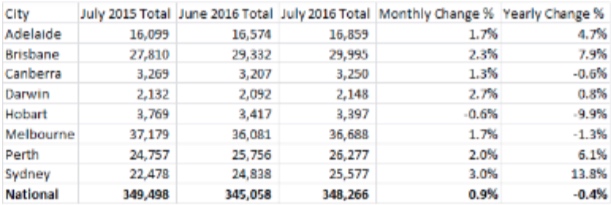

Figures released this week by SQM Research have revealed there were 25,577 residential listing in Sydney across July 2016, a 13.8% increase compared to July 2015.

Sydney was one of five capital cities to record a year-on-year increase in listings in the 12 months to July, however nationally listings fell 0.4% over the year.

After Sydney, Brisbane saw the largest increase, with listings up 7.1% in the year to July, while Perth saw an annual increase of 6.1%.

Listings also increased over the year in Adelaide by 4.7% and in Darwin by 0.8%.

At the other end of the spectrum, Hobart saw the largest yearly fall, with listings over July 2016 in the Tasmanian capital down 9.9% compared to July 2015.

Smaller yearly falls were also recorded in Melbourne, where listings fell 1.3% year-on-year and in Canberra where they fell 0.6%.

In month-on-month terms, Sydney was also home to the largest increase, with listings up 3% in July compared to June,.

Darwin and Brisbane saw listings rise 2.7% and 2.3% respectively over the month, while Hobart was the only city to record a monthly fall, with listings down 0.6%.

Nationally, listings rose 0.9% in July.

Source: SQM Research

While Sydney has seen significant short and long-term increases in listings, Louis Christopher, head of SQM Research still believes it is a relatively strong market.

“Listings and asking prices for the national residential property market still suggest a mixed picture with Melbourne and to a lesser extent Sydney, recording buoyant markets, while other cities recording a weaker market environment,” Christopher said.

The continued strength of the two markets may please those who have bought in them recently, but Christopher also said it could act as a double-edged sword, especially after interest rates fell this week.

“Going forward, the market is likely to rally further given [Tuesday’s] rate cut decision,” he said.

“There is a possibility now that Melbourne dwelling prices could accelerate from an already heated rate of growth. And if Sydney were to also accelerate I think we could see APRA stepping into the market once again as early as fourth quarter this year.”