflection point. Buyer fatigue really started to set in and the APRA changes really started to have an effect,” Harvey said.

“People just started to take a breather and we noticed a real drop-off in our business around that time. If you look at a market like Sydney, I wouldn’t say it’s an extreme seller’s market, there’s still some demand there but nothing like it was.”

In particular, Harvey said the demand that is present now is coming mainly from owner occupiers, rather than investors.

Source: Commbank/CoreLogic

While Harvey may disagree with some of the classifications handed out by the index, he did say it does show one truth about Australian property.

“It does show that conditions are different across the country.

“There’s definitely no one big Australian property market, we’re a country that’s made up of multiple different markets.”