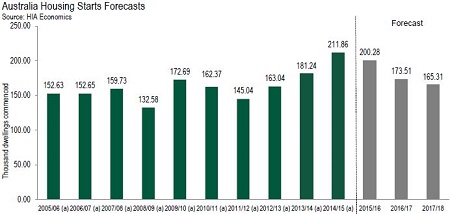

The HIA’s Spring 2015 Housing Industry Association National Outlook has predicted the record breaking 212,000 new residential commencements that occurred in 2014/15 is the peak of the current construction cycle, however the level of commencements projected for 2015/16 has come as somewhat of a surprise.

“2015/16 will be another very healthy year for commencements,” HIA chief economist Harley Dale said.

“A peak in new home construction is usually followed by an abrupt decline,” Dr Dale said.

While the direction the construction cycle is moving in may be an unusual one, the HIA claims it will come with benefits for the broader economy with investment in new dwellings predicted to grow in 2015/16.

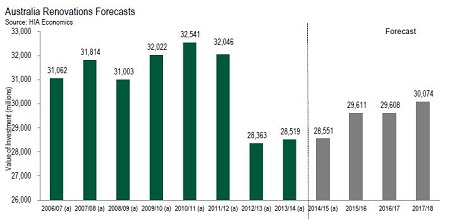

It’s not only new homes where investment will improve; the HIA also predicts renovation investment will grow as well.

“Renovations investment is forecast to grow by 3.7 per cent in 2015/16 following marginal growth – from a decade low – over the last two years,” Dr Dale said.

Over 2013/14 and 2014/15 renovation investment grew by 0.6% and 0.1% respectively and the HIA predicts renovation activity will have been worth $32 billion in the decade to 2019/20.

While investment in new housing and renovations is set to increase, the HIA has again called for an overhaul of how the construction industry in Australia is taxed.

“As the focus – quite rightly – intensifies on the need for economic and taxation reform in Australia it is imperative that policy makers recognise the importance of the residential construction industry,” Dr Dale said.

“Residential construction is the second most heavily taxed industry in the Australian economy, to the detriment of the home ownership aspirations of many Australians.

“Independent research undertaken over a number of years demonstrates the inefficiency of much of this taxation and the large gains to productivity and Australian living standards from reducing this onerous cost impost on new housing.”