According to real estate franchise LJ Hooker, which claims to have identified the emergence of so called rentvestors ™ in 2013, the strategy is becoming increasingly popular with Australians of different ages and income levels.

When the trend first emerged it was favoured strategy of a particular segment of the population, but LJ Hooker head of research Mathew Tiller said the rentvesting is moving further into the mainstream.

“Interestingly when LJ Hooker first identified the rentvestor trend we described it as a ‘young couple in their late 20’s or early 30’s who love their lifestyle and don’t want to relocate from where they were renting’, however our latest research shows that there are now two clear types of rentvestors,” Tiller said.

“The first category being those who are driven by lifestyle choices and affordability constraints and the second category who are driven by work, study or other personal circumstances,” he said.

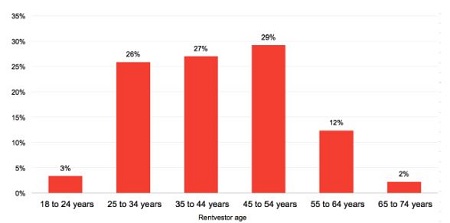

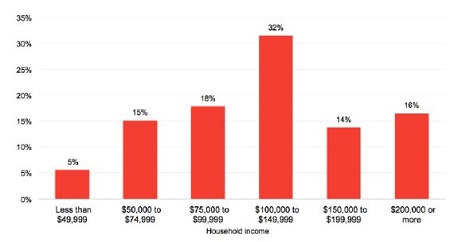

According to research by LJ Hooker, 56% of rentvestors are between 35-55 years of age, and just 38% have an average household income of less than $100,000 per year.

Source: LJ Hooker

Twenty-six per cent of rentvestors said they had chosen the strategy due to affordability, while 43% said their choice was due to work or study.

“Contrary to common perceptions, that a rentvestor is a young professional or university student; our survey found that a diverse age group rentvest,” Tiller said.

“Rentvesting has fast become a common part of the Australian real estate market.”

Source: LJ Hooker

As the strategy increasingly appears to be one used by people from all walks of life, Tiller said it is likely to become even more widely used as rental affordability increases and large sectors of Australian workforce are forced to transition.

“The past year has seen rental growth, in most capital city markets, remain soft. This has made renting a more attractive and affordable option and will potentially make “rentvesting” a more budget friendly investment strategy,”

“The recent strong price growth seen in Sydney and Melbourne has brought with it affordability constraints for those currently renting in the inner city and wanting to buy in the same location, and in turn pushed them towards becoming a rentvestor.

“Also, the increasing mobility of our workforce will also see rentvestor numbers rise. For example, as the mining and resource sectors slow, this workforce will move to other parts of the country and into different industries as opportunities present themselves. They will initially rent in the new locations and continue to hold either a family home or investment property in another part of the state or country.”