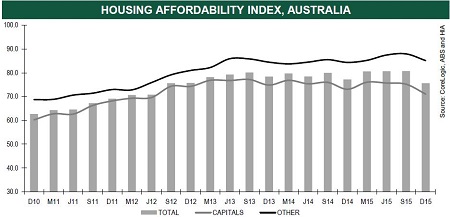

According to the Housing Industry Association’s (HIA) Housing Affordability Report for the December 2015 quarter, the interest rate rises levied as a result of stricter capital requirements for lenders saw housing affordability in Australia fall 6.4% over the three month period.

“The unilateral increase in the major banks’ variable mortgage rates which came despite the absence of any change in the official cash rate has delivered a significant blow to housing affordability,” HIA chief economist Shane Garrett said.

“Combined with double-digit dwelling price growth in cities like Sydney and Melbourne, the shock jump in interest rates has pushed home affordability to its least favourable position in over three years,” Garrett said.

Canberra’s real estate market was the worst hit by the rate rise, with affordability declining 11.4% during the quarter.

Affordability worsened 10.5% in Melbourne and 3.3% in Sydney.

Darwin was the only market to see an increase in affordability over the quarter.

Garrett said the impact on affordability the November rate rises had was worsened due to current levels of wage growth in Australia.

“The affordability challenge has been compounded by the slow pace of earnings growth which means that the buying power of households has not kept pace with dwelling prices,” he said.

“The increase in mortgage interest rates during November was an unpleasant surprise for homeowners, and housing affordability will be damaged even further if this tactic is repeated.”

Source: HIA

Garrett also renewed calls for policy makers to address affordability issues by making changes to stamp duty arrangements.

“HIA research has shown how the typical stamp duty bill of around $20,000 eventually costs homebuyers about $50,000 over the course of the mortgage due to higher LMI premiums and mortgage interest costs. It’s time for this inefficient tax to be addressed.”