LocationScore’s latest research has identified the top five blue-chip suburbs in six states where renters are paying less than property owners to enjoy the same top-notch lifestyles.

The company’s analysis also revealed the top five suburbs in each state where rentvestors can buy strategically to boost their portfolio returns.

The rentvestor strategy of investing in high-growth markets while living in desirable lifestyle locations is proving a winner, according to LocationScore, which interprets big data to analyse and score every suburb in Australia.

“[Savvy] rentvestors are a new breed of investor who are using the power of yield and growth to their advantage by ensuring they make the most of every single dollar,” said Jeremy Sheppard, director of research at LocationScore. “Smart rentvestors are renting for lifestyle and investing for growth to beat home owners in the financial stakes.”

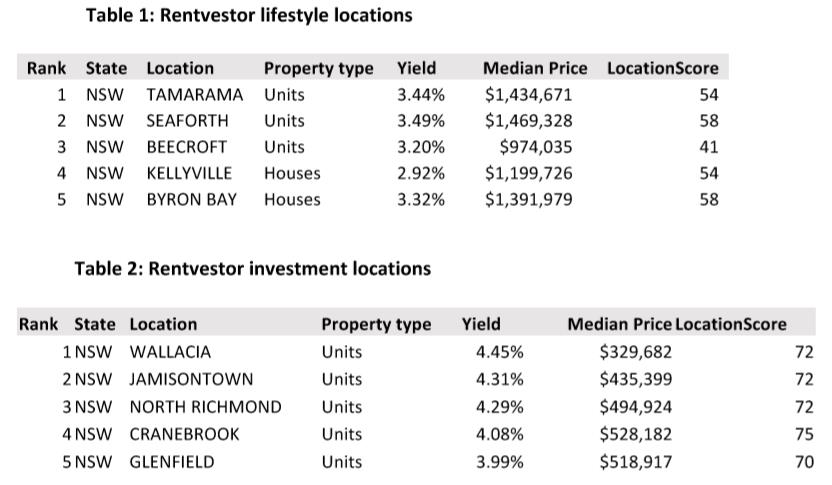

Table 1 for each state (Rentvestor lifestyle locations) ranks the low-yield, low-growth, high-priced addresses where renters pay less per week than owner-residents to enjoy the same amenities.

“These blue-chip markets also have poor two-to five-year growth forecasts based on current supply and demand indicators, so tenants aren't missing out on much by not being able to buy in,” Sheppard said.

Table 2 for each state (Rentvestor investment locations) reveals the low-priced zones with higher yields and better growth potential. Savvy rentvestors are parking their money here for strategic wealth creation.

“These are affordable markets with good growth prospects that renters with some kind of deposit can buy into to get on to the property train,” Sheppard said. “By using this research as a starting point, people with lower incomes who choose to rentvest can identify properties that will help them get ahead of those who already own homes in expensive markets.”

LocationScore graded each suburb out of 100 using eight key indicators that measure the level of demand and supply, as well as growth prospects. The index reveals a suburb’s strength as an investment prospect, with a score above 62 considered “good,” or above 77 considered “excellent”.

New South Wales

Sydney has an abundance of great lifestyle locations where low yields mean renters are getting the better end of the deal.

“Tamarama is an iconic waterfront location in Sydney, but with a unit buy in price of around $1.4 million, it remains out of reach for many purchasers,” Sheppard said. “Yet for around $500 per week in rent [$948 per week as of January], a couple can enjoy all the beachfront benefits of a one-bedroom unit in this suburb, and still come out ahead by investing elsewhere.

Victoria

.jpg)

Both McKinnon and Brighton East offer their residents ample lifestyle options.

“You can head to the water and enjoy the beach life with the iconic Brighton Beach Boxes as a backdrop, and then make your way to some of the city's great cafés and restaurants along the commercial strip,” Sheppard said. “With units only providing just over three per cent gross return, tenants are definitely coming out ahead of owners.”

When it comes to investment locations, investors should look beyond the inner urban ring to achieve top-notch yields in suburbs with great growth prospects.

“Millgrove housing priced around $330,000 has been achieving yields close to five per cent,” Sheppard said. “This small town 62 kilometres east of Melbourne is achieving great returns and, according to our analysis, has terrific prospects for growth in the coming three to five years.”

Queensland

.jpg)

Renters in Woolloongabba, Brisbane’s top lifestyle location, are very near to the CBD and can take advantage of some highly urbanised gentrification zones.

“And with an abundance of accommodation options, there’s competition to attract tenants which is keeping rent prices reasonable,” Sheppard said.