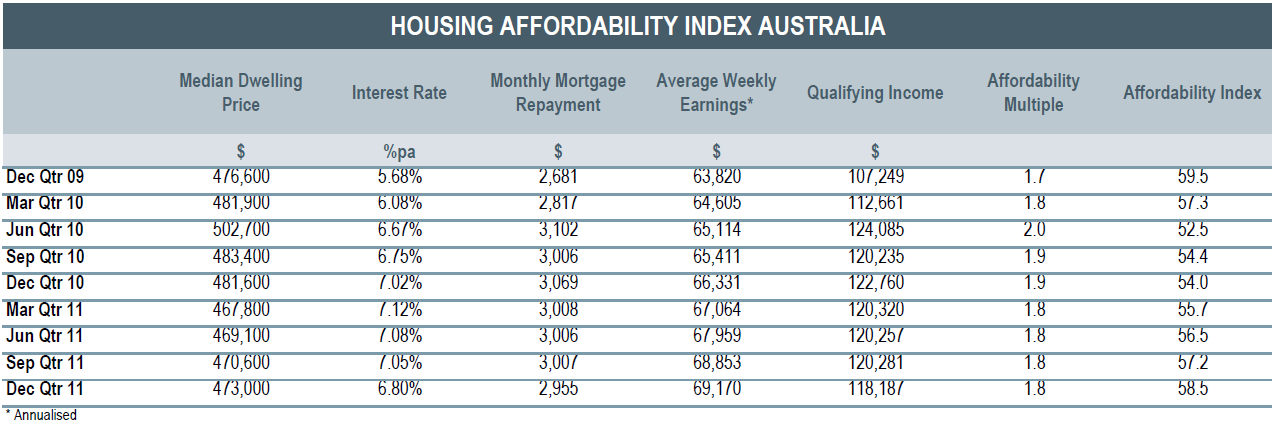

Australia’s level of housing affordability has risen for four consecutive quarters, according to data released this week.

According to the HIA-Commonwealth Bank Housing Affordability Index, housing affordability improved by 2.2% during the December quarter of last year. This result saw the Affordability Index rise by 8.3% over the course of the year.

In an assessment that will be music to the ears of investors who are waiting for signs of increased buying activity, the Housing Industry Association (HIA) has claimed that these latest results show that conditions are steadily getting better for potential homebuyers.

“A decrease in mortgage lending rates and continued earnings growth more than offset a modest increase in the median dwelling price to further improve housing affordability in the December 2011 quarter,” said HIA senior economist Andrew Harvey.

“As expected, the interest rate cuts in November and December of last year saw housing affordability continue to trend in the right direction. When the recent improvements in affordability are considered alongside the easier access to skilled trades as home building activity has eased, it increasingly looks like a good time to buy a new home for those financially able to do so.”

What has helped Australia’s housing affordability cause, says the HIA, is a quarterly increase in the nation’s average weekly earnings of 0.5% – which compares well with a 0.25% drop in mortgage lending rates.

There was a 0.5% increase in home prices over the December quarter, says the HIA, but over the course of the year prices had dropped -1.8%.

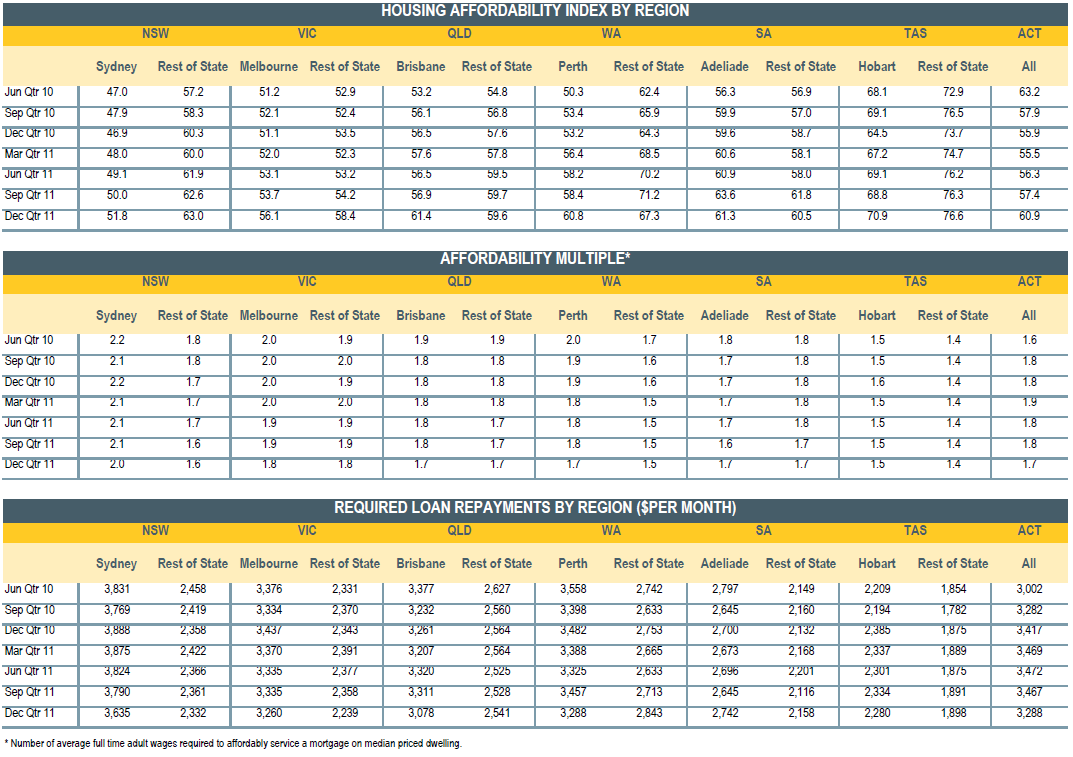

According to the report, Brisbane was the capital city that showed the biggest quarterly improvement in housing affordability, recording a 7.9% increase in its Index score. Canberra took the second spot (6.1%), followed by Melbourne (4.6%), Perth (4.1%), Sydney (3.5%) and Hobart (3.1%). Adelaide, however, saw its affordability score drop by -3.6%.

Outside of the state capitals Victoria took the top spot, with non-metro housing affordability rising by 7.8%, according to the report. Regional New South Wales (0.5%) and Tasmania (0.3%) saw slight affordability increases.

Perhaps unsurprisingly, given continued capital growth in its resource regions, non-metro WA saw its affordability score drop by -5.5%. Regional South Australia (-2%) and Queensland (-0.1%) also saw declines. Results were not compiled for the Northern Territory.

The results:

Source: HIA-Commonwealth Bank Housing Affordability Index

Will improving affordability see buyers return to the property market in force? Have your say on our property investment forum.

More stories:

Revealed: the suburbs property professionals tip to boom