Owning a decent-sized house on a block of land in the suburbs has long been the classic Aussie dream. These days owning a stylish inner-city apartment is another version of that dream. And most investors stick to one of these options when buying property.

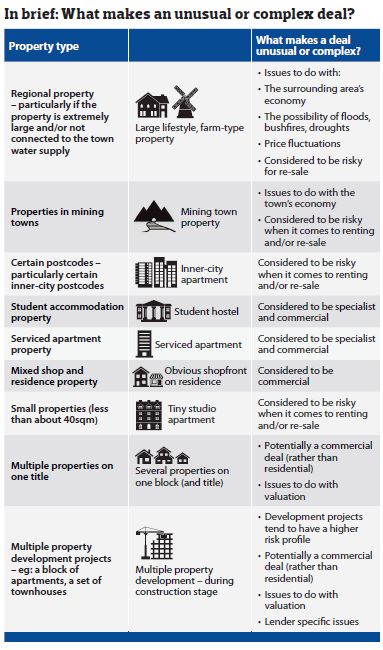

However, some investors dare to dream a little differently. Instead, they might want to invest in a regional property, or in multiple properties on one title, or another type of non-standard deal. If this is the case, they are likely to find it harder to get finance for their investment.

Financing “out-of-the-box” deals used to be easier pre-GFC, Catherine Lezer, from Smartline, says. “It is simply no longer possible to do lots of things that you could in the past. We don't have that flexibility any more. Lenders have a comparatively limited pool of funds. So they tend to go for bread-and-butter deals.”

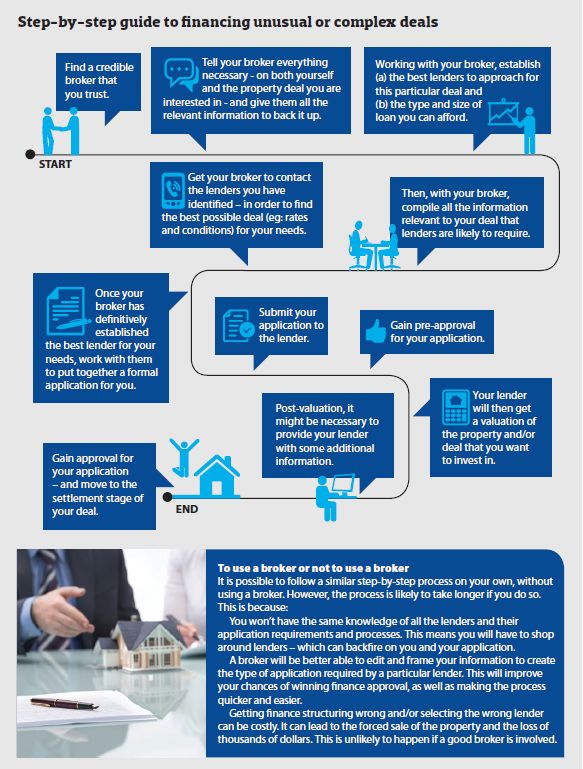

Lender policies are set accordingly and requirements are now much tighter. While this means getting finance for non-standard deals is more difficult, it doesn’t mean it is impossible.

Some lenders are open to more unusual or complex deals, Lezer says. “But every deal takes longer and is not as easy. It is necessary to provide more information [in a finance application] and jump through more hoops. There are lots of little things the banks look for which can easily trip people up.”

This means that investors, who are keen on an “out-of-the-box” deal, need to ensure they have all their ducks in the right row when applying for the finance. Here's your Investment Property's guide to helping them do just that.

No standard policies

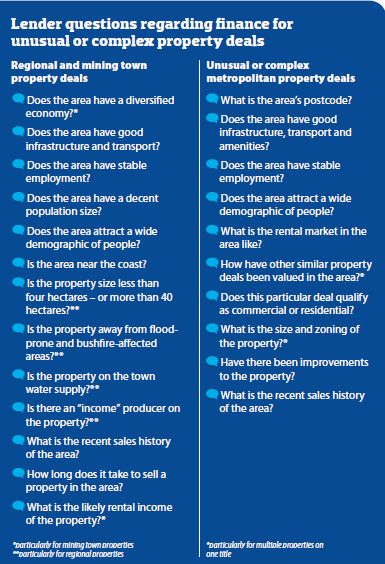

When it comes to policies regarding finance for unusual or complex deals, there is no standard set of policies. Every lender is different and their policies vary widely.

In fact, compiling a checklist of lender policies is too hard, Lezer says. “Lenders are just too variable. For example, one bank might lend for a maximum of 10 acres [four hectares] while another will go to 125 acres [50 hectares].”

Further, such financing is also dependent on each individual customer and deal, which is why the presentation of an investor’s application is crucial, Lezer continues. “If an application meets a particular lender’s criteria, the investor will have access to better rates and an easier approval process. If not, then they will need to go to a commercial loan at higher rates.”

Shaun Rasulov, from Positive Real Estate, says major problems gaining finance start when an investor wants to borrow more than 80% of the value of a property. This is because, at this point, lender mortgage insurance (LMI) companies get involved and they have to approve the application, too.

“That is when the real challenge starts because those companies have more stringent criteria than most lenders, so it’s a whole different territory. So you might have an application approved by a bank, but declined by an LMI company.”

Rasulov says that LMI companies tend to focus on things like:

- An area’s postcode: They have postcode restrictions which means they won’t approve applications in a restricted area.

- An area’s established infrastructure

- An area’s environmental issues – e.g:high bush fire or flood risks

- The [building] quality of the property – eg: degree of asbestos exposure

- Maximum exposure level forevery single building – so, with multiple properties, if the LMI has reached its maximum in that building an application can be declined.

- A client's credit file

- A client's income

- It is worth knowing that LMI companies review areas – to analyse stability, economic growth, employment and development – on a regular basis, Rasulov says. “If they determine an area has high unemployment and a high level of mortgage delinquency, they will class it as high risk, down grade it and sometimes restrict the postcode.”

Meeting lender requirements

Not only does each lender have varying policies about unusual or complex deals, but their requirements for finance approval also differ - depending on the type of deal and the customer themselves.

The good news is that basic finance approval requirements tend to be the same as any other deal. Along with proof of identity, lenders will want to know:

- An applicant’s income and ability to pay off the loan

- An applicant’s asset position (which includes properties, investments and bank accounts)

- Whether the applicant has a good credit history (including whether or not they tend to be on time with repayments)

- How big a deposit the applicant hasThe type of property the applicant is seeking finance for along with its value and condition

It is likely that lenders will also want information about an applicant’s monthly expenses (eg: rates, water, etc) and payment history, and financial liabilities (eg: credit cards and loans).

Lezer says that for an applicant to be seen as a solid bet, they will have a reliable income, a steady employment history, a good credit record and they will be able to provide comprehensive information to prove it.

Meeting these criteria would smooth the way to some extent, she says. “It gives lenders some comfort. So, even if the deal might not be ideal, if a customer seems good and looks like they would be

successful, a lender might be willing to take the risk.”

Applicants can’t hide much these days because they are more comprehensively researched, Lezer adds. “Lenders will look at months of credit history and account statements. And they will look at every line in those records. This is to see if, for example, the applicant goes and spends money on the pokies every weekend.”

Multiple property deals

It is no surprise that multiple property deals – be they existing properties on one title or a development - tend to face additional, and more complex, finance requirements. In such situations, one of the biggest issues can be valuation, as opposed to an applicant’s income where standard criteria usually applies.

This is because valuers have to make sure there are comparable sales in the area and this is not always possible, explains Rasulov. “If the valuer has to value a duplex in an area which doesn’t have many duplexes, they will struggle to put a value to the property. That’s the biggest hurdle when it comes to multiple properties, and particularly for construction loans.”

When it comes to multiple property development deals, it is also necessary to think about whether it involves an apartment block or five townhouses or a duplex. Rasulov says that, depending on what type of property it is, every lender has different criteria and, once again, it can vary a lot.

For example, there is one lender that requires that every dwelling in a development has to have a separate laundry, he says. “This lender is happy to approve up to 10 developments in one block, but each individual property must have a laundry in it.”

Generally, lenders like to see decentsized dwellings (eg: over 40sqm for a unit), but smaller buildings (eg: a block of units) because they are considered easier to sell, Rasulov continues.

“Lenders want to reduce their risk as much as they can. So they want to see the property is located on a good street, with good views, not blocked by other buildings, ideally. They will also look at the postcode. If you have all of those things sorted it will be easier to get finance."

“Friendly” lenders and their costs

The high-risk perceptions surrounding “out-of-the-box” deals mean that some lenders are unwilling to take on such deals at all. However, there are lenders which are open to more unusual or complex deals – particularly if they consider an application to be strong enough.

To boost the value of their portfolio, Mr and Mrs Smith want to build two additional dwellings behind the existing dwelling on their large property block. They want to utilise the equity in the block to build the new dwellings for $200,000 each. The block is worth $500,000 and the debt against the property is $450,000.

1. Not enough funds or equity to complete the development due to the way the property is valued.

2. The loan-to-value ratio (LVR) may be too high, exceeding 80%, which could inhibit the development approval. Some lenders do not support this strategy under LMI.

3. The lender will value the property ‘as is’ and not as a completed product. This is defined as “one parcel of land with an existing dwelling and two proposed property constructions”. Further, the value of the one parcel of land is less than if the subdivision has occurred.

If Mr and Mrs Smith want to maintain the LVR at 80%, to avoid paying additional LMI, they will need to source more cash or equity.

To resolve the issues Mr and Mrs Smith could:

1. Provide $130,000 in cash or equity from another property.

2. Complete the subdivision prior to their application for construction finance. However, this would delay the overall project from starting construction.

3. Complete the transaction as a ‘build strata’. This means the application for the subdivision is completed while the properties are under construction. However, currently only P&N Bank will accept this form of development finance.

4. Complete the transaction under commercial lending, which mean higher fees and interest than under standard residential lending.*

Currently, lender finance requirements generally include:

- Two recent payslips.

- 2013 and 2012 group certificates or letter from work on company letterhead, dated and signed-outlining mode of employment, gross income, net income, term of service or start date - or work contract

- 2013 and 2012 (or 2012 and 2011 if you don't have 2013 yet) ATO tax assessment notices.

- Or, if self-empployed, the full 2012 and 2013 tax returns and ATO assessment notices - for all entities (e.g: companies, trusts and personal).

- Three months savings account statements.

- Recent statement for all credit cards/leases/personal loans/interest free loans.

- Copy of passport, driver's license and Medicare card.

- If an applicant is renting, it is advisable to get a statement from their rental agent which shows they have been paying the rent on time for, at least, six months.

- Anything else that might be relevant - eg: share information or bonus information.

Construction loans have further requirements including a full set of approved plans, specifications, a fixed-proce builder's contract, the builder's licence and insurance details, and a progress payment schedule.

* This checklist was based on advice from Catherine Lezer from Smartline.

According to Loans.com.au managing director Marie Mortimer, the major lenders are more likely to accommodate such lending. “This can mean an interest rate that is less competitive than other sectors of the market. However, this is not exclusively the case and it will depend… as each lender has their preferences of what they will and won’t provide finance for."

There is no hard-and-fast reason why costs would be higher unless the property is truly exceptional (eg: very high value, in a remote location) in some way, Mortimer says. If it is, additional valuation costs might be passed on to the borrower.

“It is more likely that certain restrictions would be put in place, such as a bigger deposit being required or only a certain style of properties being acceptable in certain regions."

Lezer points to CBA as being particularly open to complex deals covering a lot of postcodes and property types. It will take on company title, small units, 50 hectares of land, duplexes - all under standard residential finance policy, she says.

“That is what you want to aim for as it means lower interest rates and standard terms and conditions. Commercial deals are more complex, so they have different terms and conditions. And the rate tends to be more costly."

A residential rate is always preferable, but when it comes to deals involving multiple properties most lenders would consider them to be a commercial product, Rasulov says.

“There are not many lenders out there who would be willing to finance multiple properties at a non-commercial rate. At the moment, that starts at 5.8% versus 4.8% to 4.9% on residential products. When it comes to multiple properties it is likely that you would incur that higher rate."

He also emphasises that finance deals are always less complicated if an applicant is borrowing less than 80% of a property’s value.

Traps to avoid: tips from the experts

Given the complexities involved in securing finance for unusual or complex deals, there are many potential pitfalls that investors need to avoid. Your Investment Property’s panel of experts provide the following tips on the traps applicants should watch out for.

Catherine Lezer:

Don't take one no as being a no for all lenders. But do your best to try and find lender first off, rather than shopping around.

Remember that the "use" of a property can be different from the "zoning". Always try to see if a residential loan is possible – as this is better for many reasons including the interest rate.

Credit history is a big one, especially given recent changes to the relevant law. It used to be that if someone was a few weeks late in paying it didn’t really matter. But now it does. A bank will look at a regularly late credit payer and refuse an application on that basis.

Shaun Rasulov:

People are creatures of habit and tend to go back to their lender for many different types of accounts and loans. Many lenders will try to cross-collateralise all the loans into one bracket. But cross-collateralisation is limiting and risky, so it is best to avoid it and spread loans across different banks where possible.

Shopping around leads to multiple credit checks. The more credit checks an applicant has the worse it is for their credit file. This is because any and all credit checks reduce an applicant’s credit score. And a low credit score places limits on an applicant when it comes to lenders.

Applicants should have a strategy covering what they want to do, what they want to invest in to achieve their goals, and which lenders might best help them. It makes a broker’s job much easier in terms of telling them which product and lender would best suit their particular needs.

Marie Mortimer:

Applicants should always be prepared for the possibility that a lender may classify the property differently than was intended. This can have a significant impact on the loan contract. For example, if a property is deemed commercial, it means a differentset of lending requirements and different terms to those in a standard residential contract, plus higher rates and fees.

James Chatfield:

Go to pre-approval before making your purchase, and always make sure that you have made all reasonable efforts to satisfy funding requirements before signing a contract.

Ensure purchase contracts are subject to finance-unless you have 100% of the purchase price plus costs in cash.

Knowledge is power: The more extensive your education on the systems for investing the more informed your decisions. Remember, there is no such thing as risk-free investing.

Please note that all the policies and requirements mentioned in this article are accurate as at the time of writing but might change in the future.

Disclaimer: The information contained in this article is of a general nature only and you should seek the guidance of a professional for a suitability to your personal finance circumstances.

This feature is from the September issue of Your Investment Property Magazine. Download the issue to read more.