While many Sydney and Melbourne property owners have enjoyed healthy equity growth following the latest housing boom, “we all know that good things eventually come to an end,” according to Simon Pressley, head of property market research at Propertyology.

“There’s been plenty of speculation and debate about peaks and bubbles but, with burgeoning populations and strong job growth, let’s be honest, prices are unlikely to slide that dramatically in Australia’s two largest cities. It’s generally accepted though, that the booms in both cities are over,” Pressley said.

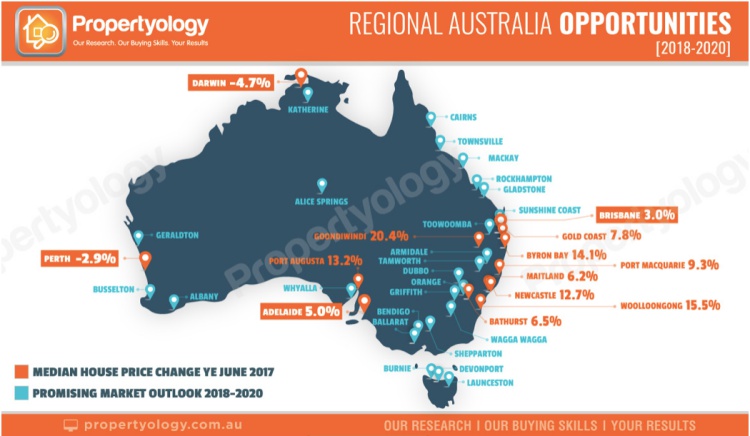

What should keen investors willing to capitalise on their equity do now? According to Pressley, the best course of action is to get out of town and take advantage of emerging opportunities in regional Australia.

“The greatest danger in the cooling of Sydney and Melbourne markets is that investors assume that our whole nation is off the boil. You couldn’t be more wrong. Outside of Sydney and Melbourne, most of Australia has experienced very little price movement since the onset of the GFC. Their growth cycles lie ahead.”

Property investors who neither have the time nor expertise to identify the most affordable regional markets should consider working with a reputable property research firm.

Propertyology, for example, was one of the few research analysts that predicted Hobart’s stellar rise in 2017, outperforming every other Aussie capital. The firm’s research methodology uncovered the city’s growth potential back in 2014, when the market was flat and the economy had been weak for several years.

While Hobart is likely to continue its upward trajectory, the firm’s attention has turned to several regional locations across Australia that have a very exciting outlook.

“Booms like Sydney and Melbourne generally only come around every 10 to 15 years, so it’s now more important than ever to get the accumulated equity from the last few years working for you. Using that equity to invest elsewhere means taking advantage of new opportunities while also adding diversification to your property portfolio.”

The good news is that prices are more affordable in regional markets. “You can buy a brilliant investment property in the range of $300,000 to $450,000, with better growth potential and higher rental yields than something twice the price in a capital city,” Pressley said.

“If you’ve got property equity in Sydney or Melbourne, you quite simply need to broaden your horizons. Look seriously at investing in other locations – it’s really a case of diversify, or die wondering!”

Strong Price Growth Areas In Regional Oz