Melbourne’s property market is in the hands of renters, thanks to its increasing vacancy rate, while rents in parts of Sydney will rise by more than 6%, it has been claimed.

These are the predictions of SQM Research, whose latest vacancy rate figures show a monthly rise in all of Australia’s capital cities – and a dramatic increase in Melbourne.

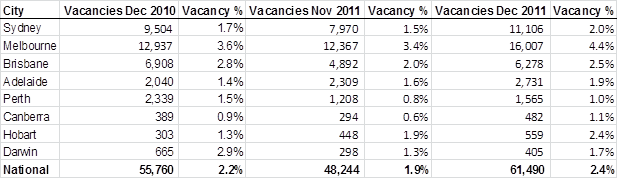

According to SQM’s December figures, the national vacancy rate increased by 0.5% over the month to hit 2.4%, while Melbourne’s figure increased by 1% to reach 4.4%. This figure puts Melbourne’s vacancy rate well above the 3% benchmark that is considered to indicate a balanced market.

While the increase in the national vacancy rate was steeper than in previous years, SQM believe this spike can be predominately viewed as a seasonal increase. Melbourne, however, recorded steady increases in rental listing numbers over the course of last year, and SQM’s managing director Louis Christopher believes its December peak of 16,007 goes well beyond seasonal factors.

“Melbourne is looking ominous and we are expecting rental declines for this capital city for 2012. Melbourne has definitely become a renter's market and landlords can no longer be expected to extract higher rents in Melbourne,” he said.

On a national level, however, January’s results are expected to show a decline in vacancies, with Sydney proving to be the standard bearer for increasing rents.

"As for the majority of the rest of the country, it is still a landlord's market and we are expecting rental increases overall to be within the 4-6% range and, in some regions within Sydney, even higher throughout the course of the year," said Christopher.

Away from the East Coast, Perth overtook Canberra as the state capital with the tightest rental market During December, recording a 1% vacancy rate to Canberra’s 1.1%.

The results:

Source: SQM Research, December 2011

Is Melbourne’s rental market really in the hands of tenants? Have your say on our property investment forum.

More stories:

Capital city values drop but rents increase