According to a report in the Australian Financial Review, Paul Bloxham, chief economist with bank HSBC, claimed the rate of house price growth in Australia during 2016 will be around half of what was seen in 2015.

According to the AFR, Bloxham predicts house price growth will cool to between 4% and 5% in 2016 compared to the 9% seen in 2015, while 2017 will see prices grow by up to 5%.

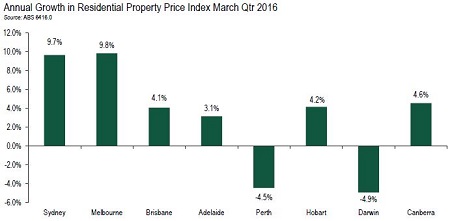

Bloxham’s prediction in a cooling of price growth comes on the same day Australian Buerau of Statistics figures reveled home prices grew at an annual rate of 6.8% in the year to March quarter 2016, but he believes factors such as reduced demand from foreign buyers will start to slow price appreciation.

Source: HIA/ABS

“Foreign purchases could partly explain the recent ramp-up in Sydney and Melbourne housing prices," says Mr Bloxham,” The AFR reported Bloxham’s note as saying.

"We expect recent increased taxes and changes to local bank lending practices are likely to weaken this source of demand in coming quarters,” he said.

A number of Australian lenders have either banned foreign investors from receiving finance or severely limited their servicing ability, while all mainland states on Australia’s eastern seaboard have hit them with increased property taxes.

Bloxham said the slowdown in demand from offshore will likely increase the impact of apartment oversupply, which will also contribute to the price growth slowdown.

"We expect that apparent oversupply in the apartment markets in Brisbane and Melbourne may see some unit price declines in these cities, but we expect the detached housing market to continue to see modest price gains," he said.

Diwa Hopkins, economist for the Housing Industry Association (HIA) also said the apartment sector had played a big role in the price growth slowdown.

“This deceleration in price growth has occurred against a backdrop of waning momentum in property transfers, particularly amongst non-detached housing. The volume of attached dwelling transfers across Australia grew strongly in 2013 and 2014. The volume of transfers was virtually unchanged in 2015 and signs of a pull-back in 2016 are now emerging," she said.

While owners may miss out on capital growth in coming years, Bloxham said the slowdown could bring benefit of lower interest rates as lower rates of price growth give the Reserve Bank of Australia more room to move on the official cash rate without fear of fuelling a possible housing bubble.