“The increase in the 30+ delinquency rate across Australia raises the risk of mortgage defaults and is therefore credit negative for Australian residential mortgage-backed securities or RMBS,” said Alena Chen, vice-president and senior analyst at Moody’s.

Underemployment and the slowing pace of home price growth will constrain mortgage performance for the remaining months of the year, the agency said.

The report, titled RMBS – Australia: Mortgage Delinquency Map: Arrears Will Continue to Rise from Three-Year High is authored by Chen.

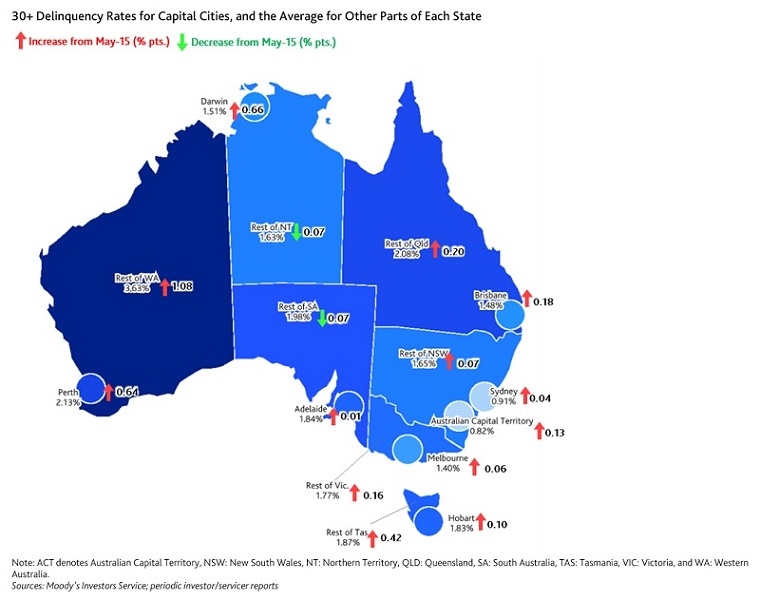

It notes that mortgage performance decreased in all eight states and territories in the 12 months prior to 31 May 2016 reaching 1.50% from 1.34% the year before.

Levels in Western Australia, Tasmania and the Northern Territory reached their highest levels since Moody began taking records in 2005. In South Australia, the most recent delinquency rate was just 0.1% below the state’s record high.

The worst performing state was Western Australia with the 30+ delinquency rate rising 0.69% to 2.33% in the year prior to 31 May 2016. This trend began in 2014 and follows the end of the mining boom. Poor housing market conditions have also contributed, Moody’s said.

Nationwide, the postcodes with the highest number of mortgage arrears were those exposed to the resource and mining sectors. Sydney had the lowest delinquency rates due to stronger housing market conditions.

Across all states, capital cities registered lower percentages of arrears than more regional areas.

However, Moody’s warned that the increasing supply of new-build apartments in Sydney and Melbourne will exert pressure on home prices and raise the risk of further mortgage delinquencies and losses.

However “while mortgage delinquencies will continue to rise, the deterioration in performance should be moderate,” the agency said.