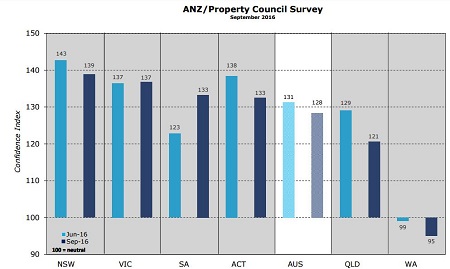

Released last week, the June edition of the ANZ/Property Council Survey has revealed consumer and industry sentiment around Australian real estate is at its lowest point since December 2013.

The survey takes into account current conditions as well as future predictions to determine the level of confidence around real estate, with a score of 100 on the index considered to be nueatral.

The confidence index came in at 128 from the June survey and while that is still a positive reading, it has dipped three points since the previous survey.

“The uncertainty created by the longest election campaign in half a century, and recent state government decisions to increase property taxes are taking a toll,” Ken Morrison, chief executive of the Property Council of Australia said

“We are seeing significant negative shifts in sentiment in NSW, Queensland and Western Australia. We are seeing a strong positive move in sentiment in South Australia. There is a clear correlation between this improvement in outlook in South Australia and the aggressive approach of the Weatherill Government in lowering property taxes,” Morrison said.

Source: ANZ/Property Council

For the residential sector, the survey shows national sentiment has cooled around the prospects of future capital growth, while the strength of the residential construction industry is also likely to fall away.

“Nationwide, expectation for capital growth in residential property are neutral. However, the state by state differences are pronounced,” Morrison said

"Expectations are positive in all jurisdictions except Western Australia. However, it should be noted that we are witnessing significant falls in expectations in Victoria and Queensland.

“While all sectors are reporting net positive expectations for construction, there is concern about the trend in residential construction. In residential construction, we have witnessed a downward shift in sentiment of 36.5 points over the past 12 months.”

Source: ANZ/Property Council

In perhaps some good news, the survey shows respondents in all jurisdictions believe interest rates are yet to hit the bottom of their current cycle.

“All jurisdictions recorded expectations of lower interest rates in the coming 12 months.

“However, the sector is feeling the impact of a tightening in lending conditions by the banks and all states are reporting strong falls in expectations of debt finance, with the exception of SA.”