Looking for an insider tip? A survey of property professionals has revealed 10 hotspots that are expected to see the best capital growth over the next 12 months.

According to NAB’s Quarterly Australian Residential Property Survey: March 2012, Gladstone has been tipped as the country’s number one hotspot for the sixth quarter running. The 10 destinations highlighted in the report that are expected to see the fastest capital growth over the next 12 months were as follows:

- Qld: Gladstone, Mackay, Emerald, Townsville

- WA: Karratha, Perth

- SA: Bowden

- NSW: Maitland, Sydney, Marrickville

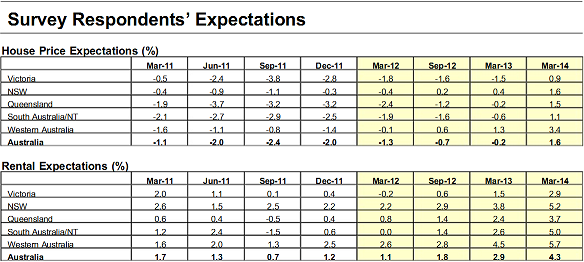

A notable exclusion from the list was Victoria, noted the report, which failed to score a nomination despite 23% of survey respondents coming from the Garden State. This result was in line with the overall negative sentiment noted surrounding the Victorian property market, with respondents expecting negative growth to occur over the next 12 months.

Negative growth was also expected to occur in Queensland and South Australia/NT over the next 12 months, while NSW and WA were expected to see marginal growth over the same period.

By March 2014, however, all of the six states/territories on the NAB list (Tasmania and ACT were excluded) are expected to hit growth territory. Respondents were most optimistic about WA, tipping it to see growth of 3.4%.

Source: NAB Quarterly Australian Residential Property Survey: March 2012

“National house prices are expected grow by 1.6% by March 2014 (1.2% previously). WA is forecast to significantly out-perform, with house prices expected to rise by 3.4% as the state resources boom drives strong population and employment growth. In NSW, expectations were pared back to 1.6% (1.9% in Q4’11), but optimism has risen in Queensland where prices are now tipped to rise by 1.5% (0.5% previously),” said the report.

“SA/NT house prices are also forecast to rise by 1.1% (0.8% previously). Victoria remains the most pessimistic state with prices tipped to rise by just 0.9%over the next two years, although this was also upgraded from 0.3% in Q4’11.These forecasts are broadly in line with our own, with NAB also expecting house prices to remain flat or fall slightly in 2012 with a modest recovery in prices expected in 2013”

The breakdown of survey respondents by business type was as follows:

- Real estate agents and managers: 35%

- Property developers: 20%

- Owners/investors in real property: 19%

- Asset managers/property operators: 13%

- Valuers: 7%

- Fund managers (real estate): 4%

Can Gladstone continue to boom? Have your say on our property investment forum.

More stories:

Danger! NSW investment spots to avoid