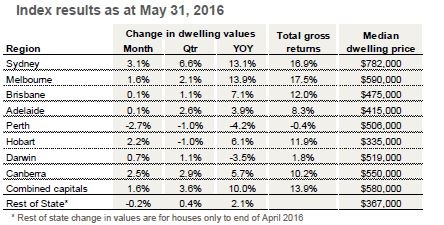

Released yesterday, CoreLogic RP Data’s May Home Value Index revealed that the median combined capital city dwelling price increased 1.6% to $580,000 over the month of May, with house prices improving 1.8% compared with a 0.1% rise in unit values.

The May increase means home values have risen 5% during the 2016 calendar year and are currently 10% higher than they were at the end of May 2015.

During May, Sydney was the best performing market with its median dwelling price increasing 3.1% to $782,000 over the month.

Canberra was the next best performer with its median dwelling price up 2.5% during May to $550,000, while the median dwelling price in Hobart increased 2.2% to $335,000.

Perth was the worst performer over the month, with its median dwelling price falling 2.7% to $506,000, while both Brisbane and Adelaide saw small price increases of 0.1%.

In the 12 months to May, Melbourne was the best performer with its median dwelling price ($590,000) up 13.9% over the year.

Sydney’s median value increased 13.1% over the year, while Brisbane ($475,000) increased 7.1%.

Perth was again the weakest performer on a year-on-year basis, with its median price falling 4.2% over the 12 months, while Darwin ($519,000) saw a 3.5% fall.

Source: CoreLogic RP Data

CoreLogic research head Tim Lawless said an uptick in investor activity may be behind Sydney’s recent strong run.

“The extent to which investors are fuelling the latest surge in Sydney home values is difficult to quantify, however housing finance data to March shows investors, as a proportion of all new mortgage commitments, have been trending higher since reaching a recent trough in November last year at 42.9%. The March data shows investors now comprise 47.6% of all new mortgage commitments which is the highest proportional reading since August last year,” Lawless said.

“Anecdotal evidence suggests investor numbers may have increased further from this time, with some lenders reversing the tighter lending requirements that were previously in place for investment purposes as growth in investor related credit tracks well under the APRA speed limit of 10% per annum,” he said.

While dwelling values have improved over the first five months of 2016, there has been little good news for the rental market, with weekly rents increasing by just 0.7% over the same time.

The combined capital city dwelling gross rental yield currently sits at just 3.4%.

In the house market, Melbourne is home to the lowest yields at just 2.9%, while Sydney’s apartments are returning just 4%.