As renewed calls are made for a FHOG boost, it has been predicted that politicians will pledge to revamp the scheme to woo voters next year.

The $7,000 grant hasn’t been increased since its introduction in 2000, and the Real Estate Institute of Australia (REIA) has called for a boost – saying that the handout has become increasingly less useful as home prices have risen over the last decade.

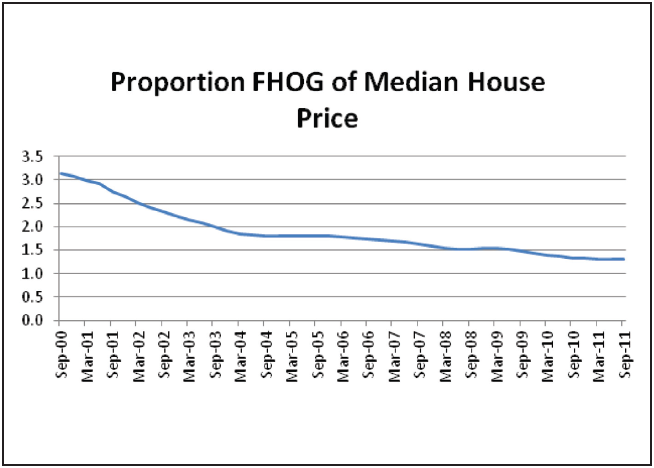

In a pre-budget submission, the industry group urged federal government to help first homeowners battle the country’s housing affordability crisis. The REIA says the grant made a big impact when it was introduced in 2000 and represented 3.2% of Australia’s median house price. But the effectiveness of the grant has now essentially been cut in half, the group says, as it represents just 1.5% of today’s median house price.

According to REIA data, the proportion of first time home buyers in the property market grew from 16.7% to 20% over the course of 2011 – when falling prices improved housing affordability. However, this year’s changes to the stamp duty rules in NSW, which have removed the stamp duty exemption for first home buyers purchasing existing property, have many analysts worried that first-time buyer numbers will drop.

In addition to increasing the size of the grant, the REIA also recommends allowing young Australians to access their superannuation funds in order to purchase their first home. The group says that only voluntary contributions should be made available for home purchases – and therefore compulsory retirement savings would not be endangered.

An election issue

With the next federal election taking place next year, property academic and author Peter Koulizos said that property investors can expect to hear a lot more about the First Home Owners Grant in the lead up to election day. He expects at least one of the major parties to make it a major issue in the campaign. “Reform is going to happen,” he said.

He added, however, that reforms should include making the grant means tested, stating that “the grant should be aimed at those who really need it” as opposed to a blanket sum that covers everyone.

“The market is different in each state. Not everyone needs the grant, and there need to be restrictions and adaptations so the First Home Owners Grant can change to meet these circumstances,” he said.

Source: REIA

Is it time for a FHOG boost? Have your say on our property investment forum.

More stories: