The federal government's HomeBuilder scheme continues to support property market sentiment, with Victoria recording the highest application numbers among all states.

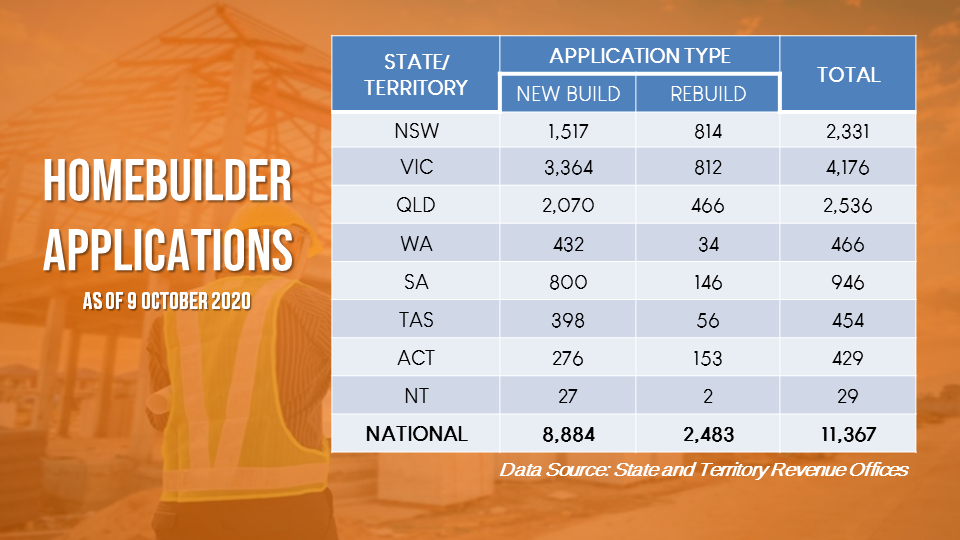

Data from State and Territory Revenue Offices show that there are 11,367 applications for the scheme as of 9 October. Of all applications, 8,884 were for the construction of a new home while the rest were for substantial renovations and rebuilding.

Of all states, Victoria received the highest number of applications, comprising 4,176 of the overall figures. Roughly 80% of all applications in the state were for the construction of a new dwelling.

This was a surprising finding, given the recent calls of the Housing Industry Association to extend the deadline of the scheme in Victoria.

Fiona Nield, executive director for Victoria at HIA, said home buyers in the state do not have enough time to process what needs to be done to qualify for the scheme.

"Stage four restrictions in Victoria have slowed home buying activity and with the 31 December deadline for signing an eligible home contract for HomeBuilder fast approaching, Victorians simply need more time," she said.

Queensland followed Victoria in terms of the number of lodged applications at 2,536. New South Wales came in third, recording 2,331 applications.

These figures were in line with the recent survey by the Property Council, which shows that the boost in industry confidence is being driven by stimulus measures. In fact, 75% of building developers surveyed said the HomeBuilder scheme would have a positive impact on their businesses over the next quarter.

Ken Morrison, chief executive of the Property Council, said there has been a big lift in sentiment among those in residential development sector as the states and territories rolled out the scheme.

“HomeBuilder is the pop star of government stimulus measures released so far — highly effective, immediate and good value for money,” he said.

New home sales were 11.8% higher in the seven months after COVID-19 restrictions came to effect compared to the same time last year, according to a recent report from HIA. This increase can be largely attributed to the HomeBuilder scheme, said Tim Reardon, chief economist at HIA.

“HomeBuilder has been successful in providing consumer confidence for those customers that had delayed a major investment decision earlier in the year,” he said. “The program has also brought buyers into the market that would otherwise not been able to purchase their first home for a number of years.”

The table below shows the number of HomeBuilder applications in each state: