Released this week, CoreLogic’s latest Pain & Gain Report, which measures the profits and losses of sellers by comparing the most recent sale price of a property to its previous sale price, showed that 90.8% of properties resold over the March quarter delivered a profit.

Over the quarter just 9.2% of properties were resold at a loss; however that is up from the 8.3% of resales that came at a loss in the December 2015 quarter and the 8.8% recorded over the March 2015 quarter.

Over the quarter, the total value of residential real estate resold at a profit was $12.9bn, with the average gross profit recorded at $239,855.

Nearly one third of resales (31.9%) over the quarter resulted in a dwelling selling for more than double their previous purchase price.

For those who sold at a loss the average figure was $66,073 with the value of real estate sold at a loss over the quarter totalling $362m.

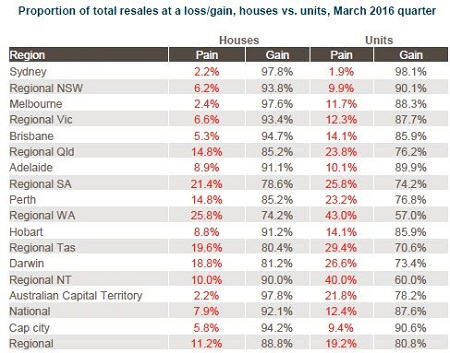

Regional areas were more likely to deliver pain to seller, with 13.1% of all resales over the quarter coming at a loss, though that was a slight improvement from the 13.4% recorded over the December 2015 quarter.

Across dwelling types, 19.2% of regional units were resold at a loss over the quarter, while losses were recorded on 11.8% of regional house resales.

In capital city markets, 6.9% of all resales over the quarter generated a loss, up from 6.7% over the previous three-month period.

For houses in capital cities losses were recorded on 5.8% of resales, while 9.4% of capital city unit resales resulted in a loss.

Source: CoreLogic

The average profit and loss in from a capital city resale in the March quarter was $294,045 and $72,042 respectively, while in regional areas it was $140,992 and $60,689 respectively.

While resale losses are more common in regional markets, Corelogic research analyst said not all regions were suffering equally.

“The trends in regional areas are shifting with the proportion of loss-making resales trending lower in areas linked to tourism and lifestyle,” Kusher said.

“On the other hand, housing markets linked to the resources sector are generally seeing an elevated level of loss-making resales after housing market conditions in many of these locations have posted a sharp correction,” he said.

In some regional areas dominated by resource industries up to 40% of resales came at a loss, while the highest proportion of resales at a loss for regional areas associated with lifestyle and tourism industries came was 23%.

While some regional markets are reporting a high proportion of resales resulting in a loss, there are also certain capital city markets where sellers face a high probability of losing money.

Over the quarter, all inner-city unit markets analysed by CoreLogic, with the exception of Sydney-Inner and South (1.6%) and Adelaide-Central and Hills (8.4%), recorded more than one in 10 unit resales at a loss.

In inner city Melbourne 19.1% of unit resales recorded a loss, while in inner city Brisbane it was 11.1% of unit resales that were loss-generating.

Conditions were worse in Hobart where 14.1% of unit sales came at a loss, while in Canberra it was 21.8%, 24.6% in Perth and 26.6% in Darwin.

For those considering selling in the future, it may pay to have a look at how long you’ve held the property for, with the report showing losses were more likely to be recorded when the time between sales is shorter.

Nationally, houses that were sold at a loss over the March quarter had been held for an average of 5.8 years prior to the sale, while for houses resold at a profit the average hold period was 10.5 years.

For units, a loss-generating resale came after an average hold period of 6.7 years, while an average hold period of 9.3 years resulted in a profit at resale.

“Property ownership, whether for investment or owner occupier purposes, should be seen as a long-term investment,” Kusher said.