With its ability to provide passive income and set investors up for a comfortable financial future, property investing is a strategy that hundreds of thousands of Australians are using to build wealth.

Many of these investors are living with loans that were arranged years ago, and that could be costing them far more than they need to be spending.

Arranging a mortgage is not a ‘set and forget’ exercise; rather, it should be something that investors revisit every 12 months, to ensure they’re not overpaying and the loan still suits their needs.

This is where refinancing comes in. This is a process of taking an existing loan and transferring it to another lender, usually for one of the following reasons: to capitalise on a lower interest rate; to access better loan conditions, such as offset or redraw; to stretch out a loan for a longer period of time; or to access a new interestonly period.

Whatever your motivation, when you refinance there’s usually more money in your pocket to use for either paying off a mortgage or buying a new investment.

“Cash flow is a key benefit of refinancing, apart from simply getting one over on the banks by ensuring you are paying as little interest as possible,” explains Graeme Salt, managing partner at Chan & Naylor Finance.

“Imagine that someone who has 20 years to run on a mortgage refinances new 30-year loan – they then get to spread out their loan repayments over a longer period and at a lower rate. This then frees up cash to do other things.”

While loan applications can be complicated when refinancing, Salt notes that buyers are currently able to save a good chunk of money in the process, as banks are beginning to offer more competitive investor products and rates

The lifting of interest-only restrictions by APRA also presents some excellent opportunities for borrowers.

“There are some great pricing opportunities. Over the last 12 to 24 months, all lenders have increased rates, but they’re reviewing now, and [borrowers] who meet all criteria can benefit by up to and beyond 1%. I’d say that’s very well worth it,” says Intuitive Finance managing director Andrew Mirams.

Meanwhile, Classic Finance founder Nancy Youssef adds that while having a principal and interest loan can facilitate the building of equity, it affects affordability for investors, especially those with larger portfolios spread across different lenders. With the lender market heating up, this is an aspect that refinancing can take advantage of.

“Many banks and lenders are offering cashback rebates to attract new borrowers at the moment. If you are bringing all of your loans over to one lender, they might be a little more motivated to give you a better interest rate,” she says.

This doesn’t mean that refinancing is a foolproof solution, especially as the market stands now.

“More and more lenders might offer a competitive rate for a P&I loan, but price the interest-only product 0.5% to 1% higher for the same customer – which can put pressure on cash flow,” Youssef points out.

“Lenders are also putting a squeeze on assessment rates and serviceability, as they are now taking into account all sorts of lifestyle expenses that they weren’t previously.”

Due to this, the results of property valuations are even more crucial to a borrower, as the investor’s equity position may not be as strong as they believed after the valuation comes back.

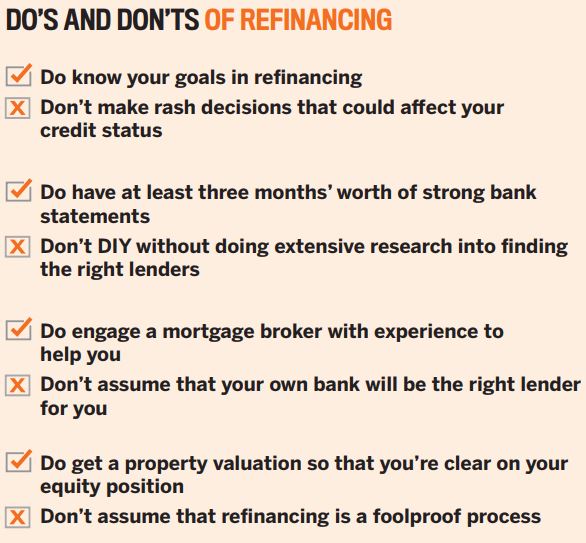

“The biggest risk of refinance is not knowing what you want from the refinancing process, getting it wrong and having a mark on your credit file,” says Mirams.

Moral of the story? If you’re planning to refinance, ensure you have a clear idea of what you’re trying to achieve, and importantly, what you’re planning to do with any savings.

Refinancing smart

When refinancing, proper preparation and knowing the right lenders is key.

“Investors need the skill set to be able to negotiate the right outcome with the right lender,” Mirams says.

“Be ready, know your position, know your expenses and know what you want to achieve, whether that’s another purchase, interestonly terms or the best rate.”

Graeme Salt also notes that, when applying to refinance a loan, banks will look at up to three months’ worth of bank statements to assess a borrower’s commitment to paying off the loan, so buyers need to present a strong financial front.

“A long way before making a finance application, borrowers need to be sure they have a good record in paying things like credit cards and utility bills,” Salt says

This is why working with an experienced professional mortgage broker can go a long way towards setting you up with the right loan.

“We hear horror stories about the millions of interest-only loans that need refinancing – and certainly it is harder to do so than five years ago. But there are quite a few non-conforming lenders that go through brokers,” Salt says.

“Good mortgage brokers have long-term relationships with borrowers so that they can make sure the borrower is properly prepared.”

Brokers also have the advantage of expert knowledge of the ideal rates and policies for an investor, which keeps investors from having to do trial and error and, in the process, damage their credit status.

“It can be a maze out there – it’s very confusing for consumers, and if you shop around too much you can do damage to your credit fi le. Many people will take a chance and just go to their own bank, but they may not be the right fit,” Youssef says.

“A mortgage broker can give you tailored advice and direct you towards lenders with better policies or rates for your situation"

CASE STUDY: "WE SAVED $400 A MONTH"

Cassie and Dean Raine from Pimpama on the Gold Coast had held the loan on their investment property for six years, and they hadn’t even considered refinancing until a chance conversation with a friend. “We were talking about how expensive health insurance is, of all things, when my friend said she’d gone through all of her bills and insurances and debts and contacted every supplier to negotiate a better deal, or she moved on to someone else,” Cassie says. “She said she saved almost $8,000 a year on her mortgage by refinancing her home loan, which got us thinking that we should check our mortgages on our home and rental property to see what our options were.”

Once they spoke to a mortgage broker, they realised they could restructure their finances to better suit their needs

The investment loan balance was $289,000, and was secured against a townhouse, for which the couple had paid $365,000. The principal and interest loan was on a variable rate at 4.25%. Once Cassie and Dean spoke to a mortgage broker, they realised they could restructure their finances to better suit their needs. “This is our first investment, so we didn’t quite realise the tax benefits of keeping the investment loan as interest-only so we could pay down our own home mortgage as quickly as possible,” Cassie says. “We ended up being able to refinance our investment loan into a brand-new interest-only loan at 3.89%, which cut the repayments down drastically – by almost $400 per month!” The pair opted not to refinance their own personal home loan, as the LVR was above 80% and they didn’t want to pay lenders and mortgage insurance. However, the couple are taking the savings made so far and pouring them into their own personal home mortgage, to accelerate payment of this non-deductible debt with a view to refinancing their own home loan in 12 months’ time.