Stamp duty is one of the largest costs associated with purchasing property – and for many buyers, it can also be among the biggest impediments to homeownership or property investment.

But this could change in New South Wales after the state’s government announced a proposal that would make stamp duty optional – a plan that has already drawn mixed reactions from industry experts.

How does stamp duty work in NSW?

Stamp duty is a type of tax levied by state and territory governments on property purchases – including houses, investment properties, and vacant land. It is also called transfer duty in NSW and is calculated based on the property’s value.

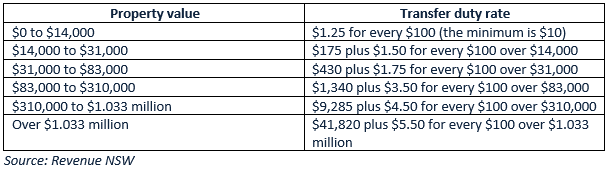

Revenue NSW determines the tax amount based on the property’s sale price or current market value, whichever is higher. The table lays down the standard transfer duty calculations from 1 July 2020. Our stamp duty calculator can also provide an estimate.

According to Revenue NSW’s website, the department also applies a premium rate of $155,560, plus $7 for every $100 for residential properties priced at above $3.1 million. For commercial properties worth more than $3 million, the revenue office only looks at the part that is used for residential purposes when applying the premium transfer duty threshold.

For land more than two hectares, the premium transfer rate is calculated only on the first two hectares of land, as a proportion of the overall parcel of land. The remainder of the property will be charged at the standard rate.

Stamp duty must be paid within three months of settlement. Buyers of off-the-plan properties must pay transfer duty within three months of the completion of the agreement, but they can also defer the payment for up to 12 months.

However, not all property buyers are required to pay stamp duty. Revenue NSW also provides exemptions and discounts.

First home buyers can apply for stamp duty exemption or discount via the state’s First Home Buyers Assistance Scheme. Under the program, first-time buyers of new homes can request for a tax exemption on properties worth less than $800,000 and a concessional rate for homes valued at $800,000 to 1 million as long as they purchase the property between 1 August 2020 and 31 July 2021.

Buyers of existing properties priced below $650,000 and vacant land valued at less than $400,000 can also avoid paying transfer duty while those purchasing homes between $650,000 and $800,000, and land ranging from $400,000 to $500,000 are eligible for a discount.

First-time buyers can also access the federal government’s First Home Owners Grant and HomeBuilder scheme.

What are the proposed changes to NSW’s stamp duty?

As part of the 2020-21 NSW Budget handed out last week, State Treasurer Dominic Perrottet has announced a proposal to make stamp duty on property purchases optional.

The new arrangement will allow buyers to choose between the current system of paying stamp duty or paying a smaller annual tax for as long as they own the property. The new property tax will be a fixed charge, with a rate calculated based on the unimproved land value of the property.

Under the property tax proposal, the government is also set to replace existing first home buyer concessions with a new grant worth up to $25,000.

What the experts say

The state government is hoping the proposed changes will boost the housing market and provide NSW with a long-term revenue stream.

In his budget speech, Perrottet said the current stamp duty system was “one of the biggest financial barriers to homeownership” in NSW, adding that an overhaul would benefit the state’s future home buyers.

“This is a reform proposal for NSW where more people can own their home and have more freedom to choose the right property for their family at every stage of life,” he said.

Perrottet also said the plan would also be a “key stimulus measure,” which could in inject billions of dollars into the state’s economy in the coming years.

Andy Kerr, homeownership executive at National Australia Bank (NAB), said the proposal was a good thing for home buyers.

“For many customers, stamp duty is a big hurdle to buying a home,” he told News.com.au. He added that the changes were “most critical for first home buyers who are often slowed down by the cost of stamp duty.”

Meanwhile, Tim McKibbin, chief executive officer of the Real Estate Institute of NSW (REINSW), said while a revamp of stamp duty has been long overdue, there were better options than what the government is proposing.

“While there is no such thing as a good tax, some are better than others,” he told News.com.au. “When tax becomes a consideration of a transaction and not a consequence, it’s a very bad tax.”

“People in NSW have elected not to pay stamp duty by not buying property. On this basis, we welcome the news that stamp duty will finally be phased out in NSW. However, we don’t support the replacement of one property tax with another property tax.”