Australia’s rental market managed to record a lift in affordability during the second quarter of the year, according to a new study by the Real Estate Institute of Australia.

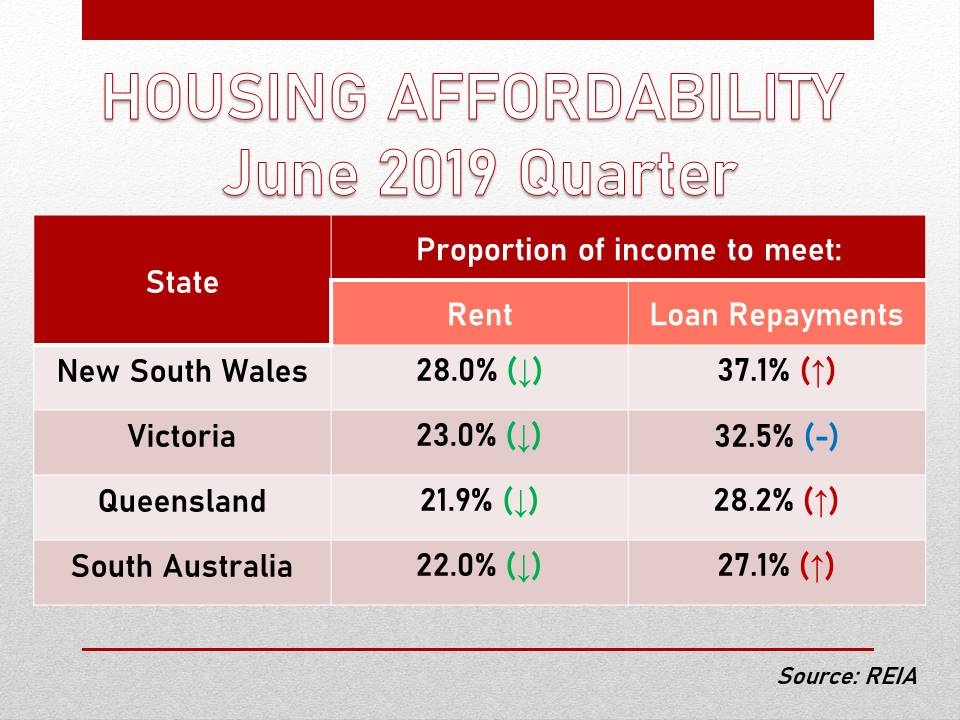

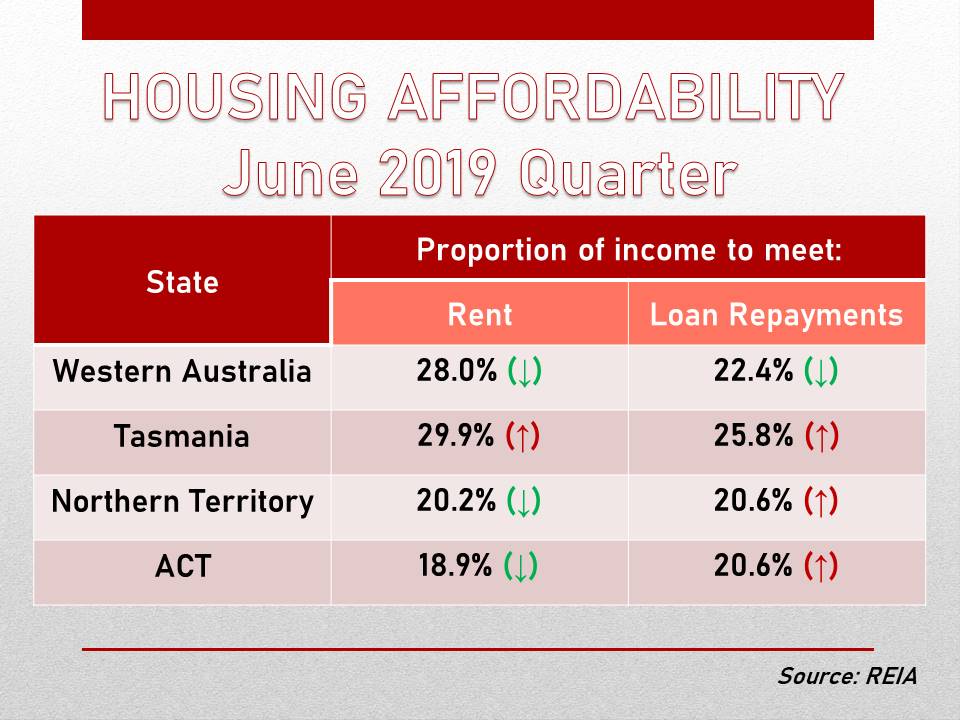

The proportion of income required to meet rent decreased to 23.8%, a fall of 1.2 percentage points (pps) over the quarter and 0.3 pps over the year. This level of rental affordability is the best it has been in 11 years, the study said.

However, housing affordability declined marginally in the June quarter due to the rise in the average loan amounts.

"With the exception of Western Australia, housing affordability declined in all states and territories. Although average loan amounts increased in all states and territories between 0.2% and 6.2% only Western Australia's family income surpassed their increase in the loan amount," REIA president Adrian Kelly said.

Can you afford an investment property? This tool would help provide an estimate of how much an investment property will cost.

The total number of loans, however, increased over the June quarter by 6.6%.

"The number of loans to owner-occupier first-home buyers has recorded increases in five of the six months of 2019. However, compared to the previous twelve months there were 16,521 less new housing loans — a decrease of 15.1%," Kelly said.

The tables below show how the affordability measures in each state during the June 2019 quarter: