Which state has seen 55% of its households experience a rise in income over the past 12 months, and which ones have seen 27% of households take a pay cut? Read on to find out more.

The financial health of Australia’s households has improved slightly since last quarter, according to the latest ING DIRECT Financial Wellbeing Index, but only 46% of households recorded an income increase over the past 12 months – and some states are suffering more than others.

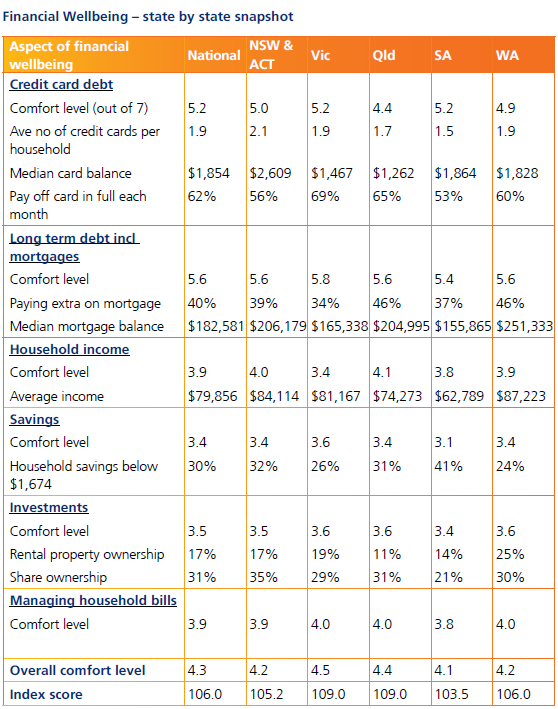

Top of the pack was Western Australia, where 55% of respondents reported a rise in household income over the past 12 months. Next up was New South Wales/ACT (47%), Queensland (45%), South Australia (43%) and Victoria (42%). (The Northern Territory and Tasmania were not included in the report.)

When it came to households that reported an income drop over the past year, NSW and Victoria both scored 27%, followed by SA (22%), WA (20%) and Queensland (18%). The nationwide figure was 24%.

Western Australia also topped the board for rental property ownership (25%), followed by Victoria (19%), NSW/ACT (17%), SA (14%) and Queensland (11%). And despite scoring the highest median mortgage balance of the states that were surveyed ($251,333), WA (along with Queensland) also recorded the highest percentage of respondents who were able to get ahead with their mortgage repayments (46%).

Source: ING DIRECT Financial Wellbeing Index

Other findings included:

- The proportion of mortgage free households in Australia is 26% this quarter (up from 23% in Q4).

- A further one in four (28%) are renting (down from 38% in Q4); 43% own their home with a mortgage (up from 38%).

- 40% of households are paying down mortgages ahead of time; 56% are paying as due (up from 54% in Q4) while 4% are getting behind in their mortgage.

- The median outstanding mortgage balance is $182,581, slightly lower than recent quarters ($219,747 in Q4).

Is Western Australia on your property investment radar? Have your say in our property investment forum.

More stories:

Suburbs tipped to see major falls