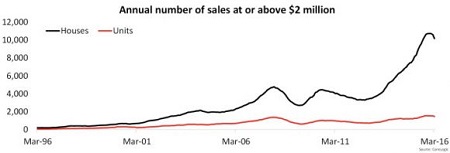

Analysis from CoreLogic shows more than 10,000 house and unit sales came with a price tag of $2m or more in the 12 months to March 2016, which is marked increase in the prevalence of multi-million dollar sales compared to when the current growth cycle began.

According to CoreLogic’s analysis, in the 12 months to when the current growth cycle began in June 2011, there were 4,103 dwelling sales of at least $2m. In the 12 months to March 2016 there were 11,648 house and unit sales at a price of at least $2m.

That figure consisted of 10,184 houses and 1,464 units and CoreLogic research analyst Cameron Kusher believes the number of homes sold for $2m or more will continue to rise, something that signals declining affordability.

“As home values continue to rise, there will continue to be some bracket creep, with the number of homes selling at $2 million or higher likely to rise further. We would anticipate an increasing number of sales at or above $2 million over the coming years, particularly in Sydney and Melbourne,” Kusher said.

“Of course the rising prevalence of sales at this price point is systemic of the deteriorating housing affordability and increasing cost of purchasing a home,” he said.

Source: CoreLogic

Before the figures from the year to march, the previous peak in $2m sales came in at 6,146 sales over the 12 months to February 2008.

The Global Financial Crisis then saw a decline in $2m sales and they bottomed out at 3,321 in the year to June 2009 and didn’t rebound to pre-GFC levels until November 2013.

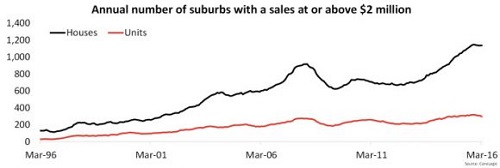

The current explosion of $2m sales has been spread across an increased number of suburbs.

At the pre-GFC peak of February 2008, 1,193 suburbs saw at least one $2m sale, before again bottoming out in June 2009 at 815.

In the 12 months to March 2016, a total of 1,437 suburbs saw at least one $2m sale.

Over the 12 month period, 1,139 suburbs had a house sale at or above $2 million and 298 suburbs had a unit sale at that price point.

Source: CoreLogic

While the sale of premium priced properties is being seen in more suburbs, the increases have been relatively isolated to NSW and Victoria, a further blow for affordability in those states.

“It is particularly evident of the deteriorating affordability of housing when you look at the number of suburbs with a sale price at or in excess of $2 million over time in NSW and Victoria,” he said.

“Particularly in NSW and to a lesser extent in Vic, there has been a significant increase in the number of suburbs with sales of at least $2 million over recent years.

“This is reflective of housing prices being pushed higher, particularly in Sydney and Melbourne, as home values rise and competition for well-located housing increases.”