A new report has identified 20 markets across Australia that show tell-tale signs of robust price gains in the near term.

Well Home Loans Green Shoots Report analysed trends on asking prices, inventory, and selling times over the three-month period to July to identify the list of promising housing markets.

The list is a diverse set of markets including 14 metro and six regional locations hailing from different states and territories.

Well Home Loans CEO Scott Spencer said the list features markets that can cater to a wide range of buyers — from investors to first-time buyers — with different budgets.

"That shows, no matter where you live, there might be a nearby housing market where prices look set to accelerate in the not-too-distant future,” Mr Spencer said.

“That provides you with a potential opportunity if you’re thinking about buying.”

Market indicators to watch

Mr Spencer said housing inventory is a crucial factor that could tell whether a market is going to be in favour of buyers or sellers.

Inventory level refers to the amount of time it would take to sell all the properties in a given location if properties kept selling at the current rate and no additional were added to the market.

Falling inventory levels indicate it is becoming harder for buyers to find properties in a particular market.

"That’s one clue as to how prices are likely to move in the months and years ahead," he said.

The time it takes to complete a house sale is also a vital consideration when forecasting how prices will behave.

"When days on market are trending down, it tells you buyers are being forced to fight harder for properties, which puts upwards pressure on prices.

“All of this translates into asking prices. When vendors feel the market turning in their favour, they start increasing their asking prices.”

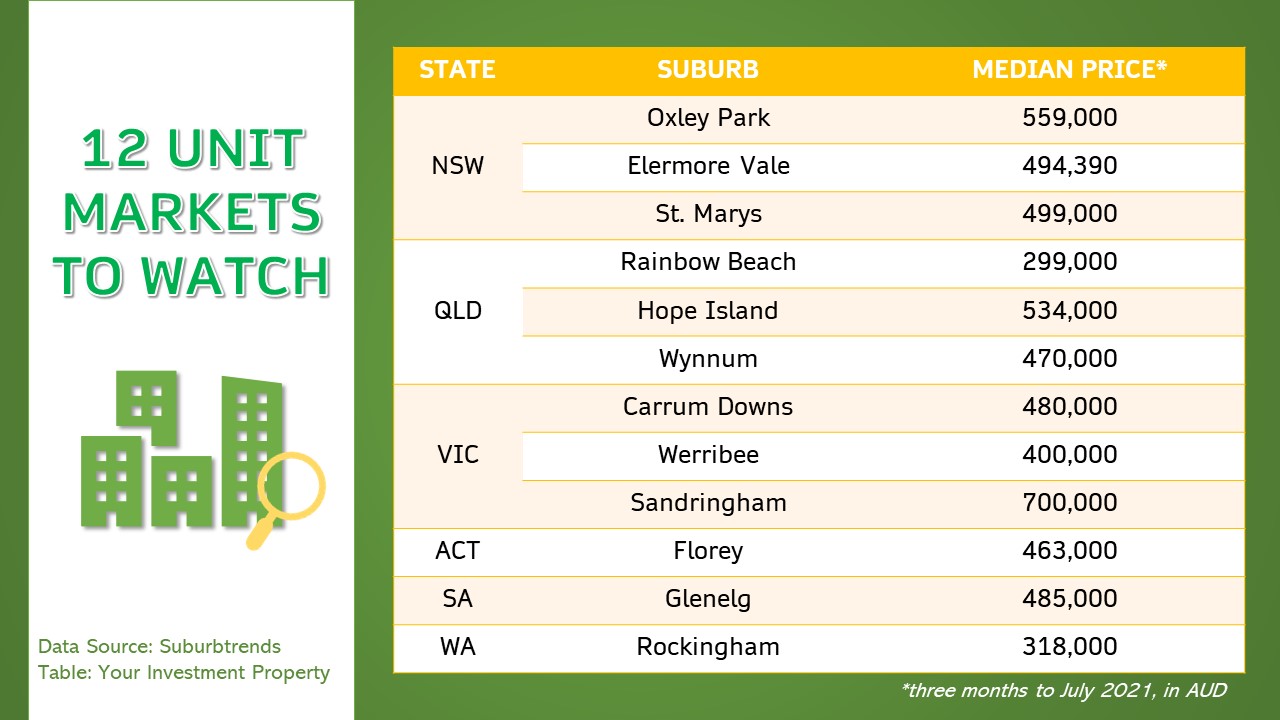

Unit markets dominate the list

Of the 20 markets that made the list, 12 are unit markets.

Oxley Park in Sydney is one of the strongest markets in the list. Over the past three months, its inventory level has decreased from 5.4 months to 3.1 months. During the period, its days on market also declined from 54 days to 42 days, which has led to a 5.1% increase in median asking price to $559,000.

Rainbow Beach's unit market in Queensland is also another market to watch out for. During the period, its inventory level went down from 6.1 to 3.4 months while selling days declined from 157 to 115 days. Units in this market had a median asking price of $299,000, reflecting a 4.9% gain.

The unit market of Glenelg in Adelaide is also showing clear signs of future gains, with inventory levels dropping from 4.7 to 3.1 months. Units take 43 days to get sold in this market, relatively faster than the previous period. The market's median unit price sits at $485,000, representing a 9% increase.

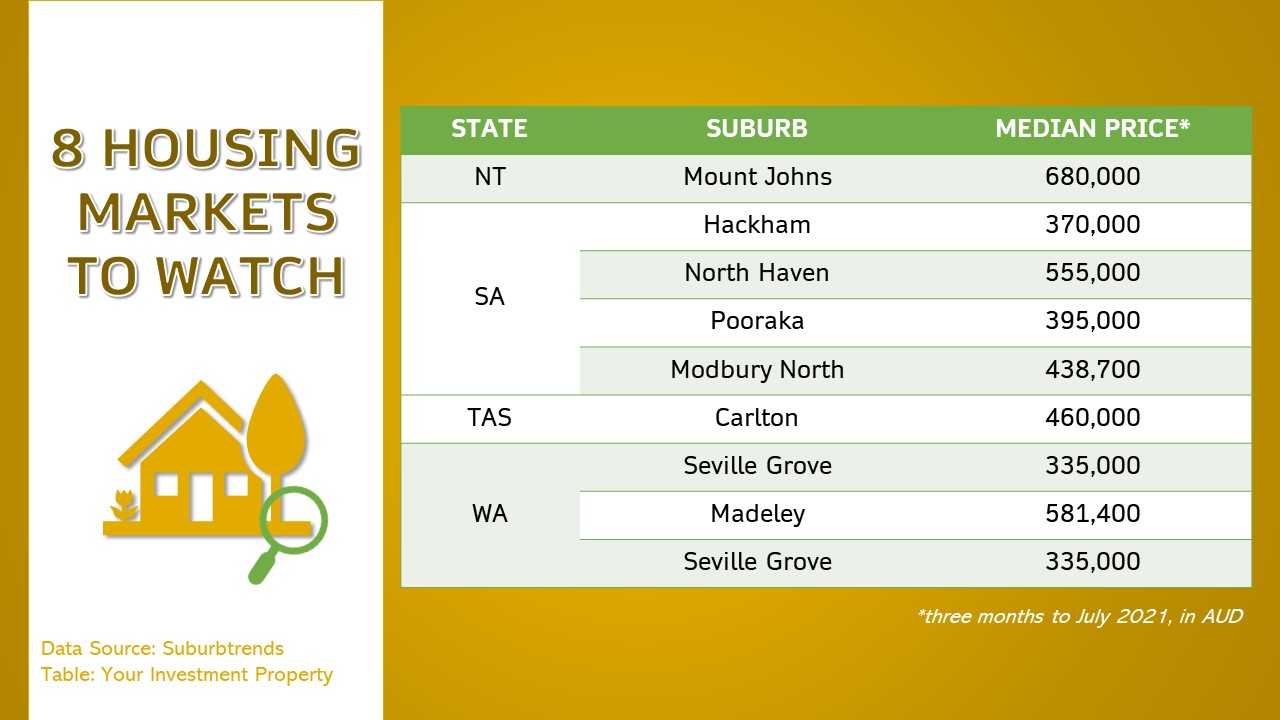

Housing markets show potential

Mount Johns in Alice Springs is slated to post robust growth in the near term. It has recorded a drastic change in inventory level from 9.6 to 3.4 months. Days-on-market also declined from 99 to 78 days. While its median asking price remained unchanged at $680,000 during the quarter, the tightening conditions point to a near-term rise.

Markets in South Australia dominated the list, accounting for four of the eight housing markets to watch. For instance, Adelaide's Hackham is poised to witness a persisting upward pressure on prices as both inventory level and days-on-market shrink. The market has already recorded an increase in median house price to $370,800 during the three-month period.