Released yesterday, CoreLogic’s July Rent Review has revealed weekly combined capital city rents fell 0.3% during the month of July and were 0.6% lower when compared to July 2015.

According to CoreLogic, the median weekly capital city rent currently sits at $483, the lowest it has been since December 2015.

At the corresponding period last year, weekly rental rates were growing at an annual rate of 0.9%.

Across July, Melbourne and Hobart were the only markets to see rents increase, with their median weekly rents growing 0.1% and 0.9% respectively.

Rents fell in all other capital cities over the month, with Brisbane and Canberra home to largest falls of 0.8% and 0.5% respectively.

In the year to June, rents rose in Hobart, Melbourne, Sydney and Canberra.

Hobart saw the largest increase in the 12 months to June, with rents increasing 6.2%, followed by Melbourne where rents grew 2% over the year.

On the other side of the coin, Brisbane, Adelaide, Perth and Darwin all saw falls in the year to July.

The largest fall was recorded in Darwin, where rents fell 15.7%, while they declined 9.2% over the year.

Hobart and Canberra are the only capital cities to have recorded stronger rental growth over the past year compared to the previous year.

Source: CoreLogic

CoreLogic research analyst Cameron Kusher said housing supply is the main reason for the lacklustre rate of growth in the rental market, with slowing population growth and soft wage growth also playing a role.

“It is anticipated that the rental market weakness will persist and that on an annual basis rents will continue to fall over the coming months,” Kusher said.

“The combination of all these factors means that landlords have little scope to increase rental rates in this current market,” he said.

“Potentially, the changing rental market conditions will have a flow on effect for older stock, particularly units given we’re seeing so much new unit supply being added to the rental market, much of which is located in inner city locations.”

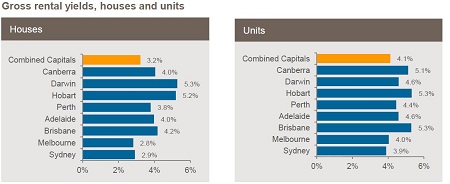

The weak pace of rental growth is also impacting rental yields, with both house and unit yields falling in the year to July.

At a combined capital city level, house yields have fallen 0.2% to 3.2% in the year to July, while unit yields are down 0.2% to 4.3%.

For houses, the highest yields are located in Darwin at 5.3%, while the lowest are found in Melbourne at 2.9%.

For units, Brisbane and Adelaide are home to the highest yields at 5.3%, while Sydney has lowest yields at 3.9%.

Source: CoreLogic

Across every capital city, except for Hobart where they are unchanged, house rental yields are lower now than they were at the same time last year.

The unit market shows similar trends to the detached housing market. Yields are lower over the year in all capital cities except for Hobart where they are unchanged and in Canberra where they have increased slightly.