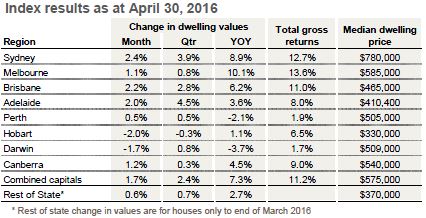

The latest CoreLogic RP Data April Home Value Index shows the combined capital city median dwelling price increased 1.7% to $575,000 during April.

In the three months to April, the combined capital city median dwelling price increased 2.4%, while it is 7.3% higher than it was in April 2015.

During month of April, Sydney and Brisbane were the best performers, recording price growth of 2.4% and 2.2% respectively.

All other capital cities, besides Hobart (-2%) and Darwin (-1.7%), saw prices rise over the month.

In the three months to April there was a surprise strongest performer, with Adelaide recording growth of 4.5%, followed by Sydney at 3.9%.

Hobart was the worst performer over the quarter, with its median dwelling price falling 0.3%.

In the year to April, Melbourne and Sydney were the strongest markets, recording annual growth of 10.1% and 8.9% respectively.

Unsurprisingly, Darwin (-3.7%) and Perth (-2.1%) were the worst performers.

Source: CoreLogic RP Data

CoreLogic research head Tim Lawless said while the figures show while there has been a slowdown in price growth, the market does seem to be rebounding somewhat after its weak end to 2015.

“The results show value growth moved at a faster pace compared with the final three months of 2015 when capital city dwelling values slid 1.4% lower off the back of weaker market conditions in Sydney and Melbourne,” Lawless said.

“While we’ve seen capital gains moderate substantially after peaking last year in Sydney and Melbourne, dwelling values continue to trend higher, just not as fast. The annual rate of growth in Sydney peaked at 18.4% in July last year and has since moderated back to slightly less than half the peak rate of growth, at 8.9% over the most recent twelve month period,” he said.

For Darwin and Perth, this set of figures may seem like the latest in a constant run of bad news, but Lawless said some light me be starting to appear at the end of the tunnel.

“With recent month-on-month increases in home values in these two cities, the declining trend rate is now levelling,” he said.

“This may be an early sign that these markets are beginning to find their cyclical trough after more than a year of annual declines.”

While the Perth and Darwin may be showing some small signs of life, the resource slowdown is still impacting regional markets.

“While house values across the non-capital city markets have generally underperformed compared with the capital city regions, regional house values moved 2.4% higher over the first quarter of the year,” Lawless said.

“The regional results are far from uniform across the states, with houses across both regional Western Australia and South Australia clearly showing values have moved lower over the past twelve months, down 1.2% and 6.1% respectively.

“Mining and resource-related areas continue to be a drag on regional housing market averages, however regional coastal and lifestyle markets, as well as major regional service centres which are sheltered from the mining downturn, are recording much healthier housing market conditions.”

The continued relative strength of the market is likely why investor activity has remained constant despite rental yields performing poorly.

“The low yield profile across Australia’s two largest cities, which are also the cities that attract the largest investment demand, suggests that most recent investors, despite the low mortgage rate settings, are likely to be utilising a negative gearing strategy to offset their cash flow losses against their taxable income.

“Buyer demand continues to be supported by mortgage rates that are close to historic lows, as well as high levels of investment demand. Even though investor demand has eased since May last year, investors still comprise approximately 46 per cent of all new mortgage commitments.”

According to CoreLogic, gross rental yields for capital city dwellings pushed to a new record low of 3.4% in April, while Melbourne’s gross yield profile is even lower, averaging 3%