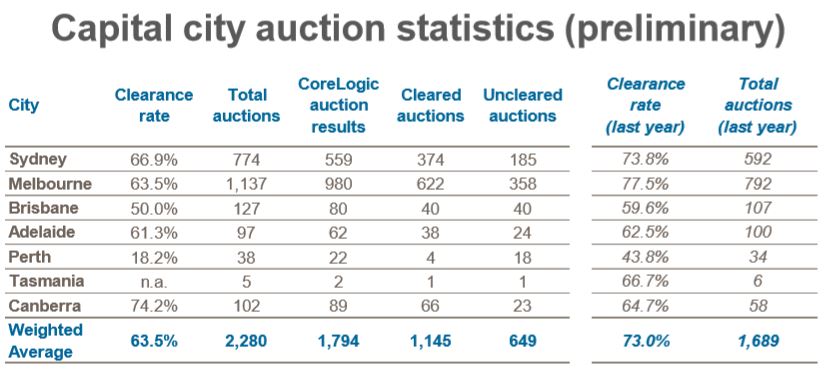

The preliminary clearance rate across the combined capitals rose to 63.5% in the week ending May 6, after the previous week saw the lowest clearance rate for the year, according to CoreLogic’s latest Property Market Indicator Summary.

The combined capitals saw fewer homes taken to auction in the week ending May 6, with a total of 2,280 auctions held. This was down from the previous week, when 2,577 auctions were held.

“The lower volumes saw an improved preliminary clearance rate over the week, returning a 63.5 per cent success rate, increasing on the week prior’s final clearance rate which was the lowest weighted average result seen over the year-to-date with 60.3 per cent of properties selling [down from a preliminary clearance rate of 62.5%],” CoreLogic said.

Although the preliminary clearance rate registered a positive rise over the week, the trend in auction clearance rates, based on the more complete final results, clearly shows a downward trend.

“Auction markets remain more buoyant than December last year, when Sydney clearance rates reached a low point of 52 percent, however the weaker auction results suggest housing market conditions are likely to remain relatively soft,” CoreLogic said.

“Looking at results over the corresponding year-to-date period last year, the capital city auction market was performing quite differently, with an average of 10 per cent more homes selling over the same period last year, while weekly volumes continue to show similar trends.”