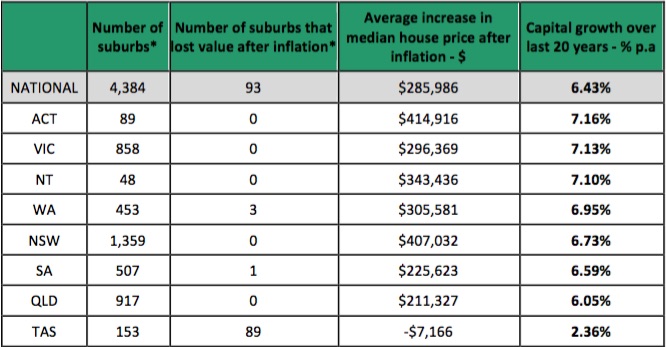

Using sales data from Residex, online comparison site Mozo.com.au calculated average real increase in value for every suburb in Australia over the last 20 years, taking into account the long term inflation average of 2.49%.

According to their analysis, real estate in Tasmania has average growth of just 2.36% per annum over the past 20 years.

Over the same period, the ACT proved to be the best performer, averaging growth of 7.16% per annum, with all suburbs in the territory recording annual growth above the inflation mark.

“Broadly speaking, real estate has been a sound investment across the mainland with 98% of Australia’s suburbs recording gains in value and average capital growth of 6.43% per annum,” Mozo director Kirsty Lamont said.

“However, Tassie claims 89 of the 93 suburbs that failed to reach the increase in value needed to stay ahead of inflation, and even its top 10 suburbs delivered gains well below the national average capital growth for the last 20 years,” Lamont said.

According to Mozo, Victoria is the second best performer over the period, with it averaging per annum growth of 7.13%, followed by the Northern Territory at 7.1% and Western Australia at 6.95%.

New South Wales came in fifth at 6.73%, ahead of South Australia at 6.59% and Queensland at 6.05%.

Source: Mozo

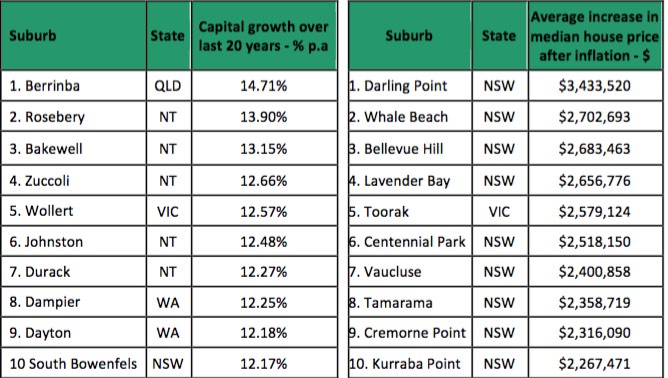

“While NSW ranks a lacklustre 5th for capital growth by percentage, it claims nine of the top 10 suburbs for highest gain by dollar value. Whale Beach, the holiday home favourite of Sydney’s rich and famous, and exclusive Bellevue Hill join Darling Point in the top three,” Lamont said

“Leafy Toorak is the only suburb outside NSW to make the top ten for gains in value, with the Melbourne enclave delivering an average increase of $2.58 million since the end of the last century.”

“While Darling Point property owners will be charging the champagne flutes after making the biggest increase in dollar value, with a staggering average increase of $3.43 million over the last 20 years, the news is more sobering for owners in greater Hobart’s Cambridge who face the biggest drop in value, losing around $320,000 on average.”

Source: Mozo