How does annual capital growth of 24% sound? Sadly this phenomenal growth rate hasn’t been recorded in any of Australia’s capital cities, but investors with an eye on overseas property markets may well be surprised to find out which global city has come up trumps over the past year.

According to the latest research from Knight Frank, property investors looking for capital city price growth may want to turn their attentions to Africa, as Kenyan capital Nairobi recorded a phenomenal average capital growth rate of 24.2% in the 12 months to March.

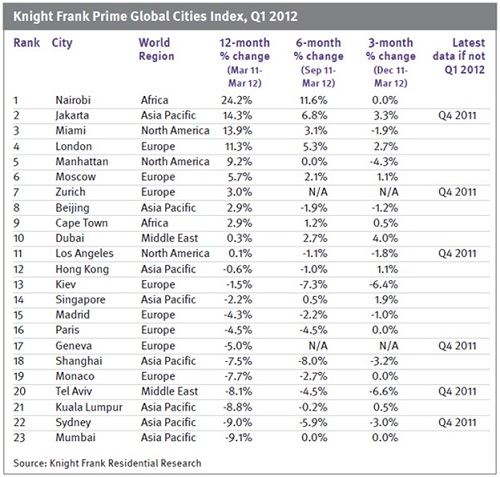

Jakarta takes second place in Knight Frank's Prime Global Cities Index, Q1 2012 with an annual growth rate of 14.3%, followed by Miami (13.9%) and London (11.3%).

Over the first quarter of the year, Dubai was the standout performer, according to Knight Frank, bouncing back from its financial woes to record a 4% capital growth rate.

As far as Australia was concerned, Sydney was the only city that was given a mention in the index, taking second to last place in the list of 23 cities with an annual growth rate of -9%. Mumbai was rock bottom with -9.1%.

Knight Frank said that the index's overall sluggish performance - a drop of 0.4% in prime property markets - was shrugged off by the likes of Nairobi, Jakarta, Miami and London.

Markets such as Singapore and London showed particular resilience, noted the report, seeing strong growth despite the introduction of new stamp duties in the first quarter.

Overall, the index remained subdued in 2012 fluctuating between marginal price falls and rises. Knight Frank said it seems unlikely the globe is on the cusp of a new deflationary cycle in luxury houses.

Are you looking to overseas hotspots for capital growth? Visit the overseas investments section of our property investment forum.

More stories: