Be sure to grab a copy from your local newsagency or buy it online by clicking here!

This jam-packed issue includes:

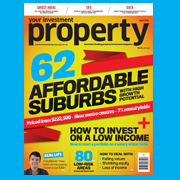

62 affordable suburbs with high growth potential

Despite the skyrocketing property prices in many markets around Australia, there are still many suburbs where you can find affordable properties to invest in and make big profit

3 successful strategies for investing on a low income

If you’re low on cash but determined to break into the property market, we’ve got the winning strategies for you to consider

Warning: 4 investments low-income earners should avoid

There are certain investments that low-income earners should swerve to avoid, as they have the potential to transform a potential money spinner into a certified dud

How to get finance as a low income investor

The spirit may be willing, but the banks don’t always share the enthusiasm. So how can you get finance to invest in property as a low income earner?

Australia’s safest suburbs to invest in

Where and how to find areas that will dramatically reduce your risks and maximise your profits?

Property investor’s survival guide

Don’t let fear and panic drive your decisions in these uncertain times – instead, arm yourself with the tools and strategies you need to overcome any setbacks you might encounter on your journey towards property success

How to survive a downturn

Property prices are still climbing in many areas in Australia, but underneath this hyperactivity is a slowing economy that could soon manifest itself to the property market. So what will you do when the downturn occurs?

Can’t pay your loan? Should you sell?

If you’re struggling to meet repayments and may be tempted to sell at a loss, read on as Joe Sirianni looks at your options

Real life success story

- Michael Lezaja: How I built my $5m portfolio using smart renovations and diversification

- Craig Merrett: How I broke into the property market with just $35k income

- David Christopher and Sascha Haddon: How we built our portfolio on a low income

Eddie Chung explains how capital gains tax is calculated, what’s taxed and what’s exempt to help you maximise your tax savings